Want to Buy Cheap Bitcoin? Check out this expert’s Buy Whale Zone!

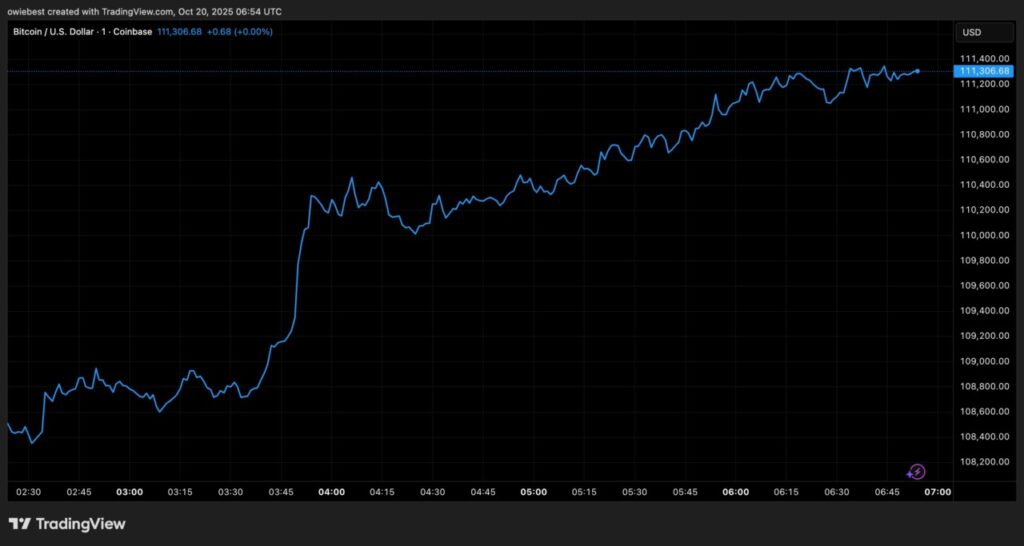

Jakarta, Pintu News – After experiencing a sharp drop over the weekend, the price of Bitcoin (BTC) seems to be stabilizing again as market sentiment begins to improve. However, this does little to alleviate the bearish expectations that emerged after the liquidation event on October 10.

In contrast to the expectation that Bitcoin (BTC) price would experience a recovery sending it to new record highs, crypto experts MMBTrader revealed what they called ‘Whale Buy Zones’ to get Bitcoin (BTC) at ‘cheap’ prices.

Waiting for Bitcoin Price to Fall Below $90,000

Currently, Bitcoin (BTC) price is still above $100,000 and has managed to maintain this psychological level despite several crashes that have shaken the crypto market. This is a drop of more than 10% from the record high of $126,000 recorded in early October. Although the price has dropped below $108,000, MMBTrader crypto analysts advise investors not to rush into buying the cryptocurrency.

Instead, they advise investors to wait and buy Bitcoin (BTC) ‘cheap’ at levels where whales are likely to start buying back the cryptocurrency. This whale buy zone is placed below $90,000 and could go as low as $87,000 before support is established.

Also Read: The Potential Price of Shiba Inu If Half the Supply is Burned: SHIB Likely to Surge?

The reason behind the Whale Buy Zone

The reason behind this is that Bitcoin (BTC) price will be near the 0.38 and 0.5 Fibonacci levels, which historically are the points where Bitcoin (BTC) price corrections usually end. From here, the price is likely to start moving up with massive buying by whales increasing its momentum.

New traders entering the market are expected to panic and sell their tokens at a loss of between 15% and 40% before exiting the market. Subsequently, the price of Bitcoin (BTC) is likely to rise after these weak hands exit, and analysts predict that BTC will then register a new record high of around $130,000-$140,000.

Strategy and Risk Management

Amidst all this, crypto analysts advise investors to stick to their strategies and strict risk management when trading crypto. Bitcoin (BTC) price often moves based on market news, but it is difficult to know which direction the price will take with each piece of news, and it is better to stick to a strategy that has been set long before the news and to set stop loss and take profit levels.

Conclusion

By understanding market dynamics and following the advice of experienced analysts, investors can capitalize on price fluctuations for long-term gains. Monitoring whale buying zones and preparing the right strategies are key to succeeding in crypto investment amid high market volatility.

Also Read: Can XRP Reach $10 Before 2025 Ends? Investors Should Know This Analyst’s Assessment!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Want to Buy Cheap Bitcoin? Accessed on October 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.