5 Important Indicators to Detect Altcoin Season Early

Jakarta, Pintu News – The altcoin season phenomenon is back in the spotlight in the crypto world. This period is characterized by massive price spikes in most altcoins – crypto assets other than Bitcoin (BTC) – which can even outperform the performance of the crypto king.

Data from the Blockchain Center shows that altseason officially begins when 75% of the top 100 altcoins outperform Bitcoin in the last 90 days. But what exactly triggers altcoin season, and why is this moment so important for investors?

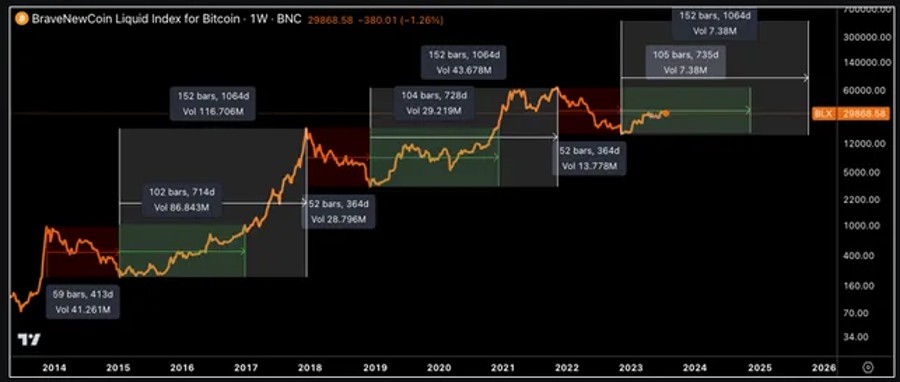

1. Bitcoin Price Cycle is the Initial Trigger

Bitcoin (BTC) has always been a major barometer of the crypto market. Its price movements are often the main trigger for the start of altcoin season. Usually, altseason comes after a big rally of Bitcoin.

For example, when BTC broke through the psychological level of $100,000 (Rp1.65 billion) at the end of 2024, many investors started taking profits and moving their capital to altcoins that offered higher potential returns.

This phenomenon is closely related to market psychology. As Bitcoin goes through a consolidation phase after a big run-up, traders start looking for opportunities in other assets such as Ethereum (ETH), Solana (SOL), and Cardano (ADA).

A drop in Bitcoin’s dominance below 60% is often a strong signal that capital is flowing into altcoins, signaling the start of capital rotation towards assets with greater risk and reward.

2. Market Sentiment and FOMO are the Main Fuel

Altcoin seasons are not only triggered by technical data, but also by market emotions, especially fear of missing out (FOMO). When altcoins such as Dogecoin (DOGE) or Pepe Coin (PEPE) started recording double- to triple-digit gains, the euphoria on social media such as X (Twitter), Reddit, and Telegram increased rapidly.

This phenomenon created a snowball effect – the more people talked about altcoins, the more interest retail investors had in jumping on the bandwagon. By mid-2025, Google Trends data recorded a surge in searches for the keyword “altcoin” to break new records, surpassing even the May 2021 altseason peak. Meanwhile, institutional funds have also started to move into altcoins, with inflows into Ethereum ETFs reaching $4 billion in August 2025.

Also read: Top 5 Altcoins that Will Shine in Q4 2025 According to Bitwise Analysis

3. Global Liquidity and Macroeconomic Conditions

Macroeconomic factors also play a big role in shaping altcoin season. When central banks like the Federal Reserve (Fed) cut interest rates or increase liquidity through quantitative easing policies, investors tend to shift funds from safe assets to risky assets like cryptocurrencies.

The low interest rate policy in 2020-2021, for example, created ideal conditions for altcoins to set record high market capitalization. Analysts now think that a potential Fed rate cut by the end of 2025 could again be a major catalyst for the altcoin rally. In addition, positive developments in regulation such as the approval of the spot Ethereum ETF in the US have also boosted investors’ confidence in the future of crypto.

4. Technological Innovation and New Narratives in the Crypto World

Every altcoin season has its own theme. 2017 was characterized by the ICO boom, 2021 was driven by DeFi and NFTs, while 2025 brought a new narrative: the integration of AI (Artificial Intelligence) and tokenization of real-world assets (RWA).

Platforms such as Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) are now focusing on developing technologies that can support the tokenization of assets such as stocks and property. AI and DeFi-based projects are also increasingly in demand by institutional investors because they are considered to have real utility. The increased demand for these technologies is one of the main drivers of the altcoin rally in this cycle.

5. Capital Flows from Institutional and Retail Investors

Unlike previous cycles dominated by retail investors, altcoin season 2025 is led by institutional capital. Data shows Bitcoin’s dominance falling below 59%, signaling large capital flows shifting to altcoins.

Ether (ETH)-based ETFs recorded inflows of up to $4 billion in August 2025, while Solana and Ripple (XRP) ETFs are awaiting approval from the SEC with the potential to raise an additional $8 billion.

In addition, altcoin trading volume on Binance Futures surpassed $100.7 billion (Rp1,667 trillion) per day in July 2025 – the highest figure since February. These figures show that altcoins are now a key focus for both institutional investors and retail traders.

Conclusion:Has Altseason Already Started?

With indicators like the Altcoin Season Index now at 78 and Bitcoin’s dominance at just under 60%, many analysts believe that the alt-season has already begun. However, keep in mind that the potential for huge profits always comes with high risks.

Altcoins are known to be highly volatile and can lose 50-90% of their value post-peak. Therefore, a wise investment strategy, diversification, and understanding of the macro and psychological conditions of the market are the keys to success in facing the next altcoin season wave.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. What Really Drives Altcoin Seasons? A Closer Look. Accessed October 19, 2025.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.