Bitcoin Plunges as Gold Price Peaks: Will Uptober Bounce Back?

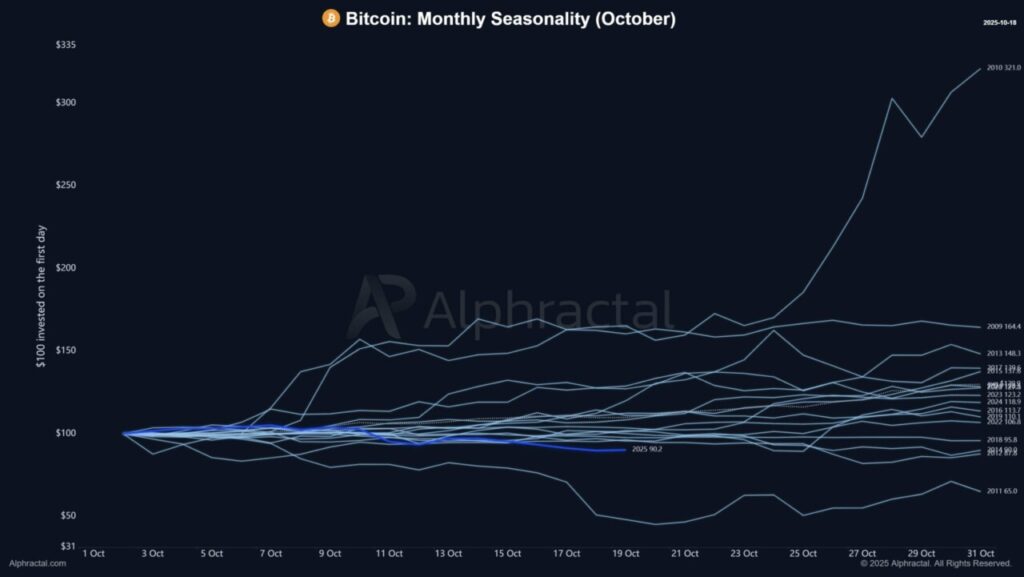

Jakarta, Pintu News – This October has been a tough test for Bitcoin (BTC) supporters. In the middle of a month usually dubbed “Uptober,” BTC found itself in an unusual situation – recording one of the worst mid-month performances in its history.

However, there is an important point that may have gone unnoticed. The chances of closing the month with an uptrend (green) are still considerable, and the rare details in the BTC to gold comparison chart point to the possibility that the price has bottomed out.

Will Uptober live up to expectations, or will it mark the end of this positive trend?

Tough Start, but History Favors the Bulls

October 2025 has been recorded as the second worst October in the history of Bitcoin (BTC). This comes as a surprise, given that October is usually known as the favorite month of bullish investors.

Read also: Stablecoin Supply Hits Record $304.5 Billion – Is DeFi & Bitcoin’s Big Rally Coming?

Over the past 15 years, only four times has October closed with a price drop (red zone). However, with a 73% chance of closing the month in the green, hope is still on Bitcoin’s side.

Despite the inconclusive start to the month, many believe that the trend could still turn positive before October ends – keeping the positive record alive.

Parts that Start to Get Interesting

A rare signal in the BTC to Gold ratio suggests that a change in trend may be imminent.

Based on recent data, this ratio has reached levels that previously only appeared when the market was at its lowest – a moment that is often the best time to switch from gold to Bitcoin.

The BTC/Gold Oscillator indicator hovers around -1.8, which historically corresponds to the low point of the cycle, where Bitcoin started to outperform gold.

As Joao Wedson, CEO of Alphractal said, the chart “blatantly warns” that now is a good time to “sell gold and buy Bitcoin.”

With gold prices peaking and Bitcoin signaling a near bottom, the risk-to-return ratio may now be more favorable for cryptocurrencies than traditional hedge assets like gold.

Read also: Bitcoin Hits $108,000 Today as Analysts Predict Continued Volatility

Selling Pressure Begins to Weaken around $107,000

After several days of relentless selling pressure, Bitcoin seems to be showing signs of stabilizing around $107,000 at the time of writing this report.

The daily chart shows that the bearish momentum is starting to weaken, with the RSI indicator signaling that BTC is in an oversold state. Meanwhile, the MACD histogram is starting to flatten – an early signal of a potential reversal if buying volume starts to pick up.

However, the price of BTC is still below several important EMAs (20, 50, and 100), signaling that the long-term trend is still bearish.

A price movement that convincingly breaks through the $110,000 level could be an early confirmation of recovery. But for now, a little optimism wouldn’t hurt.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Gold peaks as Bitcoin falls, but Uptober isn’t dead yet. Accessed on October 20, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.