Dogecoin Holders Are Buying the Dip — But Is the $1.60 Target by 2026 Within Reach?

Jakarta, Pintu News – Dogecoin (DOGE) suffered a sharp decline on Black Friday (Oct 11), with the price plunging from $0.25 to $0.08 in a 66% flash crash. Although the price quickly recovered to the $0.20 level, the event led to more than $365 million in long positions being liquidated – more than four times the previous annual record of $89 million.

According to Cointelegraph, while the leveraged market is undergoing massive adjustments, traders in the spot market can take advantage of this situation.

Dogecoin Plummets Sharply, but Fundamentals Remain Strong

On-chain data shows that DOGE’s long-term fundamentals remain strong despite the wave of liquidation. Alphractal’s CEO, Joao Wedson, stated that DOGE has not yet entered the “euphoria” phase, and short-term holders continue to accumulate.

Read also: Dogecoin Falls to $0.19 Today: Are Whales and Holders Pulling Out?

According to Wedson’s analysis, DOGE reached its cycle peak in December 2024 right at the CVDD Alpha indicator, a Cumulative Value Days Destroyed-based tool used to identify price cycle peaks and bottoms.

Although the 2024 price peak is relatively weak in terms of on-chain interest, Wedson emphasized that the model has successfully identified every DOGE price peak since 2016.

Hodl Waves data points to further upside potential for DOGE price

Recent data from Hodl Waves shows an increase in the proportion of DOGE supply owned by investors with a holding age of up to six months. This is indicative of new speculative capital inflows. Historically, this has often been an early sign of price increases, as the influx of new funds usually pushes up the Realized Cap of DOGE.

Supporting this signal, the MVRV Z-Score is still well below the last euphoric level recorded in 2021. This suggests that the DOGE market is still in the early phase of expansion.

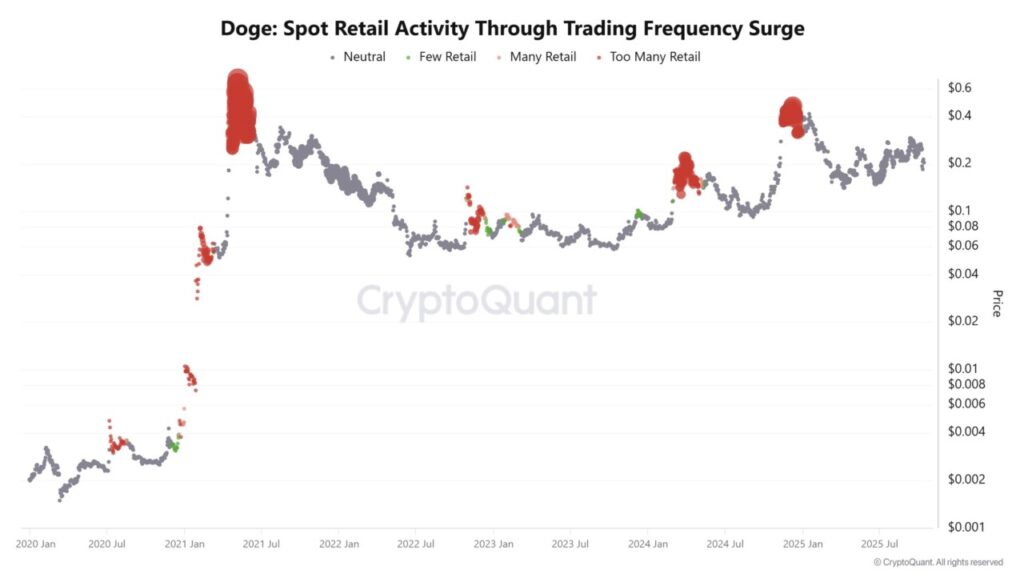

Meanwhile, data from CryptoQuant reveals that retail investor positioning remains neutral, with no signs of speculative euphoria. This balance-not overheated, but also not lethargic-usually reflects a situation where accumulation prevails over hype.

Phases like this are often the precursor to large waves of retail investor participation, which means the current DOGE rally likely still has room to continue before it reaches its peak.

Read also: Global Pi Network Market Reaches 208,000 Users, but Criminality Issue Looms!

Uncertainty Could Be a Bullish Signal for DOGE

Although sentiment towards Dogecoin is cautious following the flash crash, this kind of uncertainty has historically often been a strong bullish signal for DOGE.

Crypto trader EtherNasyonal noted that every major DOGE rally in the past always started after the price managed to hold above the 25-day moving average, break the long-term downtrend, and enter the retest phase.

According to him, all of these conditions are currently occurring-signaling that DOGE tends to initiate its big moves when the market is filled with hesitation and fatigue.

Similarly, market analyst Trader Tardigrade highlighted that DOGE’s current price movement structure mirrors the bull cycle that occurred in 2014-2017. He estimates that if this pattern continues, DOGE could potentially experience a further rally that could target a price of around $1.60 by early 2026.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. DOGE holders are buying dips: Is $1.60 by 2026 realistic? Accessed on October 16, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.