The End of Bitcoin’s Rise: The Peak Time Signal is Almost Over! (10/17/25)

Jakarta, Pintu News – Bitcoin (BTC) is showing another decline after a turbulent few days, with the current price dropping towards $111,000. This is a 12% drop from its recent peak of $126,000, sparking concerns among market experts who argue that Bitcoin’s price rise may be nearing its end.

Does the Bitcoin Bull Cycle End in Nine Days?

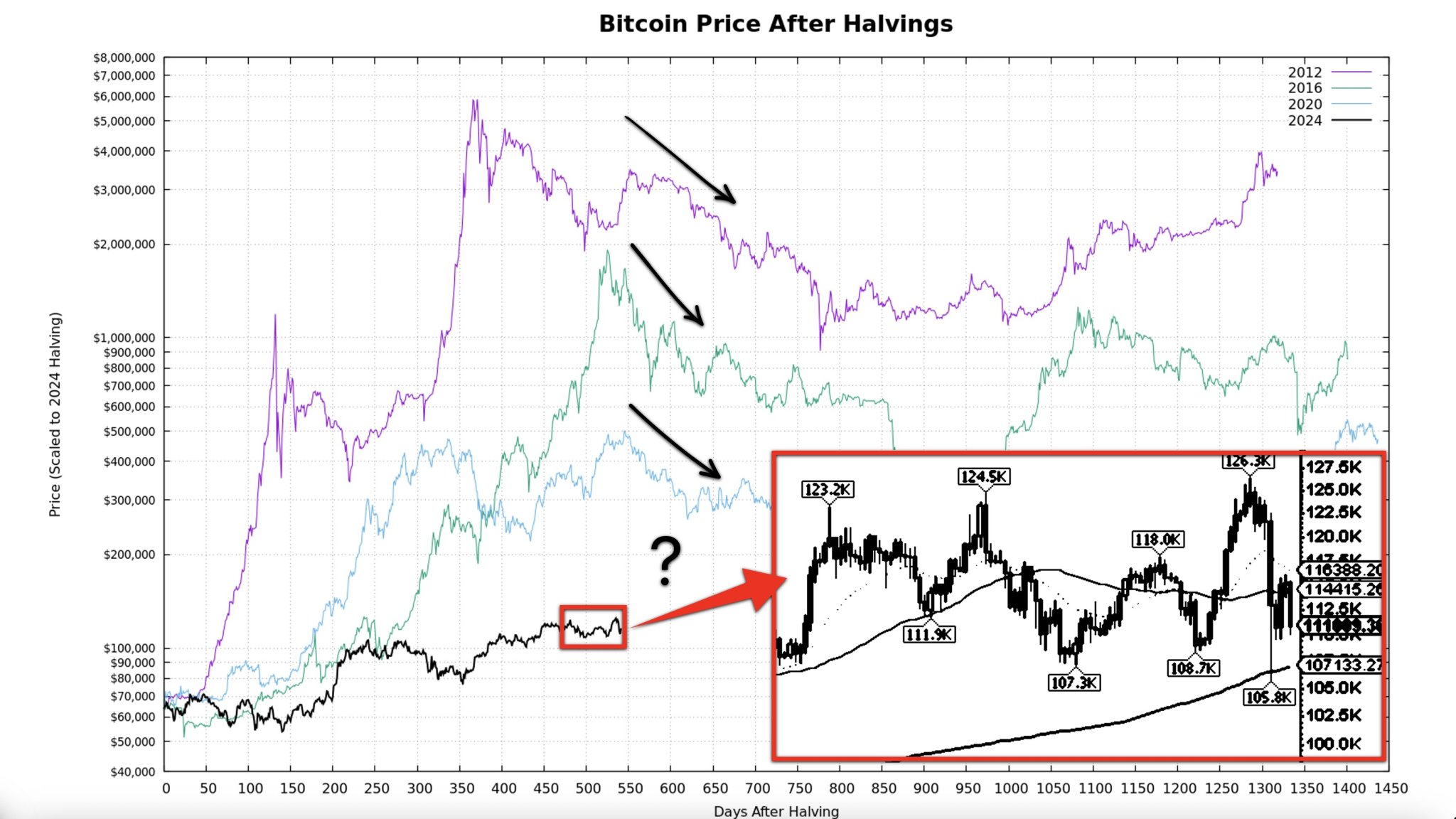

On October 14, a market analyst known as CryptoBirb stated on social media platform X (formerly Twitter) that Bitcoin’s bullish cycle might end in the next nine days. He referred to the Cycle Peak Countdown indicator which shows that Bitcoin has already passed 99.3% of the current cycle which has lasted for 1,058 days.

According to CryptoBirb, this final stage is characterized by a “classic weak-hand shakeout,” a pattern often seen before market peaks. CryptoBirb emphasized that October 24 is a critical date to watch out for, and mentioned that the recent price crash is “right on schedule.”

Furthermore, he explained that the market is already in the peak zone, with 543 days having passed since the last Bitcoin Halving, exceeding the historical peak window of between 518 to 580 days. The Fear & Greed Index also dropped dramatically from 71 to 38, signaling a change in sentiment from fear to euphoria. The Relative Strength Index (RSI) also dropped from 67 to 47, suggesting that this emotional flushing may create the ideal foundation for the final euphoric surge.

Read More: Altseason Index This Week: Traders Prepare to Take Profits

Mixed Signals from Technical Indicators

Although the Relative Strength Index (RSI) stands at 47 indicating that momentum has reset, the Average True Range (ATR) has increased to 4,040, signaling higher volatility. This suggests that the market may still have some significant turbulence before it peaks or before it finally crashes.

At the same time, institutional investors started to change their strategies, as seen by the fund flows on the Bitcoin Exchange-Traded Fund (ETF) that went from an inflow of $627 million to an outflow of $4.5 million. Outflows on the Ethereum (ETH) ETF reached $174.9 million, indicating that smart money took advantage before retail investors started to fear missing out (FOMO). This behavior corresponds to the classic distribution-to-accumulation transition.

On-Chain Metrics Show a Cooling Market

On-chain metrics showed a decrease in market activity, with Net Unrealized Profit/Loss (NUPL) dropping to 0.522 from 0.556, and Market Value to Realized Value (MVRV) falling to 2.15 from 2.45. This profit-taking may have created the necessary space for the final euphoric push.

Although Bitcoin’s performance in October showed a decline of 2.09%, contrasting with the historical average of 19.78% gain, this decline could be a bullish sign indicating that big moves are still possible in the last weeks of the month.

Conclusion

With the current cycle seemingly nearing completion, having spent 25 days in the peak zone and experiencing a reset in sentiment and institutional distribution, as well as weak performance in October, this analysis could be the perfect storm for a final surge before entering a new crypto winter.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Bull Run Coming to an End, Cycle Peak Countdown Signals 99.3% Completion. Accessed on October 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.