Bitcoin (BTC) Price Prediction: The Influence of the Fed’s Interest Rate Decision on October 29, 2025

Jakarta, Pintu News – Global financial markets are eagerly awaiting the Federal Reserve’s (Fed) latest decision on interest rates, scheduled for October 29. This decision is crucial as it could affect the future price direction of Bitcoin (BTC) and other crypto assets.

Trader Positioning Ahead of the Fed Decision

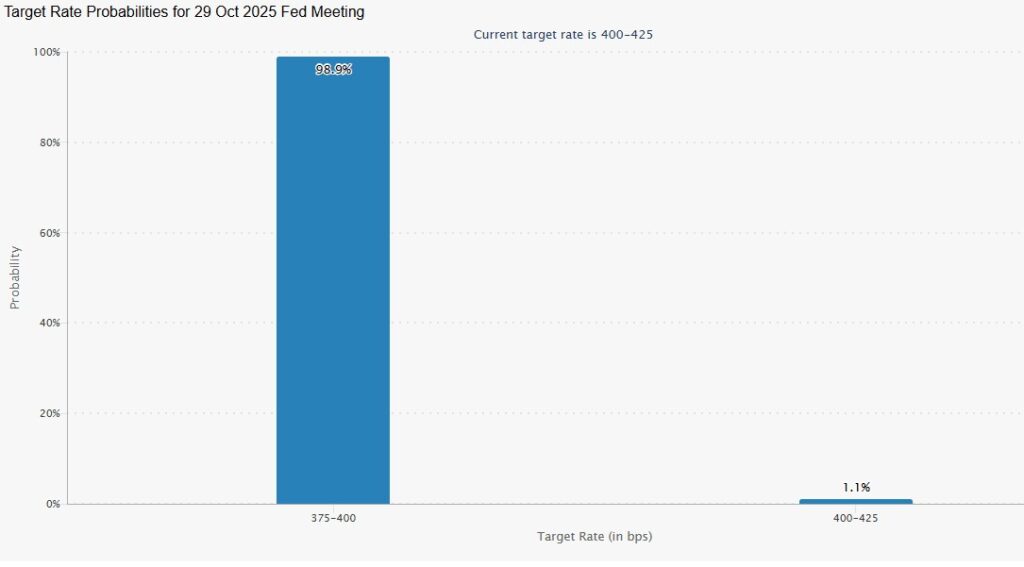

Traders seem to be taking a cautious stance ahead of the Fed’s announcement. Current market consensus suggests a possible 0.25% rate cut, which has kept some investors on their toes. History has shown that interest rate cuts often fuel bullish sentiment and boost the prices of risky assets, including Bitcoin (BTC).

Despite concerns that some macroeconomic data is not available due to the government shutdown, the market remains optimistic that the Fed will cut interest rates. Joshua Deuk, Head of Trading at Mozaik Capital, stated that the easing policy will continue and the Fed still has enough ammunition to support the market.

Also Read: Want to Buy Cheap Bitcoin? Check out this expert’s Buy Whale Zone!

US-China Tariff Update and its Impact on Bitcoin

In addition to the Fed’s interest rate decision, the latest update on tariffs between the US and China is also an important factor affecting the price of Bitcoin (BTC). The trade relationship between the two countries has a significant impact on global market sentiment and indirectly affects the crypto market.

According to analysts, if the situation between the US and China worsens, this could lead to greater market uncertainty and potentially depress Bitcoin (BTC) prices. However, if there is an improvement in negotiations and a reduction in tariffs, this could strengthen investor confidence and push Bitcoin (BTC) prices up.

Key Levels for Options Traders to Watch

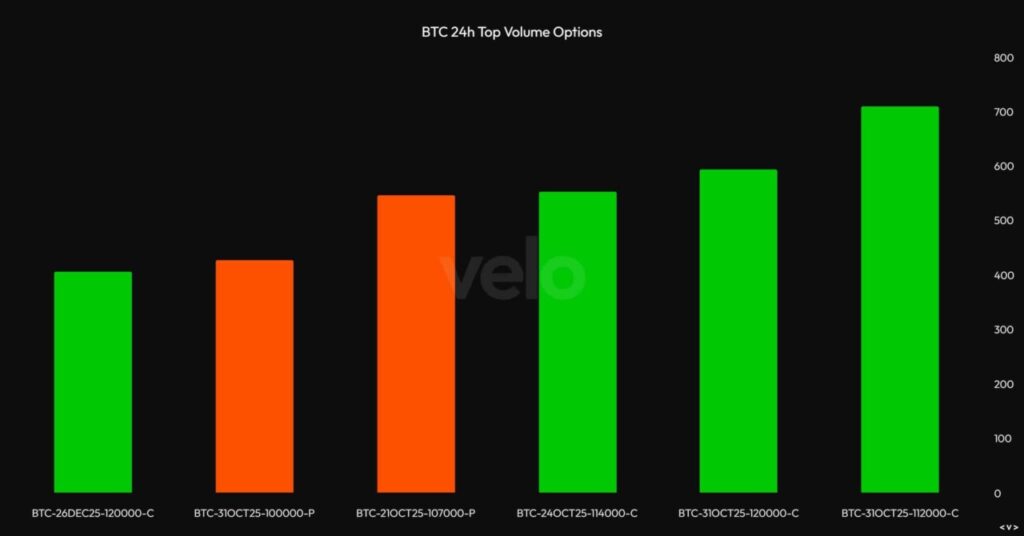

In the options market, traders seem to be setting high expectations for Bitcoin (BTC) with ambitious price targets. They expect Bitcoin (BTC) to be able to maintain $100,000 as support, with an upside target of $120,000. Gracy Chen, CEO of Bitget, emphasized that the $100,000 level or the 360-day Moving Average is a key support that, if successfully maintained, will strengthen Bitcoin’s (BTC) bullish structure.

However, there is uncertainty in the options market, as indicated by Amberdata’s 25-Risk Reversal (25RR) being negative for next week’s maturities. This signals high hedging activity or demand for put options (bearish bets), indicating caution among traders.

Conclusion: Market Expectations for Q4 and Q1 Next Year

With various factors at play, including the Fed’s interest rate decision and global trade dynamics, the Bitcoin (BTC) market looks set to have a decisive few weeks. If Bitcoin (BTC) manages to break the previous record high, there is potential for further upside ahead. However, if it fails to hold key support levels, there could be profit-taking based on technical signals.

Also Read: John Bollinger’s Legendary Prediction: Ethereum & Solana Set to Surge in Late 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. A Look at How the Fed’s Next Steps Can Affect Bitcoin’s Price. Accessed on October 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.