6 Financial Institutions Update Nvidia (NVDA) Stock Price Predictions

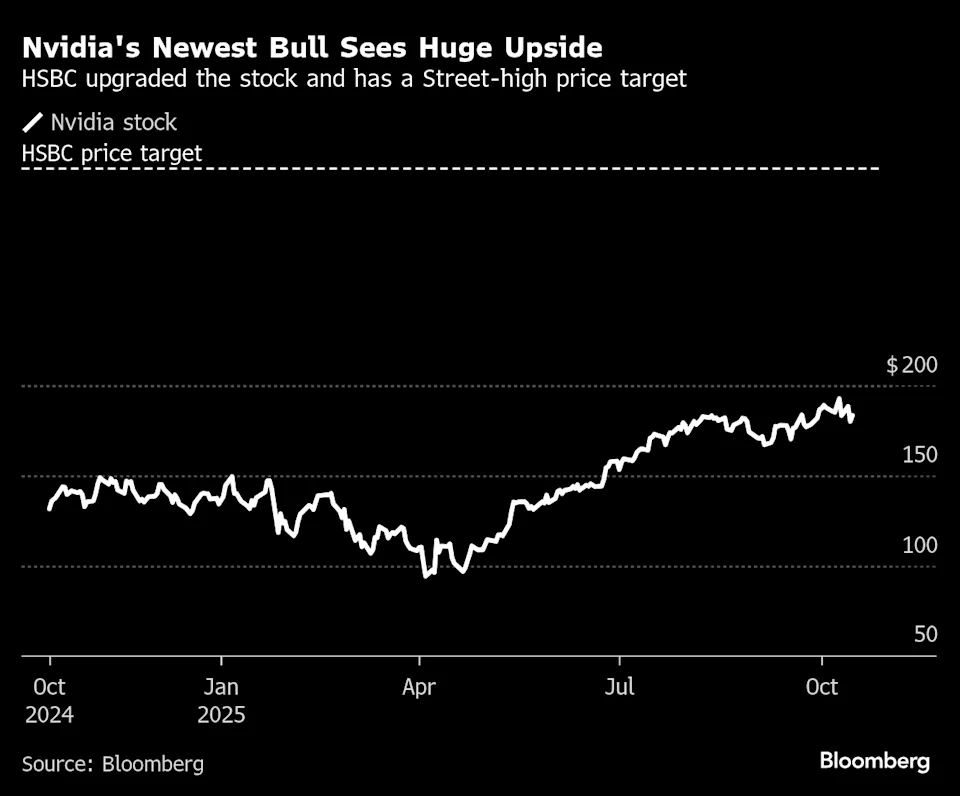

Jakarta, Pintu News – Nvidia’s (NVDA) share price is back in the spotlight after six major financial institutions, including HSBC, Morgan Stanley, and TD Cowen, simultaneously raised their price targets for the GPU giant’s stock.

This increase strengthens market optimism about Nvidia’s long-term prospects amid the artificial intelligence (AI) boom. NVDA shares had risen 2% on Wednesday (15/10/2025), signaling stronger buying sentiment from global investors, even amid market turmoil due to US-China trade tariffs.

HSBC Raises Nvidia Rating to “Buy”, AI Optimism is the Main Driver

Financial institution HSBC officially upgraded Nvidia’s stock rating from Hold to Buy and raised its price target from $200 to $320 or around Rp5.3 million per share.

In his latest research report, analyst Frank Lee emphasized that Nvidia’s revenue potential is still huge, especially since the AI chip (GPU) market is expected to continue to grow beyond Big Tech companies such as Amazon, Microsoft, and Google.

Lee added that the Total Addressable Market (TAM) for AI GPUs will continue to increase as more companies from various sectors integrate AI into their operations.

With the GPU market share still dominated by Nvidia, the company’s revenue growth prospects are considered very solid. This is what makes many institutional investors strengthen their long positions on NVDA shares.

Also read: What is NVIDIA? Owner, Products and Difference with Intel

5 Other Financial Institutions Raise Nvidia Stock Price Target

In addition to HSBC, five other major financial institutions – Baird, Evercore ISI, KeyBank, Morgan Stanley, and TD Cowen – also revised up their price targets for Nvidia shares with all bullish predictions.

Here’s a list of the latest projections from each institution:

| Financial Institutions | Old Target | New Target |

|---|---|---|

| Baird | $195 | $225 |

| Evercore ISI | $190 | $214 |

| KeyBank | $190 | $215 |

| Morgan Stanley | $200 | $206 |

| TD Cowen | $140 | $235 |

All of these projections put Nvidia’s share price above $200 (Rp3.3 million), with a potential upside of at least 14% to a maximum of 31%. This means that an investment of $1,000 (IDR 16.5 million) could potentially grow to $1,310 (IDR 21.7 million) if the predictions prove accurate.

The consistency of this increase suggests that Nvidia remains the most desirable asset in the US stock market in 2025. Buying interest comes not only from institutional investors but also retail and foreign investors.

Also read: 4 Factors Causing NVIDIA Shares to Rise, Here’s What You Need to Know!

Global Investors Still Have Faith in US Stock Market

According to Elyas Galou, Director of Global Investment Strategy at Bank of America, international investors are still very aggressively buying US stocks, including Nvidia. He noted that foreign funds entering the US stock market in 2025 have reached $290.7 billion (Rp4.8 quadrillion).

This shows that trade tensions between the US and China have not dampened investor interest in leading technology stocks. Nvidia has even managed to survive several market “mini crashes” so far this year and remains up nearly 30% year-to-date (YTD).

With its strong position in the GPU industry and its important role in the development of generative AI, Nvidia is now considered a “hot stock” in the US tech sector. Many analysts say that global AI momentum – from AI adoption in large enterprises to expansion into the public sector – will continue to drive demand for Nvidia chips over the next few years.

Also read: Does NVIDIA Stock Share Dividends? Here’s How Much!

Nvidia and AI Stocks are the Main Focus of Investors in 2025

Investment trends for 2025 confirm that AI-based stocks such as Nvidia (NVDA), AMD, and ASML are the backbone of the technology sector. Optimism about the future of AI has prompted major financial institutions to update their projections and give buy signals to investors.

Analysts consider Nvidia’s continuous innovation – from the H100 to H200 chips for data centers and AI model training – to be the main factor behind the increase in market confidence. With its technological dominance and strong fundamentals, NVDA is predicted to continue leading the global semiconductor sector in the long run.

US xStocks Comes to the Door: Access US Stocks Through the Crypto World

US xStocks (Tokenized) is now available for trading on Pintu. This product allows you to have exposure to major US stocks such as Apple (AAPLX), Tesla (TSLAX), Nvidia (NVDAX) in the form of tokens whose value follows the original stock price.

US xStocks is a crypto asset that represents US public stocks and is backed by a verified underlying asset. With US xStocks on Pintu, you can easily access global stock markets through a secure and transparent crypto ecosystem.

Check US xStocks Price at the Door!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Watcher Guru. 5 Firms Revise Nvidia Stock Price Prediction, See Bullish NVDA Target. Accessed October 16, 2025

- Watcher Guru. Nvidia (NVDA) Stock Gets Price Forecast Upgrade from HSBC. Accessed October 16, 2025

- Featured Image: Yahoo Finance

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.