XRP Gains Momentum as Trading Volume Surges 50% and DEX Activity Hits Multi-Month High

Jakarta, Pintu News – After falling to $2.20 last week, XRP (XRP) seems to be regaining momentum in line with the broader crypto market’s upward trend on October 20.

XRP’s daily trading volume surged by 50%, reaching $4.05 billion, indicating renewed interest from investors.

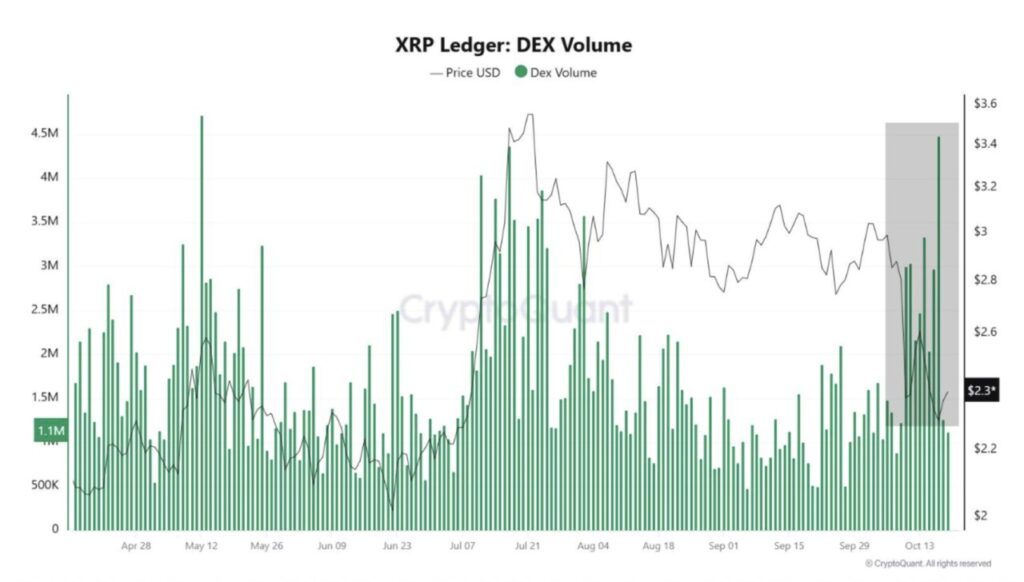

Based on data from CryptoQuant, trading volume on XRP Ledger’s decentralized exchange (DEX) showed a stark difference between October 8 and 17. While the price of XRP fell sharply, the trading volume of the DEX jumped dramatically, even reaching the highest level in recent months.

Ripple (XRP) Dynamic Recovery

According to CoinSpeaker, analysts are interpreting this discrepancy with two possibilities. First, it could be a phase of capitulation, where massive selling pressure indicates panic among retail traders. This phase usually marks the end of a downward trend, as weaker holders begin to exit the market.

Read also: Dogecoin Drops 3% Today, but MVRV Z-Score Signals Room for Growth

On the other hand, this spike in volume could also indicate accumulation by savvy investors, who deliberately bought XRP when the price dropped. Periods like this often see assets move from weak hands to strong hands, which then sets the stage for a potential price recovery.

Positive sentiment towards XRP has resurfaced after a surge in put option demand following the October 10 price crash, which touched $1.70 on some exchanges. As of October 20, XRP was trading at $2.46 – up 5% in the last 24 hours according to data from CoinMarketCap.

Ripple’s Expansion Plans and Macroeconomic Pressures

Recent reports have revealed that Ripple Labs is planning to raise more than $1 billion to form a digital asset treasury (DAT) focused on XRP. This plan has created a positive sentiment in the market, as it could tighten the amount of XRP in circulation and attract institutional interest in Ripple’s payment platform.

However, pressure from broader macroeconomic factors remains a challenge. The US government shutdown has caused delays in a number of SEC activities, including ETF approvals, so hopes of an XRP spot ETF launch this month have dimmed.

Although XRP saw a price increase today, overall the asset is still down 17.5% in the past month. If the US Senate approves the stopgap funding bill, hopes for ETFs could return and spark renewed demand for XRP.

Where is XRP Price headed next?

On the daily chart (10/20), XRP is currently approaching the middle line of the Bollinger Band (20-day moving average) after previously bouncing off the lower line, indicating a short-term recovery.

Read also: Ethereum Price Drops 2% Today — Are Investors Buying the Dip?

The pattern on the Bollinger Band indicates a potential breakout, and traders are advised to watch the key resistance area around $2.80.

Meanwhile, the RSI (Relative Strength Index) indicator shows that XRP is still in the bearish to neutral zone, but is starting to recover from oversold conditions. If the RSI is able to move up and cross the 50 level, then this could be an early confirmation that bullish momentum is starting to form.

However, if XRP fails to hold above the $2.30 support level, there is a possibility of the price dropping further towards $2.10.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. XRP Sees 50% Uptick in Volume on DEX Trading to Multi-Month High. Accessed on October 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.