XRP Shows Bullish Signal as Selling Pressure Drops 82% — Just a 5% Push Away from Breakout

Jakarta, Pintu News – As of October 20, 2025, the price of XRP (XRP) had risen 5% and was trading around $2.46, extending its short-term recovery. However, in the last 30 days, the token is still down 18%, signaling that a full recovery has not fully taken place.

Recent on-chain trends show that one group is starting to reduce selling pressure, while another important group is adding to XRP holdings – a sign that confidence is starting to return. Even so, everything still hinges on one key XRP price level.

Holders Start Selling Rarely, Short-Term Investors Step In

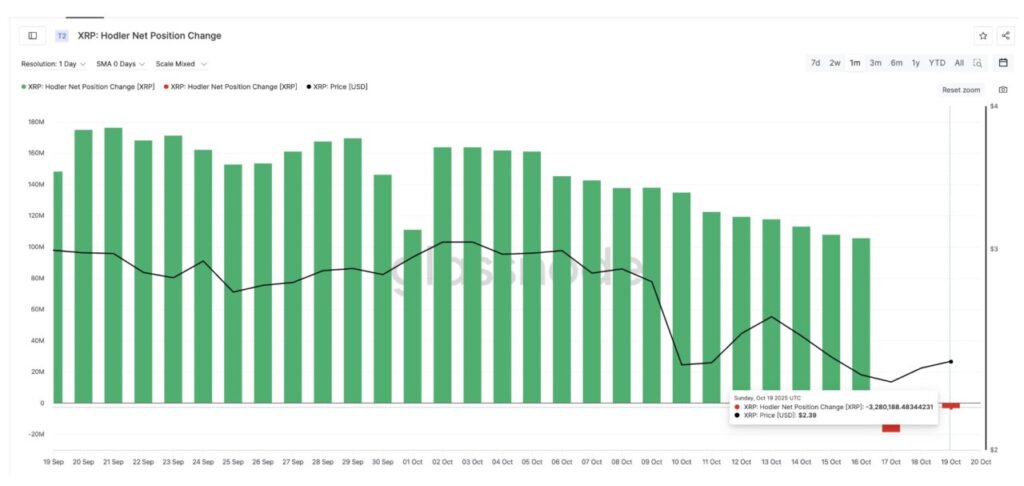

The Hodler Net Position Change indicator, which measures the amount of XRP raised or sold by long-term holders, showed a fairly positive change in investor behavior. Between October 16 and 17, long-term holders sold a large amount, bringing this metric down to -18.57 million XRP.

Read also: XRP Gains Momentum as Trading Volume Surges 50% and DEX Activity Hits Multi-Month High

However, on October 19, the net outflow was drastically reduced to -3.28 million XRP, reflecting a decrease in selling pressure of over 82%. Since then, the price of XRP has started to move up more aggressively.

This suggests that long-term investors are no longer selling heavily, possibly because they are preparing for a potential price recovery.

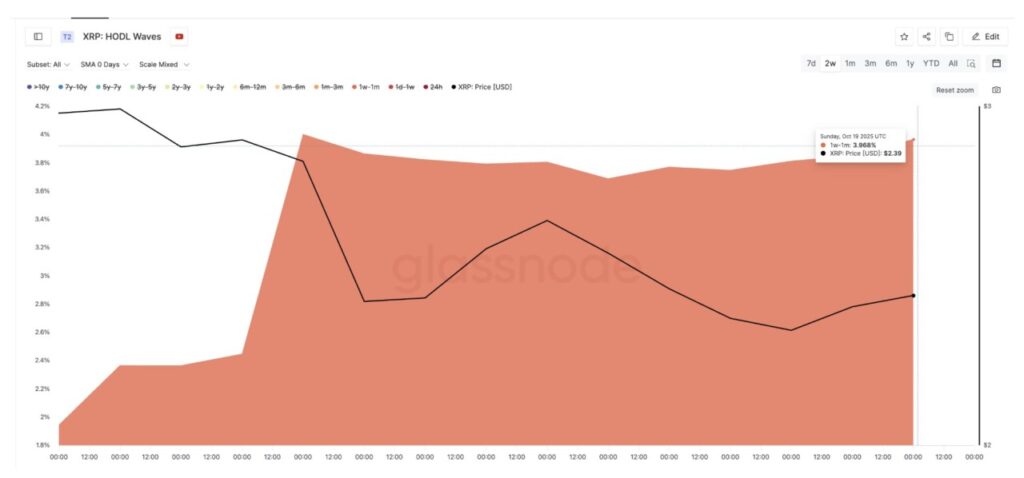

On the other hand, the group of XRP holders in the 1-week to 1-month timeframe – who are typically short-term traders – actually increased their holdings of the total XRP supply, from 1.94% on October 5 to 3.97% on October 19.

This HODL Waves metric shows that short-term groups are now starting to hold (even add) to their holdings, rather than exit the market.

HODL Waves itself describes how large a percentage of the coin supply is held by investors based on the length of time it is held.

The combination of reduced selling pressure from long-term holders and renewed accumulation from short-term investors provides a more positive outlook for XRP prices.

XRP Price Needs 5.4% Rise and Retail Support to Break Higher

Technically speaking (10/20), the price of XRP finally broke through a key resistance level at $2.43 – a level that had been limiting recovery efforts throughout the beginning of this month. The next hurdle is at $2.59, about 5.4% above the current price, and is the next important resistance.

Read also: House of Doge Officially Acquires Italian Football Club, US Triestina Calcio 1918!

If XRP prices are able to print a daily candle close above $2.59, then it could be a breakout signal that paves the way towards the $2.81 and $3.10 levels – two important levels based on Fibonacci retracements.

However, the Money Flow Index (MFI), which measures buying pressure, has shown a downward trend since October 6. This indicates that retail investor participation remains weak despite rising prices.

For this bullish scenario to actually materialize, it would require increased buying activity from small traders. Conversely, if the XRP price fails to hold above $2.43, a drop below $2.27 could invalidate the bullish projection. In that scenario, the price risks dropping further to the $2.08 or even $1.76 area.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Price 5 Percent Away From Rally. Accessed on October 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.