3 New Bitcoin Whale Behaviors After October’s Market Crash

Jakarta, Pintu News – The market collapse on October 11 not only had a major impact on retail investors, but also changed the behavior of Bitcoin (BTC) whales. Analysis of recent on-chain data shows three significant changes in the activity of this group!

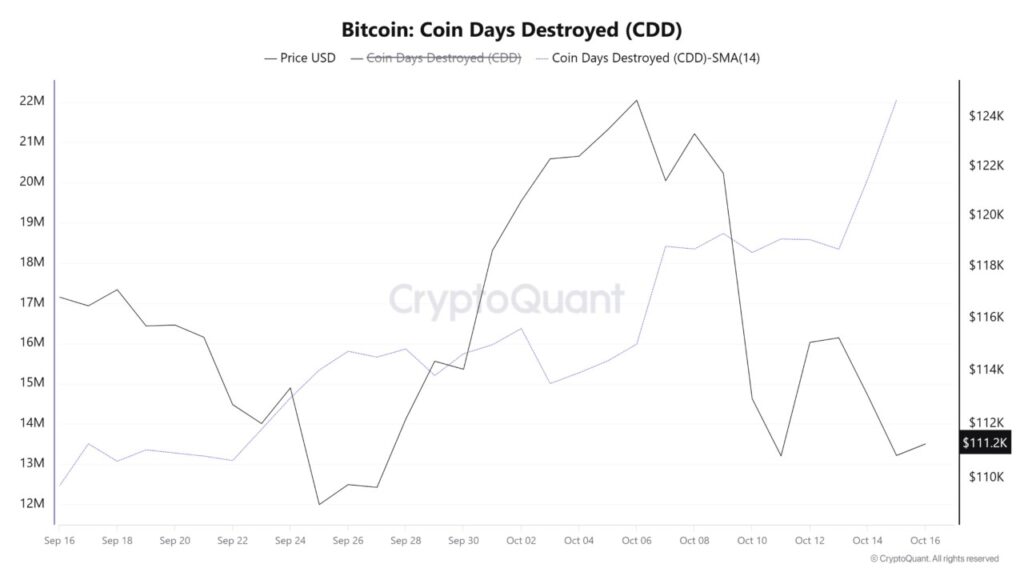

Sleeping Whale Starts to Move

Post-collapse, Bitcoin (BTC) from wallets that had been dormant for a long time started to move. This suggests that the old whales felt the need to take action. For example, on October 14, about 14,000 BTC that had been dormant for 12-18 months were moved within the network.

This movement could be a response to the price fluctuations that have occurred, or perhaps as a strategy to secure assets amidst market uncertainty. Whatever the reason, it signals a change in strategy that may affect Bitcoin (BTC) market dynamics going forward.

Read also: Why isn’t Pi Network (PI) listed on Binance yet? CZ Opens Up!

Increased Whale Inflow

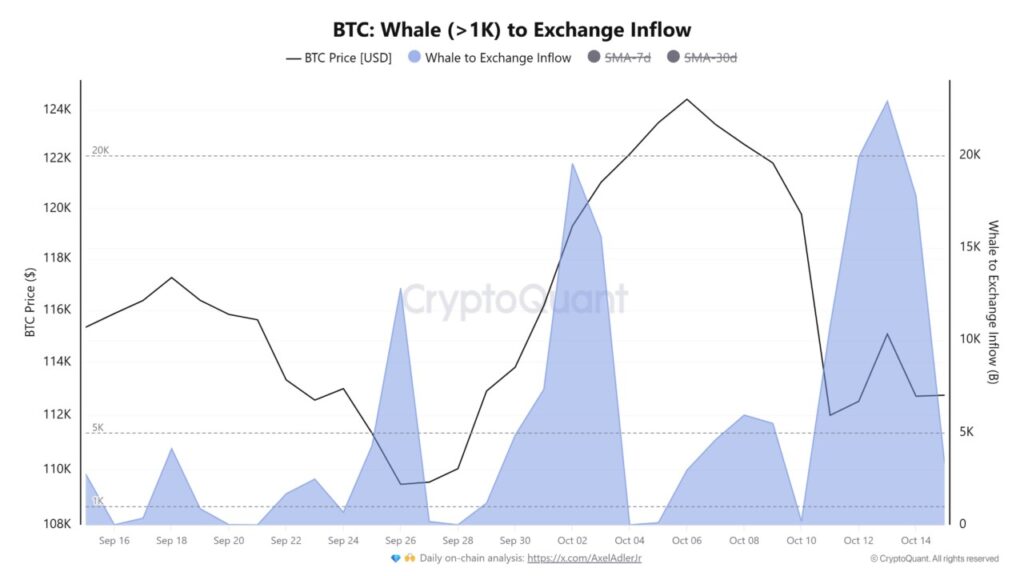

According to data from CryptoQuant, there was a spike in inflows from whale wallets holding more than 1,000 BTC after October 11. This indicates increased activity among the big whales in the Bitcoin (BTC) ecosystem.

This increase may be an indication that the whales are preparing for a significant price move or they may be trying to capitalize on market volatility for short-term gains. Both possibilities are important to monitor as they can provide signals about the next direction of the market.

Read also: Bitcoin (BTC) Bull Run Cycle Predicted to End in 10 Days? Analyst Explains

Proportion of Whale Transactions on the Exchange Increases

Another important metric is the Exchange Whale Ratio, which measures the proportion of the 10 largest incoming transactions relative to the total inflows on the exchange. After the events of October 11, there was a significant increase in this metric.

This increase suggests that Bitcoin (BTC) whales are more active in moving their assets to exchanges, perhaps as part of a sell strategy or to capitalize on price swings. These changes are important to analyze further as they may provide insight into the behavior of large investors in the face of market volatility.

Conclusion

This change in Bitcoin (BTC) whale behavior indicates a normal redistribution phase where Bitcoin (BTC) moves from old whales to new whales. This process not only marks a change in ownership but could also help in the maturation of the market. These new whales include ETF funds and institutional accumulators that are increasingly playing an important role in the Bitcoin (BTC) ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Shifts in Bitcoin Whale Behavior. Accessed on October 18, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.