Pi Network Price Edges Up Today – Are Market Indicators Pointing to a Recovery?

Jakarta, Pintu News – Pi Coin has recently experienced increased volatility, with its price fluctuating amid weak growth in recent days.

The altcoin’s limited upward movement has raised doubts among investors, but improving market sentiment and technical signals point to a possible trend reversal.

Then, how will the Pi Network price move today?

Pi Network Price Up 1.9% in 24 Hours

On October 20, 2025, the price of Pi Network was recorded at $0.2076, having risen 1.9% in 24 hours. If converted to the current rupiah ($1 = IDR 16,569), then 1 Pi Network is IDR 3,439.

Read also: Stablecoin Supply Soars to Record $304.5 Billion — Is a Major DeFi and Bitcoin Rally on the Horizon?

The PI price moved in a range of $0.2021 to $0.2079, indicating a steady recovery from the previous pressure. On the fundamental side, Pi Network’s market capitalization stands at $1.79 billion, while its fully diluted valuation stands at $2.64 billion.

The trading volume in the past 24 hours stood at $21.41 million, reflecting relatively active market activity.

Pi Coin Potentially Recovers

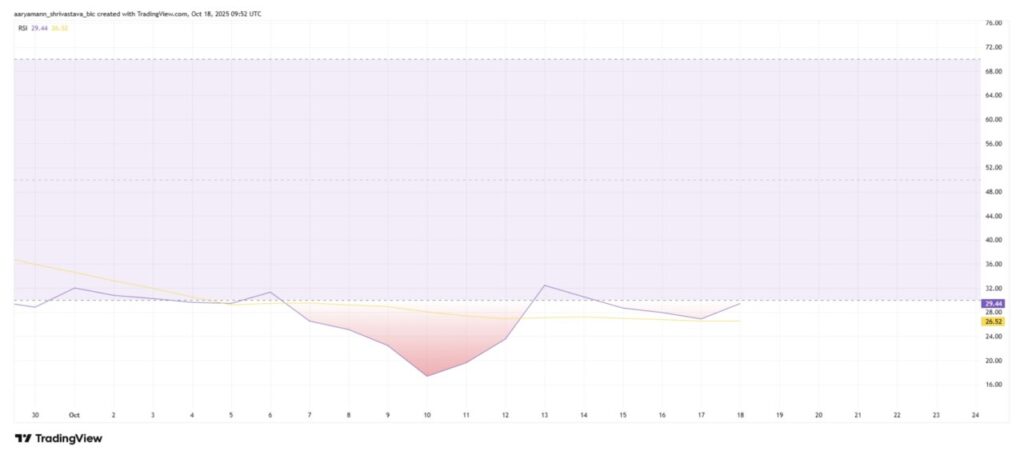

Reporting from BeInCrypto (10/18/25), the Relative Strength Index (RSI) for Pi Coin is currently in the oversold zone, a level that often signals sell-side fatigue.

Historically, a drop to this level is often an important turning point for the price movement of this crypto.

Source: TradingView via BeInCrypto

Last week, similar conditions also occurred before Pi Coin finally experienced a significant rise, which signaled that an accumulation phase might soon replace selling pressure.

An oversold condition is often interpreted by investors as an opportunity to enter the market at a cheaper price. If accumulation activity increases, Pi Coin could potentially experience a momentum shift as buyers begin to capitalize on the low valuation.

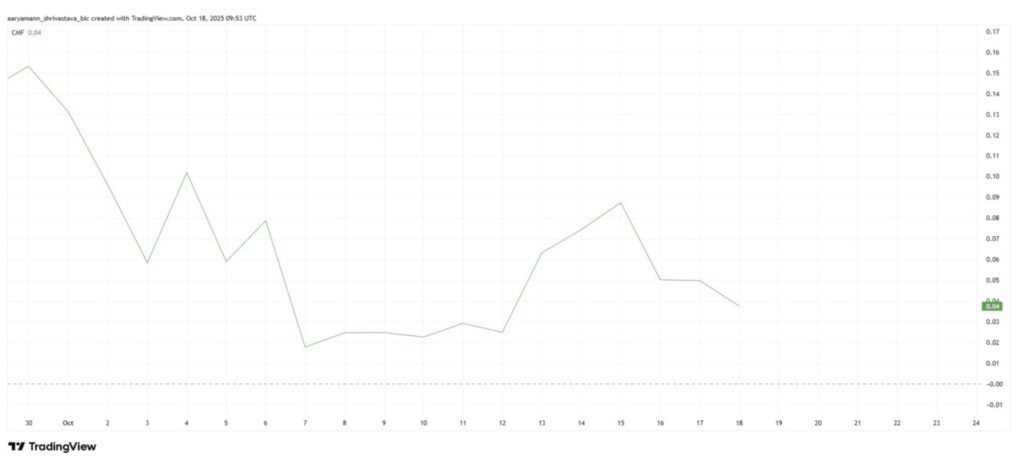

The Chaikin Money Flow (CMF) indicator has shown fluctuations in the past few sessions, but is still holding above the zero line, which means it is in positive territory. This indicates that capital inflows are still greater than outflows, a positive signal for market stability.

Source: TradingView via BeInCrypto

Despite the slight weakness, the consistent inflows show that investor confidence in Pi Coin has not been completely lost.

Read also: Dogecoin Rises 2% Today as Evidence of Accumulation Mounts — What Comes Next?

Although the current momentum has weakened slightly, the overall liquidity structure remains favorable for a potential steady recovery. If the CMF indicator continues to stay above zero, this could be a strong foundation for the resumption of buying activity.

PI Price Holds Above Key Support Level

As of October 18, Pi Coin was trading at $0.205 and is still holding strong above the $0.200 support level, which was previously an important foundation in the price recovery. This level helped the altcoin bounce back last week, and a similar potential bounce could occur if positive sentiment continues to rise.

If this scenario materializes, Pi Coin has the opportunity to rise towards the resistance level at $0.229. If it manages to break through that level, the path to $0.256 could open up. However, this movement requires strong support from investors as well as favorable market signals.

Conversely, if the overall market conditions turn bearish, Pi Coin could lose the $0.200 support level. In this case, the price risks dropping to $0.180 or even touching its all-time low of $0.153-which would invalidate the previous optimistic projections.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Price Reversal Outlook. Accessed on October 20, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.