Ethereum Price Prediction: Here’s the Long-Term & Short-Term Bullish Potential (10/22/25)

Jakarta, Pintu News – The cryptocurrency market is always full of unexpected dynamics. Ethereum (ETH), as one of the major players, has shown some interesting signals for investors and market watchers. Although there are long-term bullish expectations, some short-term indicators still raise doubts.

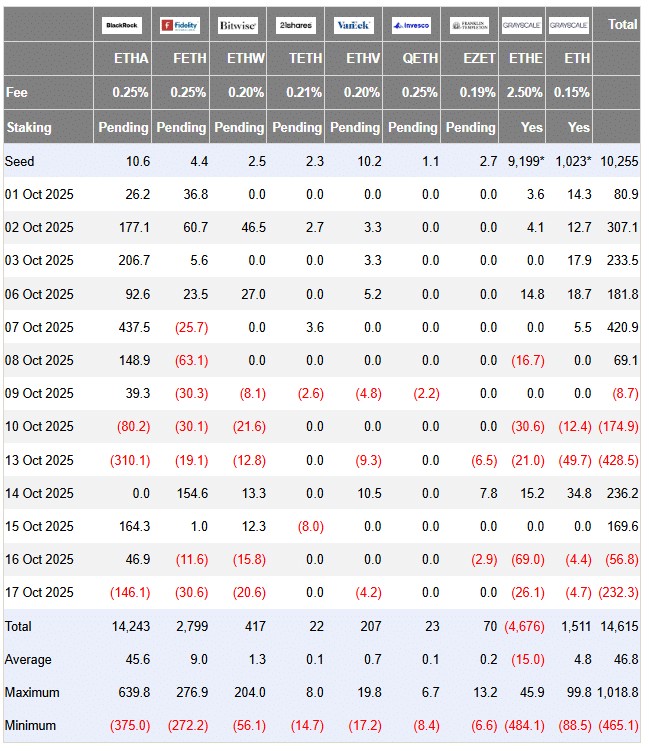

Fund Growth: Ethereum (ETH) Outperforms Bitcoin (BTC)

In recent months, Ethereum (ETH) has experienced significant growth in terms of normalized fund holdings compared to Bitcoin (BTC). This suggests that there is growing investor interest in the smart contract economy offered by Ethereum.

While Bitcoin still holds the role of ‘digital gold’, the growth of Ethereum signals a shift in interest towards broader applications of blockchain technology. While Bitcoin (BTC) remains the top choice for many investors, the faster growth in Ethereum fund holdings suggests that investors are starting to look beyond mere stores of value.

They are interested in the real application potential Ethereum offers, which could bring more use cases and adoption in the future.

Also Read: Want to Buy Cheap Bitcoin? Check out this expert’s Buy Whale Zone!

Resistance and the Potential to Reach a New Price Record

Despite the increase in demand, Ethereum’s (ETH) bearish price structure in the daily chart suggests that there are critical resistance levels that must be broken before reaching a new price record. The $4,300 and $4,700 levels are important boundaries to overcome. If Ethereum manages to break through these resistances, there is a high probability of reaching new price highs.

However, this achievement will not happen instantly. It requires strong and sustained momentum, as well as support from various external factors such as favorable regulations and wider adoption of blockchain technology and smart contracts.

Warning: Potential Price Drop According to Analysts

Ali Martinez, a crypto analyst, recently posted on X about the potential for a significant price drop for Ethereum. Using the MVRV momentum metric, Martinez pointed out that if the MVRV ratio falls below the 160-day moving average, this signals bearish momentum.

This phenomenon has occurred recently, and the last time similar conditions existed was in January, followed by a price correction from $3,300 to $1,500. These conditions should be watched out for by investors who may be considering entering the market or who already have a position in Ethereum. A drop like this could have a significant impact on investment strategies and risk management.

Conclusion

When considering an investment in Ethereum (ETH) or any other cryptocurrency, it’s important to do your research and understand that this market is highly volatile and fraught with risk. While there is a long-term bullish outlook, investors should remain aware of the potential for sudden changes in price that could occur in a short period of time.

Also Read: John Bollinger’s Legendary Prediction: Ethereum & Solana Set to Surge in Late 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum’s price prediction: Bullish in the long term, but short-term doubts remain. Accessed on October 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.