How is the Crypto Market Today (10/17/25)?

Jakarta, Pintu News – The crypto market is back in the news after recent reports revealed the involvement of United States President Donald Trump and a number of crypto industry executives in a fundraising event at the White House.

On the other hand, the Financial Times report also mentioned that the Trump family has earned more than $1 billion (IDR 16.5 trillion) from various cryptocurrency projects they have built since the beginning of his second term.

Meanwhile, the crypto world was also abuzz with a major technical glitch from Paxos, the issuer of the PayPal USD (PYUSD) stablecoin, which “accidentally” minted 300 trillion tokens before promptly burning them back – an incident that put a spotlight on blockchain transparency.

Crypto Executives Attend White House Fancy Dinner

President Donald Trump reportedly hosted major crypto industry executives at a fundraising event for the construction of a new ballroom at the White House.

According to the Wall Street Journal, invited guests included Cameron and Tyler Winklevoss (founders of the Gemini exchange), as well as representatives from Coinbase and Ripple (XRP). The event aimed to raise around $250 million (IDR 4.1 trillion) to expand the White House complex by more than 8,000 square meters.

Interestingly, the event took place in the midst of a partial US government shutdown for more than two weeks, when thousands of federal employees were furloughed with no certainty. In addition to crypto luminaries, representatives from Meta, Google, Amazon, Microsoft, and Lockheed Martin were present.

The presence of these big names reinforces the signal that the crypto industry now has an increasingly strong political influence in the US government, especially under Trump’s leadership.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (10/17/25)

Trump Family’s Crypto Wealth Reaches IDR 16.5 Trillion

A Financial Times investigation revealed that the Trump family’s newfound wealth has largely come from crypto business expansion, particularly through the company World Liberty Financial (WLFI). Founded by Trump’s children, the company sells billions of dollars worth of tokens and stablecoins, with Donald Trump himself listed on WLFI’s official website as co-founder emeritus.

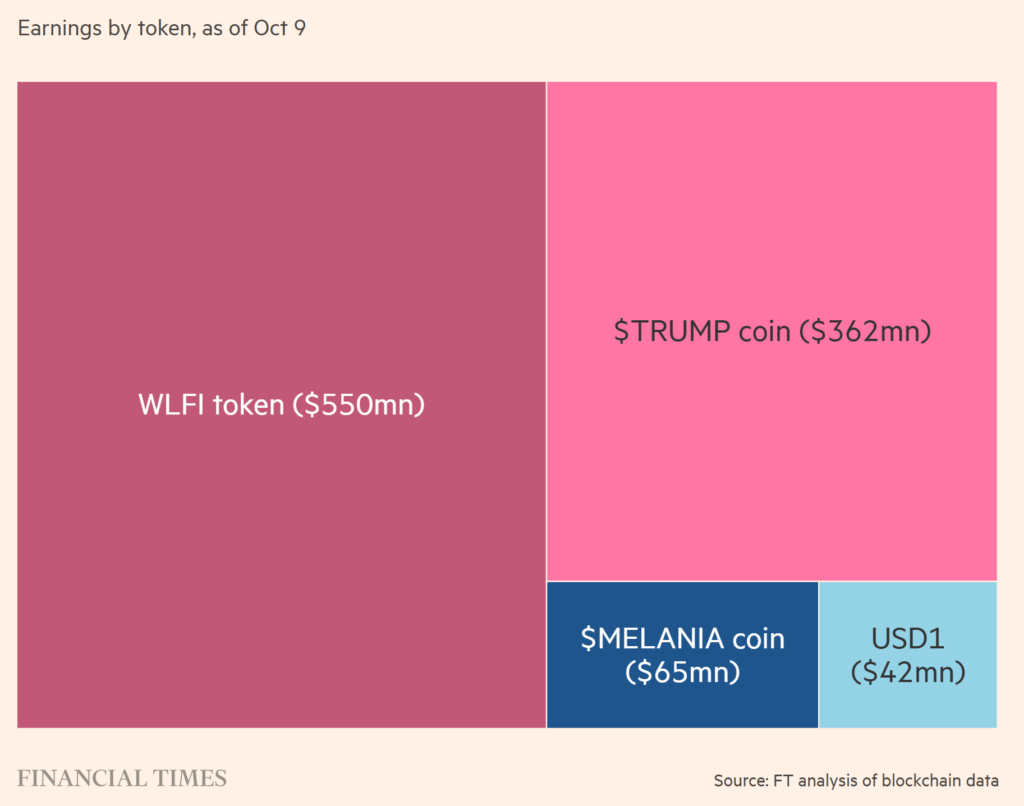

WLFI has reportedly made $550 million in the past year alone, while the Trump family’s total crypto income since 2024 stands at more than $1 billion before taxes. In addition, they have also benefited greatly from memecoin projects such as Official Trump (TRUMP) and Official Melania Meme (MELANIA), which provided hundreds of millions of dollars from trading fees and token sales.

Analysts think this move shows how political figures like Trump are able to utilize the power of personal branding to dominate the still rapidly growing cryptocurrency market.

Paxos Prints 300 Trillion USD PayPal Tokens, Then Deletes Them

A major incident also rocked the crypto world when Paxos, the issuer of the PayPal USD (PYUSD) stablecoin, accidentally minted 300 trillion tokens – equivalent to IDR4,975 quadrillion – in less than half an hour. Blockchain data shows the minting occurred at 7:12 p.m. UTC on October 15, 2025, and all tokens were burned again 22 minutes later.

Paxos explained that the incident was an “internal technical error” with no security breach. Although the PYUSD price remained stable at around $1, there was a drop of around 0.5% shortly after the incident. Crypto lending platform Aave even temporarily froze trading of the token.

Also read: CoinShares XRP ETF Soon Listing on Nasdaq, Check out the Details!

Blockchain Transparency in the Spotlight

While the error sounds fatal, industry players have praised the blockchain system for its ability to provide transparency and quick corrections. OKX Australia CEO Kate Cooper thinks the incident proves that “mistakes can happen in any financial system, but only blockchain makes them openly traceable and correctable.”

Meanwhile, Eco’s CEO, Ryne Saxe, added that this level of transparency “has never existed in the traditional banking system,” and is a strong reason why more financial institutions should consider adopting blockchain technology.

Conclusion

From lavish White House dinners to “fat finger errors” worth hundreds of trillions, the crypto world continues to exhibit a dynamic that reflects the intersection of politics, technology, and global finance. Whether it’s the Trump family’s massive profits or blockchain’s transparency in the face of technical glitches, one thing is clear – cryptocurrency is no longer just a digital asset, but a major centerpiece in the modern economy and geopolitics of the world.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Here’s what happened in crypto today. Accessed on October 17, 2025.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.