Can BNB Overthrow Ethereum? 3 Key Signals Heating Up the Debate

Jakarta, Pintu News – The competition between Ethereum (ETH) and BNB Coin (BNB) is heating up as BNB shows remarkable resilience amidst a sluggish crypto market.

Although ETH still dominates, various indicators have sparked debate regarding the possibility of BNB challenging ETH’s position as the second largest cryptocurrency in the market.

BNB vs. Ethereum: Will Network Growth and Market Power Change the Balance?

The crypto market has experienced many ups and downs in recent years, including the most recent drop that dragged the total market capitalization below $4 trillion. Despite this ongoing volatility, Ethereum is holding its own as the second-largest crypto asset after Bitcoin (BTC).

Read also: Ethereum Price Slips to $3,800 – Here’s Why ETH Is Struggling to Break Above $4,000

But can this dominance be shaken? Three key signals are early warnings of a possible shift.

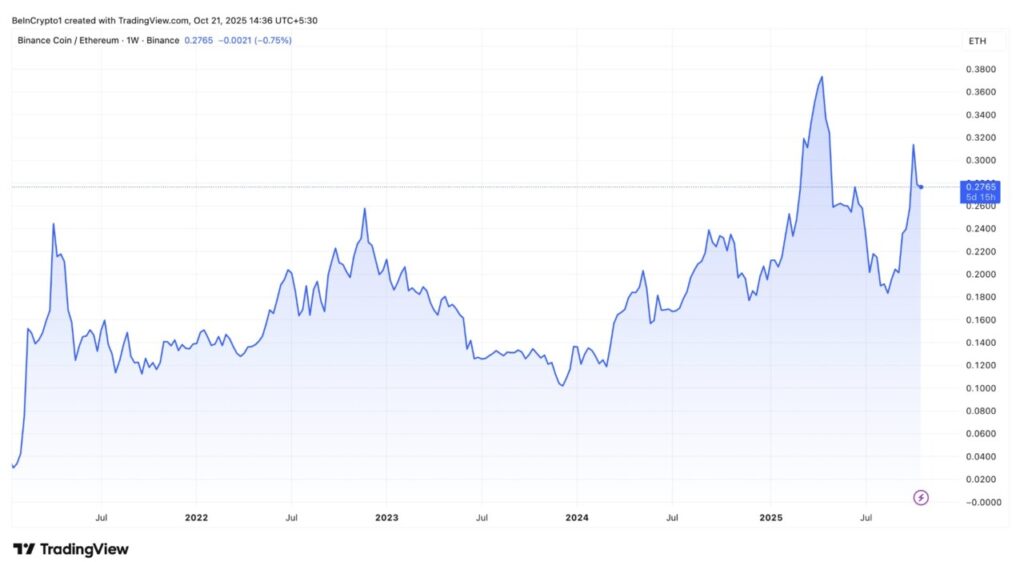

From a technical standpoint, the BNB/ETH chart shows a long-term bullish structure formed by expansion and correction cycles. While volatility remains, the big picture shows that BNB has a structural advantage.

Altcoin Vector also mentioned in a post on X (formerly Twitter) that BNB has outperformed ETH so far this year.

“It’s not just about price: BNB maintains a consistent impulse phase, strong enough to create its own season, ‘BNB Season’. While ETH’s impulse weakened, BNB stayed afloat, keeping its structure even after a deleveraging event,” they wrote.

BNB Supported by Strong Real Use

Another signal of BNB’s momentum is the spike in the number of daily active addresses. Altcoin Vector emphasizes that BNB’s value is not just short-term price movements – it’s also backed by strong real-world usage.

A high number of active addresses indicates a large number of users performing transactions on the network, signaling steady demand and adoption.

“BNB active addresses indicate continued user engagement, as a sign of network health and adoption. Even after the shock, participation remains structurally strong,” Altcoin Vector added.

Not only that, BNB also recorded a significant spike in on-chain volume, reflecting increased liquidity and activity in its ecosystem. Altcoin Vector notes:

“BNB’s on-chain volume surged with daily peaks in coin transfers evidencing a surge in liquidity, large transactions, and ecosystem activity. ‘BNB Meme Season’? It’s over before it even really started. But the on-chain volume is still alive. It’s not just about price action, but also fundamentals: liquidity and active participation.”

Read also: Could Gemini’s New Solana Credit Card Spark a SOL Price Rally Toward $240?

Ethereum’s Dominance Is Still Significant

Although BNB shows many strong signals, Ethereum’s dominance in smart contract infrastructure, DeFi, and market capitalization is still very significant.

Based on data from BeInCrypto Markets, ETH holds a market share that is about three times larger than BNB. In addition, development and innovation on Ethereum continues.

As such, shaking Ethereum’s dominance is no easy task. Its well-established ecosystem, large developer community, and network effects have kept it in second place for years, making any shift a slow and challenging process.

The next few years will be a test for both assets. Whether BNB’s surge can change the market capitalization map, or whether Ethereum’s dominance will stand up to the challenge, remains to be seen as the crypto market evolves.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. BNB vs Ethereum: Market Cap Debate. Accessed on October 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.