Pi Network Holds Steady at $0.21 Today — Is This the Beginning of a Trend Reversal?

Jakarta, Pintu News – Pi Network’s native token, PI, has managed to bounce back sharply after plummeting to an all-time low of $0.1533 during Friday’s market crash. In the past three days, the altcoin has actually shown strong resilience amidst the still bearish market sentiment, recording steady gains as traders return to the market.

Technical indicators show that buying momentum is increasing, which could open up opportunities for PI to break through previous resistance levels. Then, how will Pi Network price move today?

Pi Network Price drops 0.2% within 24 Hours

On October 14, 2025, the price of Pi Network was recorded at $0.2126, having corrected 0.2% in 24 hours. If converted into the current rupiah ($1 = IDR 16,579), then 1 Pi Network is IDR 3,524.

Read also: Pi Network Has a Chance to Rise Amidst the Market Crash? What’s the Reason?

In the last 24 hours, the price of PI briefly touched a high of $0.2273 before finally dropping back near the low of $0.2114. This movement shows strong selling pressure after experiencing an upward rally.

In terms of fundamentals, Pi Network’s market capitalization currently stands at $1,758,436,909, ranking it #77 globally. The trading volume in the last 24 hours was recorded at $52,395,466, indicating that there is still quite high transaction interest among traders.

PI Coin Shows Early Signs of Bullish Reversal

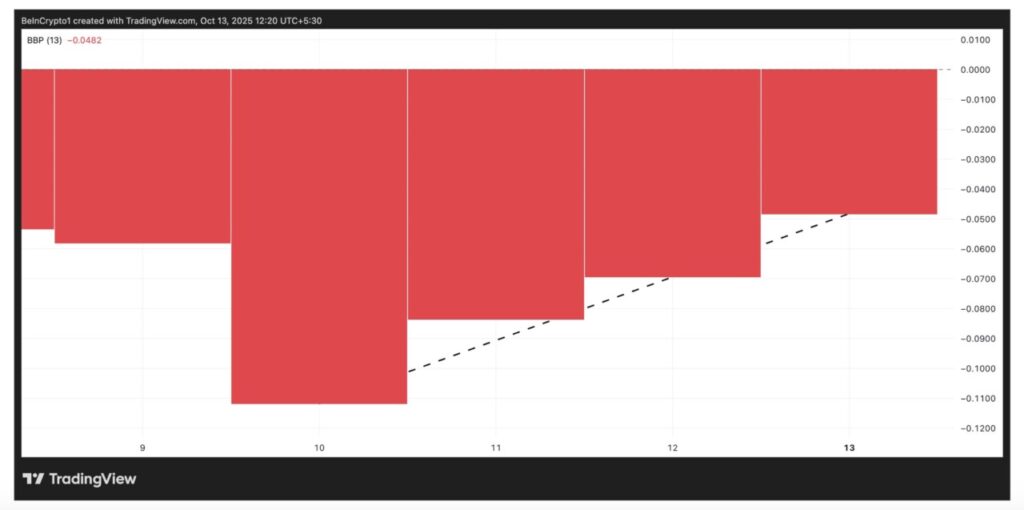

Data from the PI/USD daily chart (10/13) indicates that selling pressure on PI Coin is starting to ease. This is evident from the Elder-Ray Index indicator, where the red bars have been steadily shrinking over the past few sessions – signaling a weakening of bearish momentum. Currently, the value of the indicator stands at -0.0482.

The Elder-Ray Index is used to measure the strength between buyers(bulls) and sellers(bears) in the market. When the red histogram starts to shrink, it indicates that selling pressure is diminishing and buying power is starting to strengthen – often an early signal of a bullish trend reversal or short-term rally.

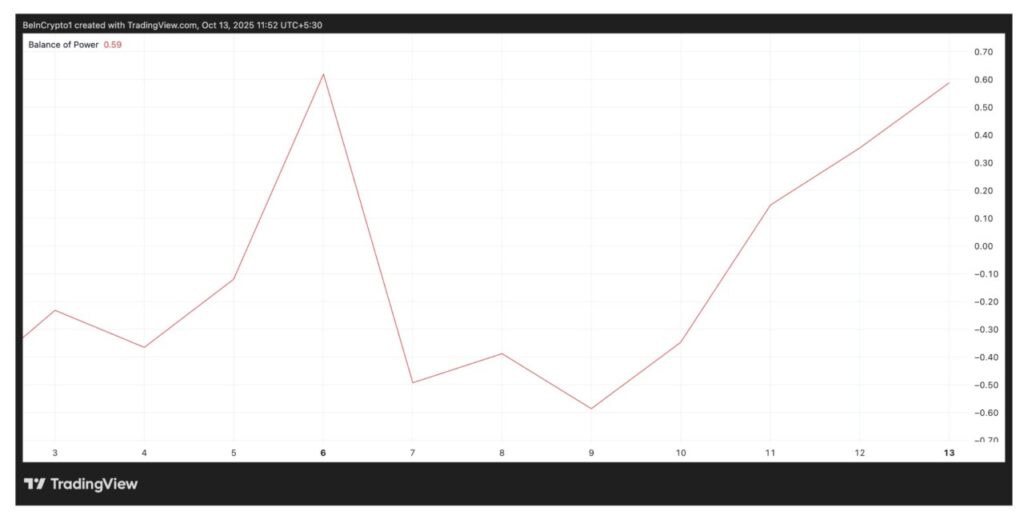

In the case of PI, positive signals are also reinforced by the Balance of Power (BoP) indicator which currently stands at 0.59 and continues to move up. This indicates increasing buyer-side confidence among traders.

BoP itself measures the dominance of buyers over sellers in a market. BoP values range from -1 to +1, where values close to +1 indicate strong buying pressure, while close to -1 reflects dominant selling pressure.

The current BoP PI value of 0.59 reflects the return of bullish sentiment among token holders. The indicator’s uptrend also hints that more and more market participants are opting to accumulate PI rather than take profits – strengthening the prospects of further price recovery.

Read also: Hyperliquid Activates HIP-3 Update, Empowering Anyone to Launch Their Own DEX

PI Coin Directional Reversal Begins to Form

The combination of current technical trends suggests a gradual shift in market sentiment towards PI Coin.

If PI prices are able to maintain this positive direction of movement, then a breakout above the $0.2573 resistance level could confirm a trend reversal and open the way to the next target zone at $0.2917.

However, if accumulation by traders and investors starts to decline, potential selling pressure could re-emerge – which risks pulling the price back to the all-time low of $0.1533. Hence, continuation of buying momentum is crucial to keep this bullish outlook alive.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. PI Coin Rebounds From Record Low, Shows Early Signs of a Bullish Reversal. Accessed on October 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.