Bitcoin Facing Pressure at $100K – 3 Chart Signals to Watch Closely

Jakarta, Pintu News – Bitcoin’s (BTC) latest correction has traders panicking. The price of BTC plummeted from levels above $120,800 to close to $102,000, before finally recovering almost 9% to over $111,000.

While altcoins such as Ethereum (ETH) and XRP (XRP) have seen declines of over 13%, Bitcoin’s 7% drop (at the time of writing) shows that the asset is still holding strong – signaling fundamental strength despite the massive liquidation action.

However, the big question remains: Will Bitcoin be able to stay above the $100,000 level, or will it drop deeper past this psychologically important mark in the near future? Three key charts can provide the answer.

Number of Holders Increases

Reporting from BeInCrypto, the first sign of support came from holder behavior based on on-chain data. Despite the price drop, the total number of Bitcoin holders has actually increased from 56.92 million to 56.98 million since yesterday.

Read also: Is the Next Altcoin Season Coming? Inside CryptoAmsterdam’s Market Cycle Analysis

This shows that investors are adding to their holdings as prices fall – reflecting buying conviction during corrections, not panic selling.

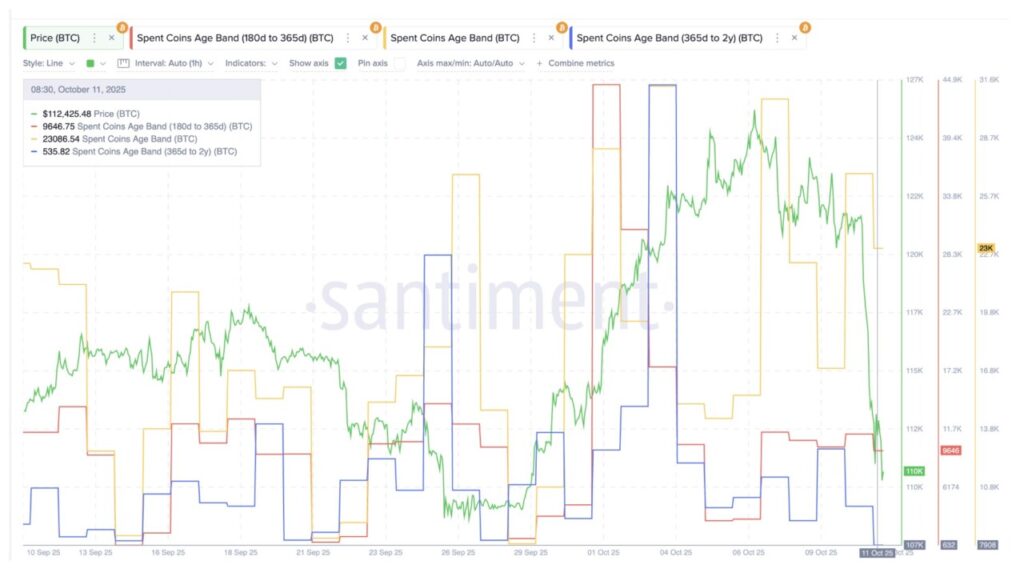

Spent Coins Age Bands (SCAB) data supports this. SCAB measures the age of the coins being moved – in other words, whether the Bitcoin being sold is from an old or new holder.

When the sell-off began on October 10, SCAB’s total was around 17,100 BTC. The 180-365 day age band (marked red) recorded around 9,995 BTC, while the 1-2 year age band (blue) stood at 2,452 BTC.

However, as the sell-off continued, SCAB’s total jumped sharply to 23,086 BTC – signaling increased selling activity from new or recent BTC holders.

Longtime Owners Keep Calm Amid Falling Prices

In contrast, the red band fell slightly to 9,646 BTC, and the blue band plummeted to 535 BTC – proof that long-term owners are keeping calm and not selling.

This means that panic selling is mostly triggered by new wallets or mid-term owners, while veterans hold onto their assets. And typically, long-term holders won’t sell unless they expect a huge price drop – like below $100,000.

When long-term holders remain passive and the total number of holders increases, this is usually a signal that the “strong hand” is replacing the “weak hand” in the market. This is a healthy form of reset to stabilize the market before prices rise again.

Bitcoin Price Pattern Changes from Bearish to Bullish

Bitcoin’s current price movement provides a clearer picture. The recent price correction was not solely due to negative sentiment, but was triggered by technical patterns that often mark market turning points.

Read also: ASTER Airdrop Postponed to October 20 as Community Voices Outrage Over Token Distribution

The main trigger was a bearish divergence on the Relative Strength Index (RSI) indicator, which measures buying and selling strength on a scale of 0 to 100.

Divergence occurs when the direction of the RSI contradicts the direction of the price – for example, the price forms higher peaks, but the RSI forms lower peaks instead. This pattern usually indicates weakening momentum before a reversal.

This is what happened between mid-July and early October. As Bitcoin price printed new highs, the RSI failed to follow suit and formed lower peaks.

The result was a sharp correction of 19.1% (yesterday), which is very similar to the previous drop that was also triggered by the divergence, which was over 14%. This shows how strongly Bitcoin reacted to the signal from the RSI.

But now, the pattern has reversed to bullish. Between September 25 and October 11, there was a bullish divergence – the price formed a lower low, while the RSI formed a higher low. This signaled that the selling pressure was starting to weaken and a rebound momentum was quietly taking shape.

As of October 11, Bitcoin price is around $111,600, which coincides with the 0.5 Fibonacci level ($111,400). If the price is able to close daily above this level, it could be a confirmation of new strength towards $113,600, $116,800, up to $120,800.

Meanwhile, the invalidation level is below $109.100, with limited downside potential to $106.400 and $101.900. Thus, a drop below $100,000 is still unlikely in the short term. Only if the daily price closes below $101,900 will the potential of falling below $100,000 become greater.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Drops Below $100,000: Analysis. Accessed on October 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.