The Market Turns Green: These 3 Altcoins Are Top Picks for Whales and Smart Money Accumulation

Jakarta, Pintu News – Weekends often bring quieter trading activity, but this also means that price movements can be sharper for those who are observant.

While most markets are still moving erratically – especially with BTC’s correction of almost 4% from its all-time high at the weekend – some altcoins are showing interesting signals of concern.

From breakout patterns, increased whale activity, to new accumulation by smart money, these three coins show potential short-term movement that could continue.

Pudgy Penguins (PENGU)

PENGU, the token linked to the Pudgy Penguins (PENGU) network in Solana (SOL), is one of the altcoins to watch this week. Although its price is still hovering around $0.031, data shows steady interest from large wallets and short-term traders.

Read also: 3 Altcoins Likely to Surge as Polymarket Valuations Rise

Over the past week, Smart Money’s holdings increased by around 2.8 million tokens (3.89%), signaling a quiet accumulation despite general market conditions remaining uncertain. This is in line with the Smart Money Index (SMI) on the 12-hour chart, which is starting to form higher highs – a sign that experienced traders are starting to prepare for a potential recovery. The SMI visualization will be presented further in this section.

Technically, PENGU is currently trading within a falling wedge pattern, which is a bullish chart pattern that often indicates the end of a downward trend. Between October 4 and 9, the token formed a higher low, while the Relative Strength Index (RSI) actually printed a lower low, forming a hidden bullish divergence that supports a price recovery scenario.

A breakout above the $0.032 level would confirm this wedge pattern and could open the way towards $0.034 – the next major resistance level, meaning a potential upside of around 10% from the current price.

If the closing price is able to break above this level, the upward momentum could continue over the weekend. However, if the PENGU price drops below $0.027, the potential recovery scenario will most likely fail, and selling pressure could return.

For the structure to change to bearish in the short term, the price needs to break below $0.026, which could attract the attention of short-term traders(short sellers).

Currently, with Smart Money inflows improving and bullish patterns still forming, PENGU remains one of the most interesting altcoins to monitor this weekend.

Aster (ASTER)

Aster (ASTER) – a new DEX based on the BNB network – experienced a sharp decline after a strong rally earlier. After briefly breaking through the $2 level, ASTER’s price has fallen nearly 17% in the past week and is now trading at around $1.59.

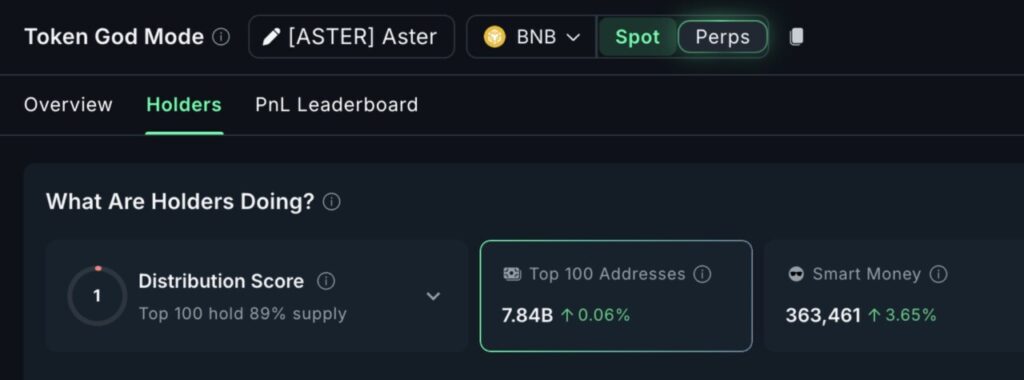

Although the price trend looks weak, the on-chain data shows a more complex picture. In the last 24 hours, holdings by Smart Money increased by 3.65%, while mega whales (the 100 largest addresses) added 0.06% to their supply.

In total, this equates to approximately 172.9 million ASTER tokens, or nearly $275 million at current prices – a significant turnaround after a week of consistent selling pressure.

This sudden accumulation comes after a prolonged downward phase and signals a re-emergence of interest from large and savvy holders.

From a technical perspective, a falling wedge pattern which is generally a bullish reversal structure is starting to form on the 1-hour chart. Given that ASTER still has a limited trading history, the hourly chart provides the clearest signal for short-term price behavior.

In this context, the hourly view is useful for identifying quick momentum reversals that could continue within 24-48 hours – making it a handy setup to monitor on weekends.

Between October 9 and 10, the price formed a lower low, while the RSI created a higher low – confirming a bullish divergence indicating weakening selling pressure.

If ASTER price is able to hold above $1.52 and break $1.72, it is likely to test the upper boundary of the wedge pattern around $1.84. If the breakout is successful, the next short-term target could be in the range of $1.89-$2.02, opening up opportunities for price recovery over the weekend.

However, if the price closes below $1.52, this recovery scenario will be nullified and the control will be back in the hands of the sellers.

Read also: Pi Network Has a Chance to Rise Amidst the Market Crash? What’s the Reason?

After a sharp 17% correction, the combination of whale activity, Smart Money inflows, and a favorable technical pattern makes ASTER one of the altcoins to watch this week, especially for traders looking for quick technical rebound opportunities.

Zora (ZORA)

ZORA is a creator-focused token on the Base network and has attracted huge attention this week. In the last 24 hours, the token’s price surged by more than 73%, driven by large inflows into DEX worth about $420,000, according to data from Gecko Terminal.

On the 12-hour chart, ZORA has broken out of the inverse head and shoulders pattern, crossing the neckline at around $0.06. This move confirmed the breakout, and now the token price is trading near $0.09. Based on the pattern projections, ZORA still has upside potential towards the $0.10 zone – around the 53% upside target from the neckline.

Adding to the strength of this momentum, the Smart Money Index (SMI) – which tracks the buying action of experienced or early traders – has been steadily increasing since yesterday.

The sustained rise in SMI suggests that this rally still has steam, making ZORA one of the most noteworthy altcoins this weekend, as long as the price stays above the $0.06 support level. However, if the selling pressure increases and the price drops below $0.05 (the right shoulder area in the pattern), its bullish structure will be considered invalidated.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Three Altcoins to Watch This Weekend. Accessed on October 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.