Crypto Market Analysis Today (10/22): BTC Touches IDR 1.89 Billion, Signals of Increased Trader Confidence

Jakarta, Pintu News – Bitcoin (BTC) price showed strength again on Tuesday (October 21, 2025), after rising to a daily high of $114,000 or around IDR 1.89 billion (exchange rate of $1 = IDR 16,616).

This increase marks a change in sentiment among futures traders who started to add exposure after the massive sell-off on October 10, which previously led to the liquidation of over $20 billion in the crypto derivatives market.

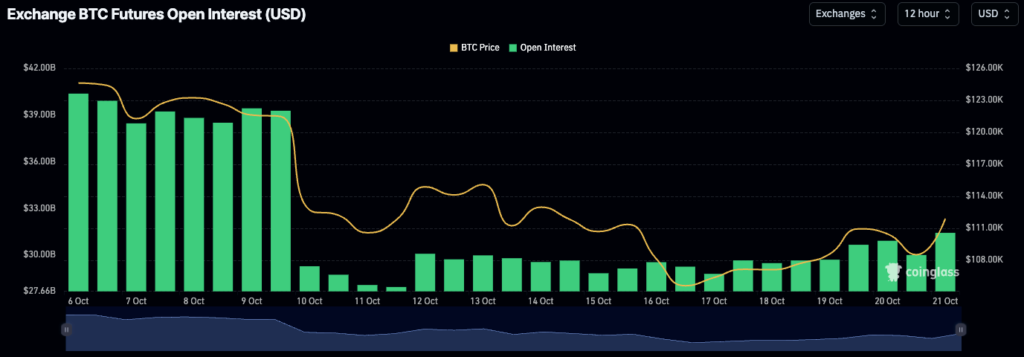

According to data from CoinGlass, Bitcoin open interest increased from $28 billion to $32 billion since October 11, signaling a significant return of speculative activity. This surge coincided with an increase in spot and futures trading volumes, indicating traders are starting to return to risk-taking after the previous selling pressure subsided.

Surge in open interest is evidence of futures market recovery

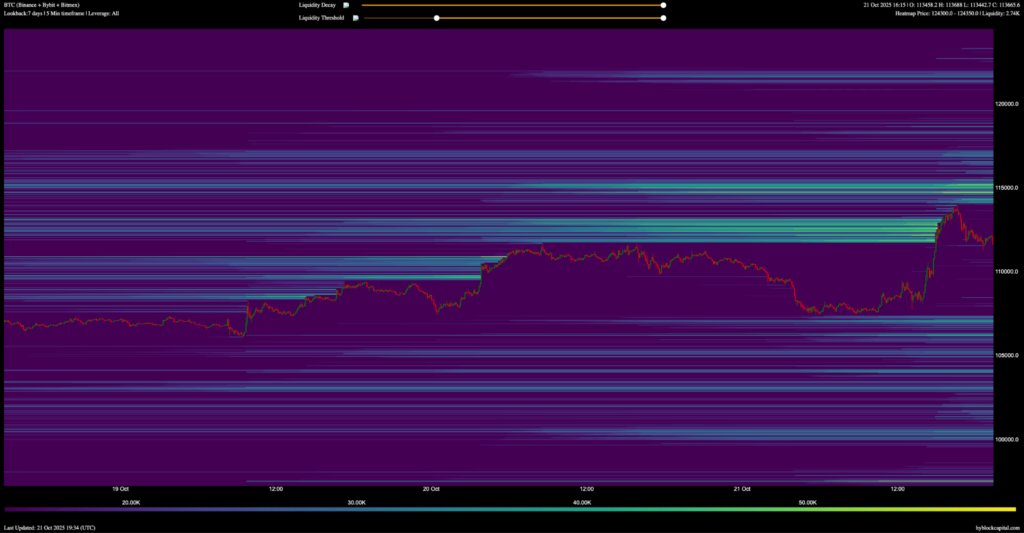

Data from Hyblock shows a surge in Bitcoin price from $107,453 to $114,000, as the anchored open interest and cumulative volume delta (CVD) indicators turned positive. This increase was also followed by an increase in BTC’s funding rate, indicating that the price rally was largely driven by the derivatives market.

Hyblock analysts explained that traders are starting to capitalize on the post-drop momentum by targeting the large liquidity zone in the $114,000-$115,000 area. This zone is an important area because it was previously the point of liquidation of large amounts of short positions. The movement pattern shows that Bitcoin is now starting to settle back into a new trading range after the sharp turmoil at the beginning of the month.

Also read: Analysts Forecast Ethereum (ETH) to Surge to $10,000, What Are the Key Factors?

Crypto traders increase activity, but remain cautious

Increased spot and futures trading volumes suggest that investors are starting to feel comfortable returning to the crypto market. However, Cointelegraph technical analyst Rakesh Upadhyay emphasized that this rally is still followed by a short-term sell-off. “Sellers will likely continue to close positions at the top of the daily rise, while buyers will maintain support around $107,000 (Rp1.77 billion),” he said.

Although market conditions are stabilizing, volatility remains high. Many traders are now opting for swing trading strategies, which utilize intraday price movements to make quick profits. This approach is commonly used in transitioning markets, where optimistic sentiment is growing, but selling pressure has not completely disappeared.

Read also: Dogecoin ETF is Getting Closer! 21Shares amends S-1 document to get green light from SEC

Altcoins follow suit, a sign that risk is starting to be accepted again

Bitcoin’s rise was followed by some major altcoins such as Ethereum (ETH) and Solana (SOL). ETH briefly breached $4,110 (IDR 68.3 million) before correcting, while SOL approached $200 (IDR3.32 million) with a brief rally to $198. While these moves have not confirmed a long-term bullish trend, the increased buying interest in various crypto assets signals a return of risk appetite in the market.

According to CoinMarketCap data, the total global crypto market capitalization rose by about 2.4% in the last 24 hours. This increase was also accompanied by a rise in daily trading volumes, indicating a new influx of funds into digital assets after the big sell-off at the beginning of the month.

Conclusion

Bitcoin’s (BTC) price increase to Rp1.89 billion indicates a shift in positive sentiment among futures traders and crypto investors. The increase in open interest as well as trading volume is evidence that market participants are starting to take risks again after the major correction on October 10.

Even so, volatility remains high, and profit-taking still looms over this rally. Traders are advised to remain cautious, especially if the price fails to break and hold above the $115,000 (Rp1.91 billion) level, which is the next area of strong resistance.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin rally to $114K highlights futures traders’ improving confidence. Accessed October 22, 2025.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.