5 Hottest Facts in the Crypto World This Week

Jakarta, Pintu News – Bitcoin (BTC) price started the second week of October 2025 in a crucial position. After plummeting below $110,000 (Rp1.83 billion) due to the largest mass liquidation in crypto history, BTC is now showing signs of recovery. But the question is: is this the start of a new rally or a sign of the end of the bull market?

1. Bitcoin Rebounds After the “Black Friday of Crypto”

Bitcoin managed to climb back to around $116,000 (Rp1.92 billion) after slumping to $109,700 (Rp1.81 billion) last Friday. The rise recorded a recovery of about 5.7%, signaling buying pressure after a massive sell-off that liquidated more than 1.6 million traders.

The main trigger for the fall was President Donald Trump’s announcement of 100% import tariffs on Chinese products, triggering panic in global markets. Not only crypto, stock indices and gold prices were also in turmoil. However, gold actually set a new record at $4,078 per ounce, showing a temporary capital flight from risky assets.

As the market recovered, analysts called this event “one of the fastest wealth transfers in crypto history,” where many short positions were wiped out in a short period of time.

2. Bitcoin Volatility Trends Back Up

Data from Cointelegraph Markets Pro and TradingView shows Bitcoin’s implied volatility jumped to its highest level since April 2025. Crypto market analyst Frank A. Fetter called this spike a sign that market participants are anticipating the next big move.

“The market is finally starting to factor in the potential for more extreme price movements,” he said. Many traders believe that a rally towards $120,000 is possible, but the risk of a correction is still wide open if sentiment turns negative again.

Read also: Will the Bitcoin (BTC) Price Crash Happen Again? Market Watchers Speculate

3. The Fight at the $120,000 Level: Between Bullish and Bearish

Some traders like Roman think that last week’s big crash marks the start of a new downtrend for Bitcoin. He warns that a drop below $108,000-$107,000 (Rp1.78-Rp1.77 billion) would confirm the formation of a new macro bear market.

However, other analysts like Skew are more optimistic. According to him, as long as the price of BTC does not close the daily candle below $112,000 (Rp1.85 billion), the opportunity to continue rising to the psychological level of $120,000 (Rp1.99 billion) is still wide open. “Many big players are coming back into the market at the $115,000 level,” he wrote on X (Twitter).

4. IDR315 Trillion Liquidation and Leverage Reset

According to data from Glassnode and CoinGlass, more than $20 billion worth of crypto derivatives positions were liquidated in the last two days – making it one of the largest leverage flushes in history.

“Derivative funding across the crypto market fell to its lowest level since the 2022 bear market,” Glassnode wrote. Open interest (OI) data also showed a big drop, from $89 billion to $69 billion, before recovering slightly to $74 billion.

Glassnode co-founder Rafael Schultze-Kraft added that this drop signals a “massive speculation purge” in the crypto market. “Although leverage has come down, the bias of large traders towards short positions is still strong – remain vigilant,” he said.

Read also: Ready for Another Bull Run? Fundstrat’s Tom Lee predicts ETH price could hit $5,500!

5. Market Focus Turns to the Fed and the “Debasement Trade”

This week, investors’ attention turns to Federal Reserve Chairman, Jerome Powell, who is scheduled to speak about the US economic outlook in Philadelphia. Inflation data releases such as PPI and jobless claims have been delayed due to the US government shutdown, so Powell’s speech is a key highlight for predicting the next direction of interest rate policy.

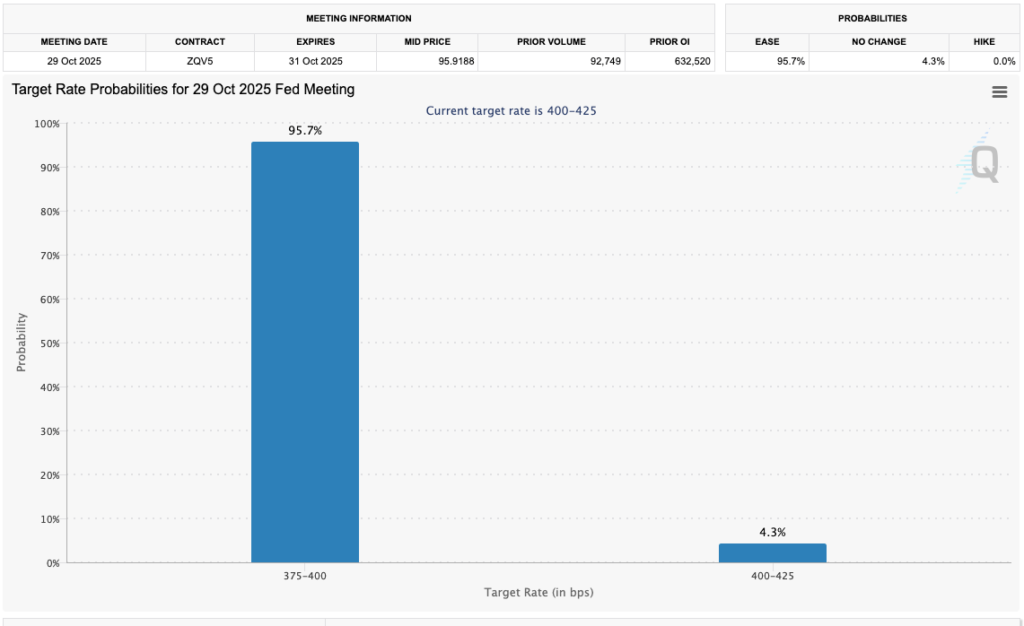

The majority of market participants expect a 0.25% rate cut on October 29, 2025, which could be a positive catalyst for risky assets such as crypto.

Meanwhile, analysts from Mosaic Asset Company think the “debasement trade” trend – a shift to hedge assets such as Bitcoin (BTC) and gold – will continue. With global debt rising and money supply expanding, Bitcoin has the potential to become a new alternative to depreciating fiat currencies.

Conclusion

This week could be a defining moment for the direction of the crypto market. If Bitcoin is able to break $120,000 ($1.99 billion) on high volume, the bullish rally could continue. However, failure to maintain support at $112,000 ($1.85 billion) could pave the way for a further correction.

With volatility still high and macro pressures yet to subside, investors are advised to remain cautious and wait for confirmation of trend direction before taking new positions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. $120K or End of Bull Market? 5 Things to Know in Bitcoin This Week. Accessed on October 14, 2025.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.