3 Reasons Bitcoin’s $125,000 Rise Could Be Delayed – Watch Out For These Signals!

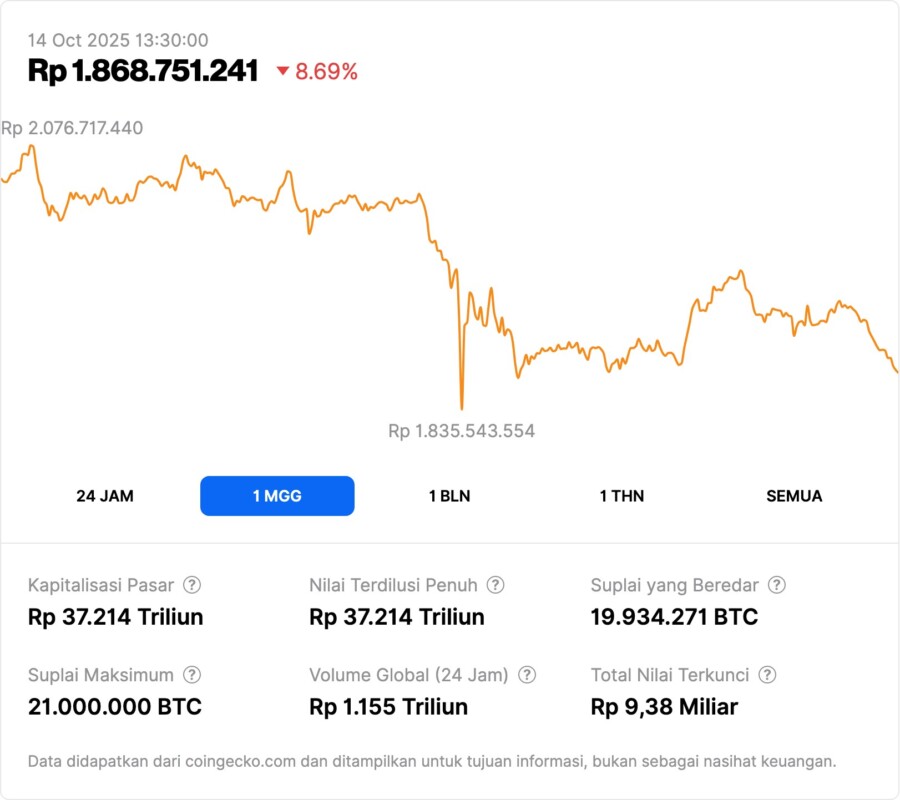

Jakarta, Pintu News – Bitcoin (BTC) price has recovered from last Friday’s flash crash, but the rise towards the $125,000 level could be delayed. Three major factors from the global market and investor sentiment are currently the main obstacles to a new all-time high.

Here’s the full explanation, based on a Cointelegraph report by analyst Marcel Pechman.

1. US Economic Data Weakens, Global Investors Start Risk-Averse

According to a report from The Wall Street Journal cited by Cointelegraph, only 17,000 jobs were created in the US during September – down from 22,000 in August. This reinforces signals of a slowdown in the US economy, which has a direct impact on investors’ risk appetite.

As a result, demand for US bonds surged, pushing the 2-year yield close to 3.5%. This reflects increased interest in “safe” assets, and signals that many investors are temporarily avoiding the crypto market, including Bitcoin.

In addition, the uncertainty of US-China relations ahead of the November 10 deadline for an extension of the tariff deal added to market concerns. President Trump has softened, but there is no real certainty about the continuation of negotiations.

Also Read: Memecoin Market Adds $10 Billion Post-Crisis: What’s Next for Traders?

2. Regulatory Uncertainty and Derivatives Risk Suppress Trading Interest

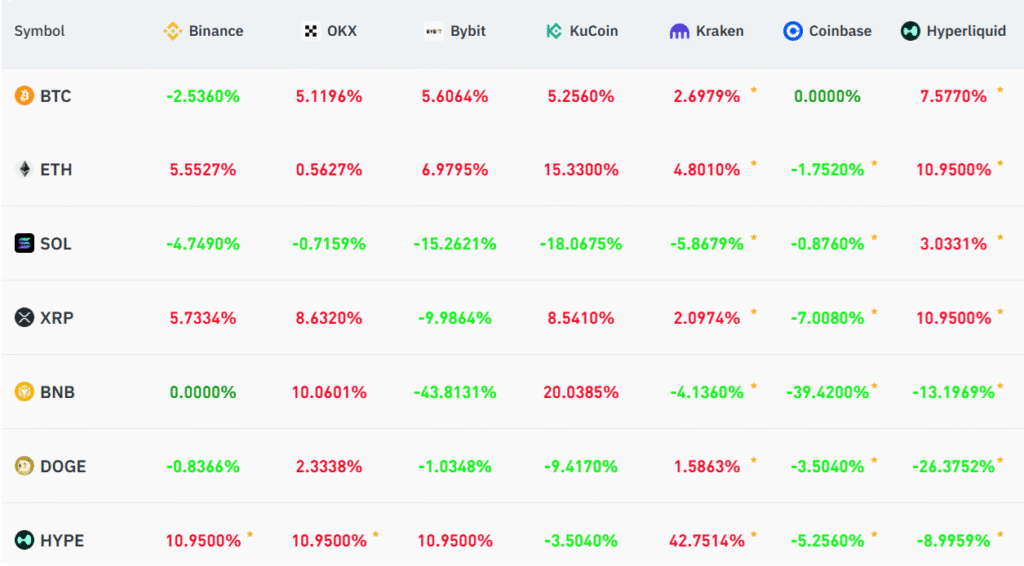

One important metric to watch is the negative funding rate in the futures market, particularly on Binance. This means that short positions have to pay leverage fees, which suggests the market is more bearish. At the same time, other markets have returned to normal, opening up the potential for arbitrage that usually only occurs when liquidity is disrupted.

Joe McCann, CEO of Asymmetric Financial, mentioned that “there was most likely a large market maker that got heavily liquidated” during Friday’s crash. This undermines confidence in price stability between exchanges, including the emergence of extreme price differences.

According to Cointelegraph, many traders are still choosing to refrain from re-entering for fear of a repeat of the crash. Confidence in the crypto derivatives system has not been fully restored.

3. Global Macro Uncertainty Hinders BTC’s Bullish Momentum

In addition to weak employment data, the US government shutdown has delayed the release of important economic data such as consumer inflation and wholesale costs. This leaves the Federal Reserve with insufficient data to decide on the future direction of interest rates – and leaves investors even more confused about market direction.

New regulations from China are also complicating market sentiment. They tightened export controls on rare earth metals, an essential ingredient for the global tech industry, including crypto mining. This was called “provocative” by US Treasury Secretary, Scott Bessent, and could exacerbate trade tensions.

Without clarity on the regulatory front, global economy, and geopolitical sentiment, BTC’s journey towards $125K could potentially be delayed for weeks to months, says Cointelegraph.

Conclusion: BTC Is Still Strong, But Investors Should Be Wary

Bitcoin’s strength to bounce back from a $19 billion flash crash does suggest long-term interest is still large. However, the risk appetite of short-term investors has plummeted.

With the combination of negative economic data, geopolitical tensions, and the uncertainty of the derivatives system, the potential for Bitcoin to break Rp2,070,000,000 ($125,000) could be delayed. For now, investors are advised to keep monitoring key metrics and wait for clearer market signals.

Also Read: BTC & ETH Rise After the “Biggest One-Day Wipeout in Crypto History”: Here’s Why!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Marcel Pechman / Cointelegraph. 3 Reasons Why a Bitcoin Rally to $125K Could Be Delayed. Accessed on October 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.