XRP Market Collapse: Is There Hope for Recovery? (10/17/25)

Jakarta, Pintu News – The Ripple (XRP) derivatives market has recently experienced a major shock with the liquidation of long positions reaching $610 million. This event has resulted in a drastic drop in Open Interest and an expected leverage ratio. However, the question that arises is whether there is hope for a recovery in the future?

Major Impact on Ripple (XRP) Derivatives Market

The Ripple (XRP) derivatives market saw a significant drop in Open Interest, which now stands at over $4 billion. This decline marks the lowest point of the leverage ratio expected throughout 2025. This suggests that many investors have withdrawn from the market, reflecting uncertainty and caution among market participants.

This drastic drop not only affected the value of Ripple (XRP) but also raised questions about the stability of the derivatives market as a whole. Investors and analysts are now looking at key indicators to predict a possible recovery or further decline.

Read More: Altseason Index This Week: Traders Prepare to Take Profits

Ripple (XRP) Recovery Hopes

Although the current market looks bleak, there are some conditions that could trigger a recovery for Ripple (XRP). One of them is the ability of Ripple (XRP) to break the $3.1 resistance. In addition, the market’s recovery also largely depends on the performance of Bitcoin (BTC), which needs to surpass $117,000 to give the overall crypto market a positive boost.

Investors are advised to monitor these developments closely. A Ripple (XRP) recovery would not only benefit Ripple (XRP) holders but could also be a positive indicator for the crypto market in general.

Trader Behavior in the Spot Market

In the spot market, traders are showing a very cautious attitude. The Buy/Sell Ratio by Takers that has remained below one over the past few months suggests that selling volumes are dominating. This reflects sellers’ dominance in controlling price movements, which contributes to the continued bearish sentiment.

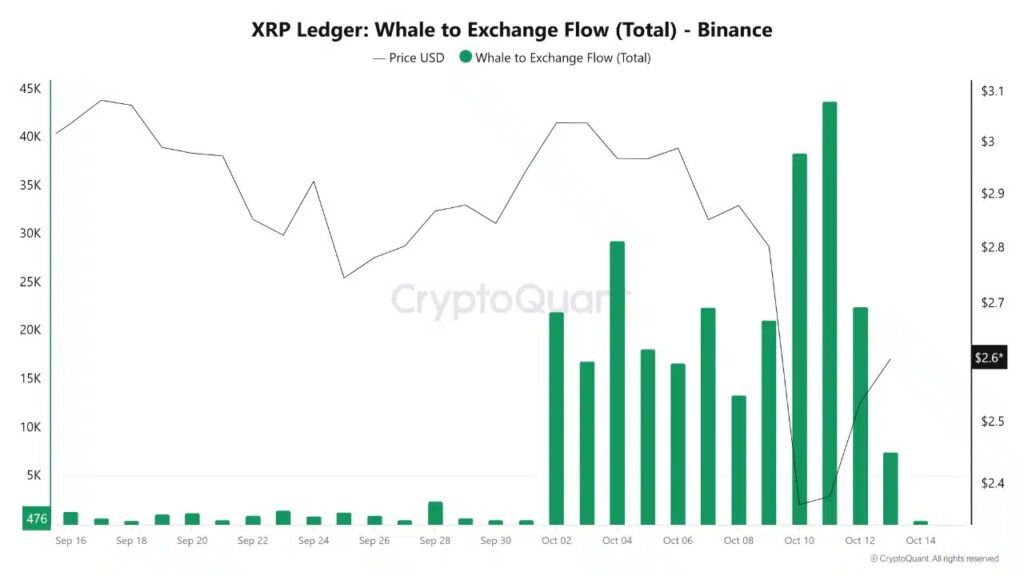

Additionally, Binance reported an increase in whale inflows to the exchange in October, which suggests that large wallets are likely to sell their Ripple (XRP). This adds to the selling pressure in the market, which could worsen the already bearish market conditions.

Conclusion

With market conditions full of uncertainty, Ripple (XRP) investors and traders should remain vigilant and prepare for any eventuality. Monitoring market indicators and current news will be crucial in navigating these uncertain times. Whether Ripple (XRP) will manage to recover or continue to decline, only time will tell.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP Deleverages Hard After $610 Mln Long Side Wipe, What’s Next?. Accessed on October 17, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.