Ethereum Price Drops 2% Today — Are Investors Buying the Dip?

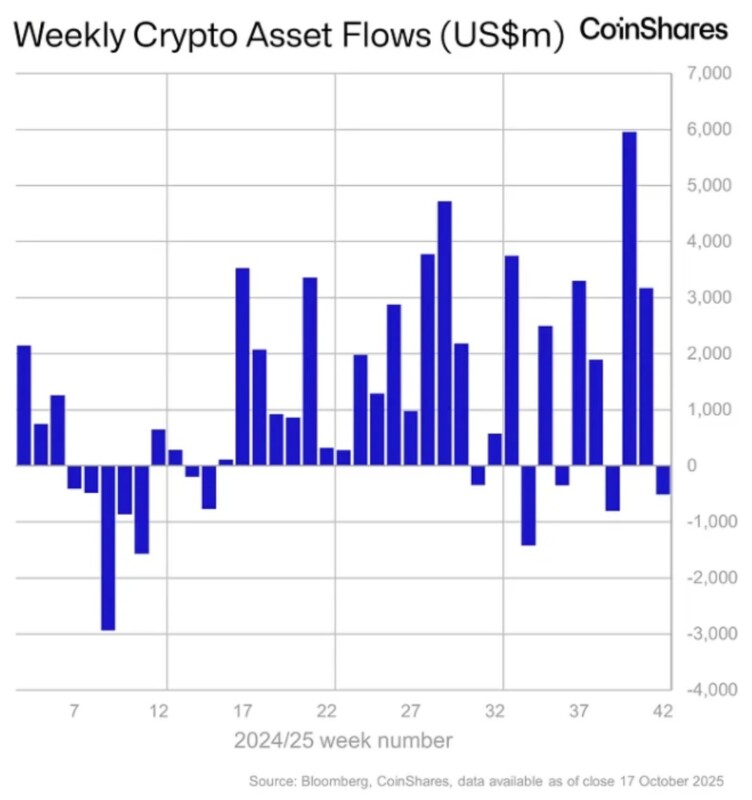

Jakarta, Pintu News – As reported by The Block, global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares recorded net outflows of $513 million last week, according to data from CoinShares. This comes as investors are still digesting the impact of the massive wave of liquidations that took place on October 10.

Then, how will the Ethereum (ETH) price move today?

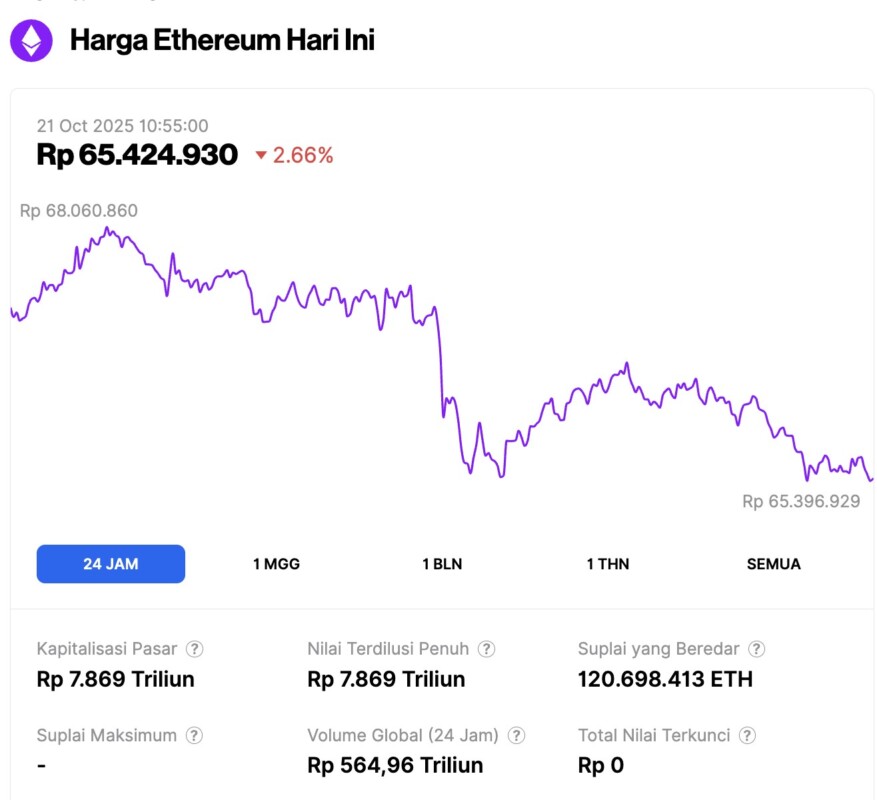

Ethereum Price Drops 2.66% in 24 Hours

On October 21, 2025, Ethereum was trading at approximately $3,929, or around IDR 65,424,930, after experiencing a 2.66% decline over the past 24 hours. During this period, ETH hit a low of IDR 65,359,948 and a high of IDR 68,060,860.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 7.869 trillion, while its daily trading volume has surged by 1% to IDR 564.96 trillion over the past day.

Read also: Bitcoin Surges to $109,000 Today, Signaling a Potential Breakout Ahead

Crypto ETPs Weekly Trading Volume Reaches $51 billion

“Total net outflows following the event have now reached $668 million, indicating that investors in the ETP space appear to be shrugging off the event, while on-chain investors tend to be more pessimistic,” James Butterfill, Head of Research at CoinShares, wrote in a report on Monday.

Weekly trading volumes for exchange-traded crypto products (ETPs) also remained high, reaching $51 billion – almost double the weekly average throughout 2025, Butterfill added.

Most of these outflows occurred in the United States, with a total of $621 million exiting crypto investment products in the country.

In contrast, investment funds in Germany, Switzerland, and Canada recorded net inflows of $59.3 million, $48 million, and $42.3 million, respectively.

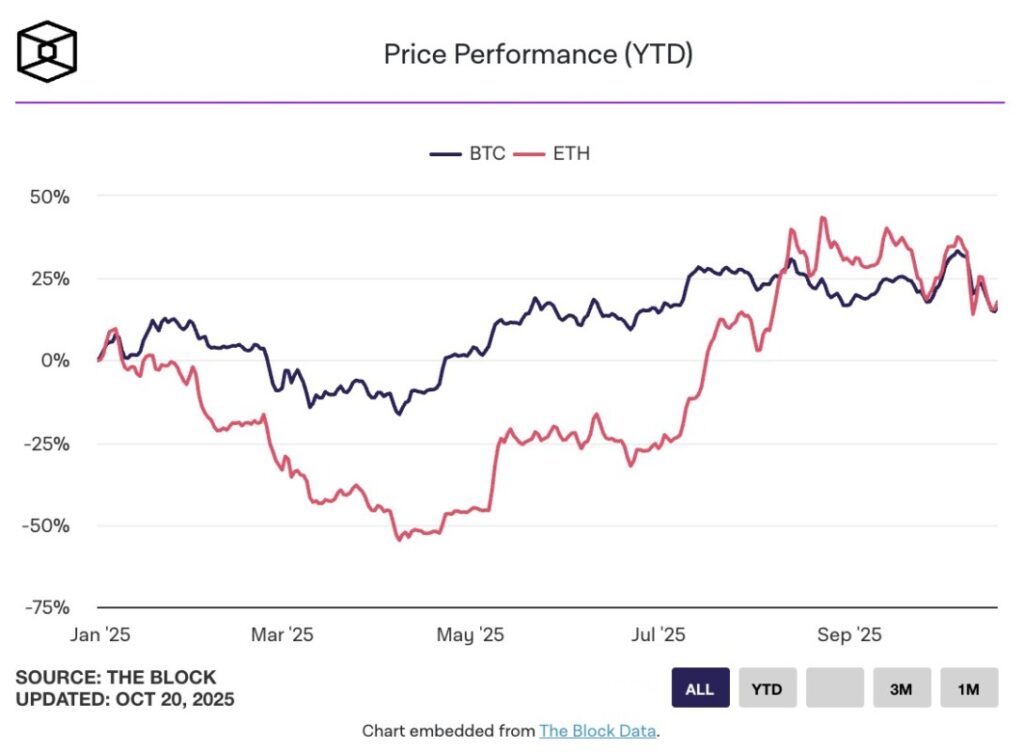

Last week, the prices of Bitcoin (BTC) and Ethereum fell by around 5.8% and 6.3% respectively, according to the pricing page of The Block.

Ethereum Investors Buy as Price Falls, Offset by Bitcoin Outflows

Bitcoin-based investment products were the main center of net outflows last week, with losses reaching $946 million. Total inflows so far this year now stand at $29.3 billion, still lagging behind the $41.7 billion total recorded through 2024.

Read also: 3 Unlock Tokens Worth Watching This Week, What Will Happen?

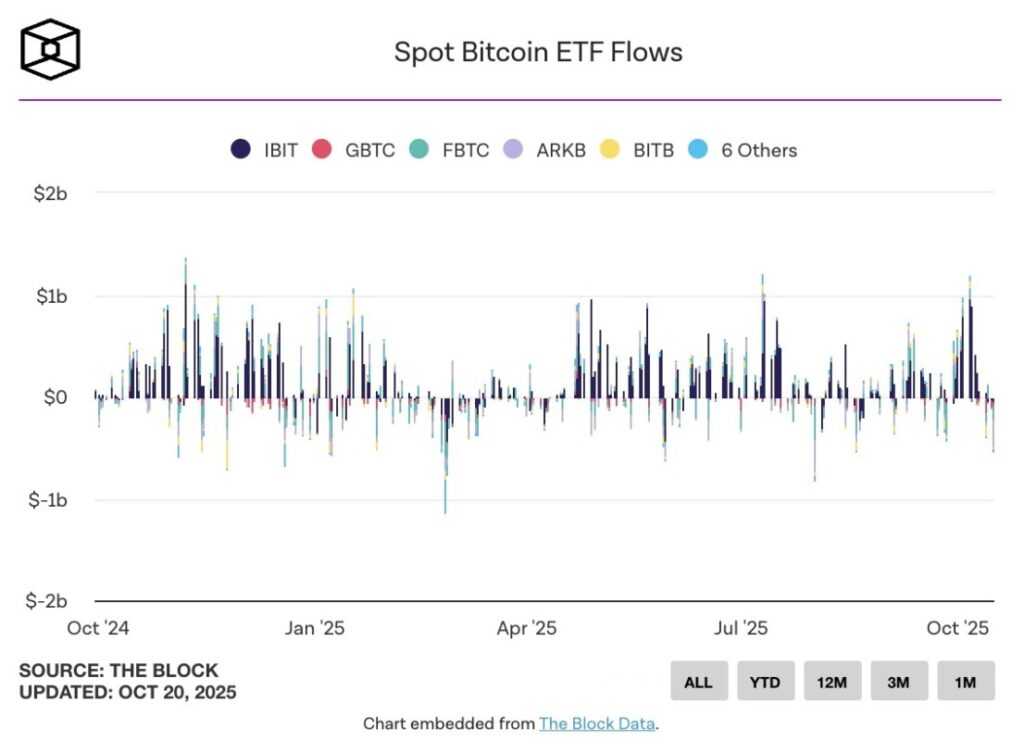

Bitcoin spot ETF funds in the United States alone recorded net outflows of $1.2 billion in just one week – becoming the second largest since their launch in January 2024, according to data from The Block.

“Ethereum investors capitalized on the price drop as a buying opportunity, thus balancing outflows from Bitcoin,” James Butterfill said.

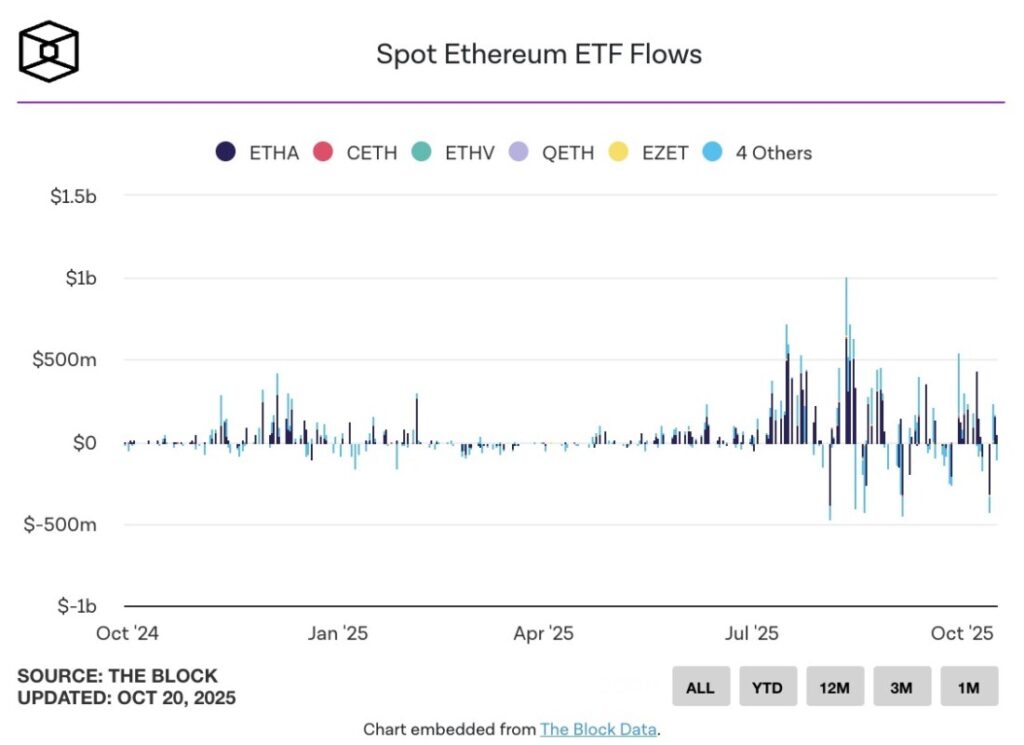

He explained that Ethereum’s price weakness is seen as an attractive moment by investors, as evidenced by the $205 million in funds poured into Ethereum-based investment products last week.

The largest inflow was recorded in 2x leveraged ETP products, valued at $457 million, indicating high confidence from investors, he added.

However, the US-based Ethereum spot ETF suffered a different fate, with weekly outflows reaching $311.8 million.

Meanwhile, enthusiasm for the launch of Solana (SOL) and XRP (XRP) ETFs in the US drove inflows into ETP products related to the two assets, amounting to $156 million and $73.9 million, respectively, according to Butterfill.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Block. ‘Ethereum investors buy the dip’ amid $513 million in weekly global crypto ETP outflows: CoinShares. Accessed on October 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.