Dogecoin Slides 2% — Is a Drop to $0.095 on the Horizon?

Jakarta, Pintu News – The leading meme coin, Dogecoin (DOGE), has experienced another 5% increase. This increase came after the Dogecoin price had plummeted to its lowest level since September 2024 during a massive sell-off on Black Friday last week.

Amidst the overall crypto market’s attempts to bounce back from a sharp decline, DOGE prices have shown a slight uptrend in recent days. However, on-chain data indicates that this recovery may not be backed by strong conviction. The following analysis explains why.

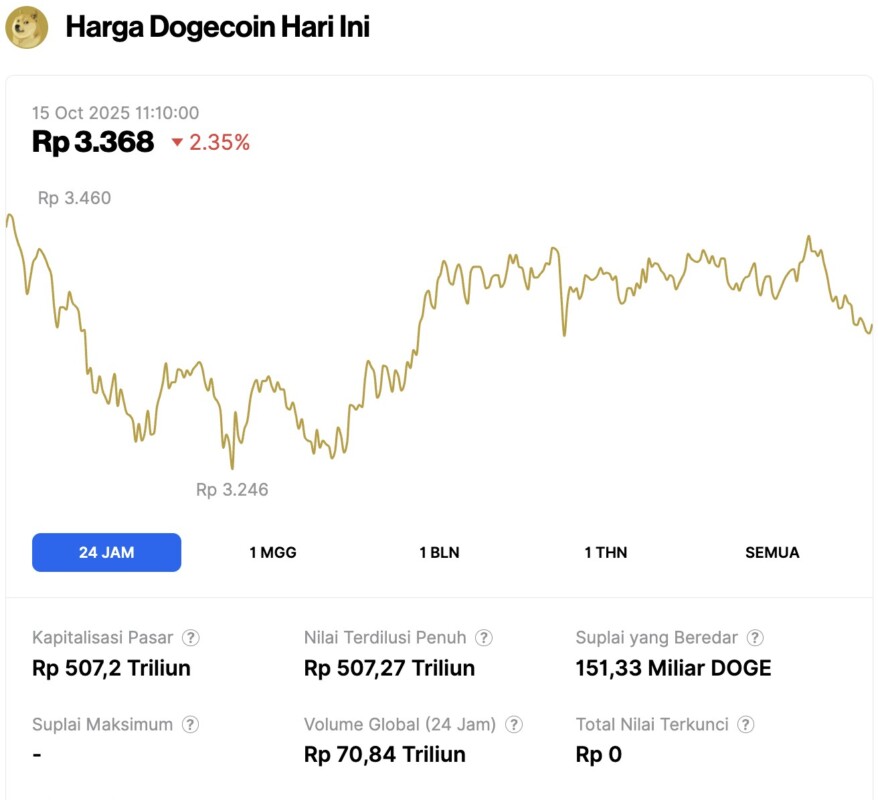

Dogecoin Price Drops 2.35% in 24 Hours

On October 15, 2025, Dogecoin saw a 2.35% decline over the past 24 hours, trading at $0.2022 — approximately IDR 3,368. During the same period, DOGE fluctuated between IDR 3,460 and IDR 3,246.

At the time of writing, Dogecoin’s market capitalization is around IDR 507.2 trillion, with a 24-hour trading volume of roughly IDR 70.84 trillion.

Read also: Ethereum Falls to $4,000 on October 15 – Is the Uptrend Losing Steam?

Dogecoin’s Recovery May Not Last Long

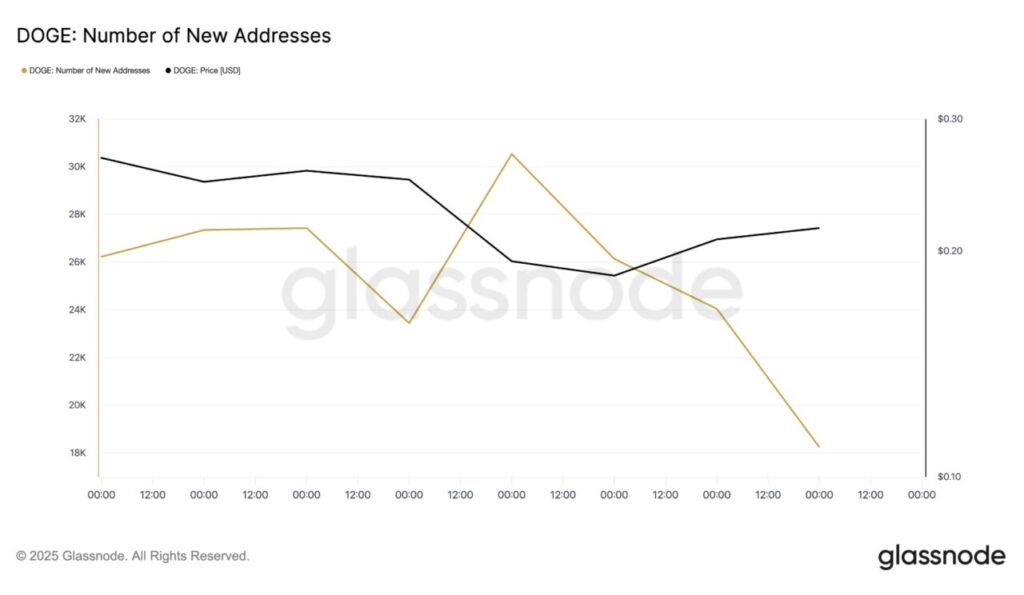

According to data from Glassnode, new demand for DOGE has been on a steady decline, with fewer and fewer new addresses interacting with the asset each day since last Friday.

Yesterday, only 18,251 unique addresses were first involved in DOGE transactions on the network. This represents a 40% decrease compared to the 30,534 active addresses that traded the meme coin during the massive Black Friday liquidation.

This drop indicates that the 5% spike in DOGE price is most likely due to short-term market sentiment, rather than real demand from investors for the altcoin. This puts the DOGE price at risk of a correction in the near future.

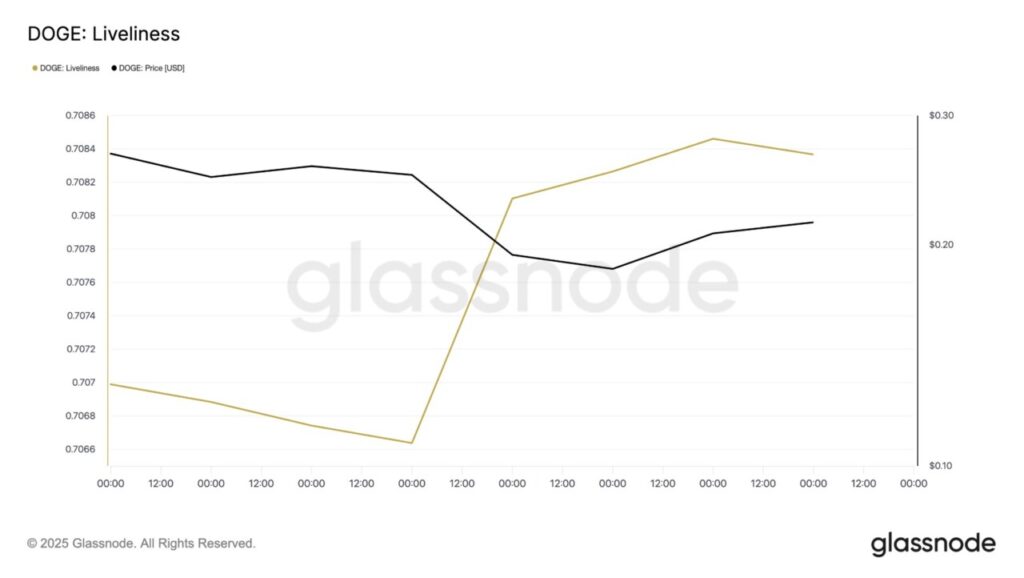

In addition, DOGE ‘s liveliness level has also shown a rise in the last few trading sessions. This suggests that long-term holders (LTH) see this price increase as an opportunity to sell their assets.

Based on Glassnode data, DOGE’ s liveliness metric closed at 0.708 on October 13.

The liveliness metric is used to track the movement of coins or tokens that have been held for a long time. When the value decreases, it means that long-term holders are withdrawing their assets from the exchange-which usually signals accumulation and is a positive (bullish) signal.

Conversely, if the liveliness value increases, as it did for DOGE, it means that more old coins are being moved or sold, signaling that long-term holders are starting to take advantage.

Read also: Bitcoin Price Plunges to $112,000 Today as Investor Confidence Remains Shaky

In the case of DOGE, the increase in liveliness metrics suggests that long-term holders are taking advantage of the current price increase to offload their holdings. This further strengthens the potential for a price correction in the near future.

Will DOGE Return to $0.095?

On the daily chart (10/14), Dogecoin is still facing significant selling pressure, with the price currently below its 20-day exponential moving average (20-day EMA). The 20-day EMA is currently forming dynamic resistance at $0.249, while DOGE is trading around $0.199 at the time of writing.

The 20-day EMA reflects the average price of an asset over the last 20 trading sessions, giving greater weight to recent prices. When prices are below this line, it indicates that selling (bearish) pressure still dominates, and short-term sentiment is negative.

Without any renewed buying interest or increased network activity, DOGE risks dropping to the next support level of $0.167.

If DOGE fails to hold this support level, then a deeper correction could occur. In this scenario, DOGE prices could potentially retest its 13-month low of $0.095, which was recorded during the recent market crash.

However, if sentiment improves and bullish momentum returns, DOGE has a chance to break the resistance at $0.224. If this breakout occurs, then the bearish scenario will be canceled, and DOGE could continue its rally towards the next target at $0.264.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Dogecoin Could Revisit Its 13-Month Low Despite a 5% Recovery. Accessed on October 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.