Ethereum Holds Steady at $3,800 Today – Analysts Predict Major Rally Ahead

Jakarta, Pintu News – The price of Ethereum (ETH) is attracting attention again after analysts called the current moment a “good time to buy.” Ethereum shows strong structural behavior and fits the Wyckoff re-accumulation model.

According to one market analyst, Ethereum is entering the final phase of the pattern, which could potentially trigger a sustained rally towards the $8,400 mark. Then, how will Ethereum price move today?

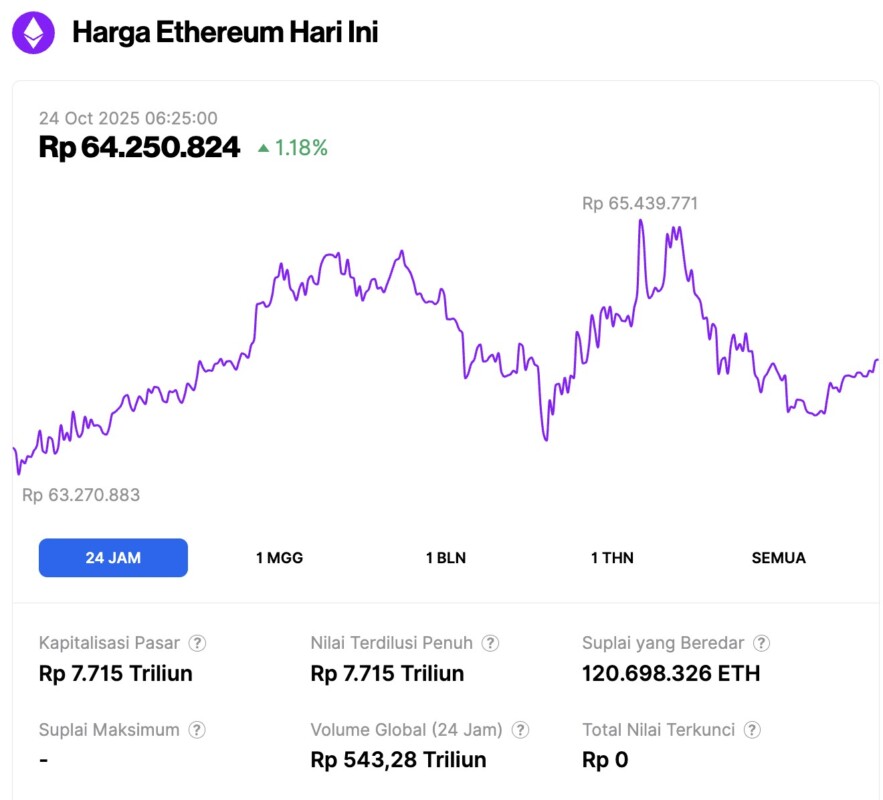

Ethereum Price Up 1.18% in 24 Hours

On October 24, 2025, Ethereum was trading at approximately $3,857, or around IDR 64,250,824 — marking a 1.18% increase over the past 24 hours. During this period, ETH dipped to a low of IDR 63,270,883 and reached a high of IDR 65,439,771.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 7,715 trillion, while its daily trading volume has dropped by 21% to IDR 543.28 trillion over the last 24 hours.

Read also: Bitcoin Price Rises to $110,000 Today: BTC Potentially Faces Decline?

Wyckoff Re-Accumulation Signal Marks Next Big Move for Ethereum

One analyst noted that Ethereum’s price movement since the beginning of 2024 followed the Wyckoff re-accumulation structure pattern exactly. Phase A starts in March 2024 until the end of June 2024, characterized by the formation of initial support (PSY), selling climax (SC), and automatic rally (AR) which are the basic framework of this pattern.

Phase B, which runs from late June 2024 to March 2025, shows a prolonged sideways movement, where the market absorbs selling pressure through a series of secondary tests (STs).

Next, Phase C, from March to the end of July 2025, introduces the Spring and Test patterns that confirm the exhaustion of sellers and signals that the accumulation process has been completed.

After that, Phase D (late July to October 2025) saw a clear sign of strength (SOS) followed by a pullback to the last support point (BU/LPS). Now, Ethereum has entered Phase E, the expansion stage. The analyst considers this the best time to buy, with a projected price increase towards $8,400.

Moreover, another analyst recently predicted a potential ETH rally to $10,000, as Vitalik Buterin’s latest update aims to improve Ethereum’s proof system-a move that is believed to accelerate adoption and strengthen Ethereum’s price outlook by 2025.

Read also: Uniswap Price Prediction: UNI Stays in Key Zone as Open Interest Stabilizes Around $150 Million

BlackRock’s $110 Million ETF Purchase Strengthens Ethereum’s Bullish Signal

BlackRock’s purchase of 28,600 ETH through their spot ETF, worth approximately $110.7 million, further reinforces confidence in Ethereum’s current price rally.

This influx of institutional funds aligns perfectly with Phase E in the ongoing Wyckoff pattern, confirming that major market participants have high confidence in Ethereum’s next move.

On the other hand, data from CoinGlass shows consistent outflows from crypto exchanges, including a net withdrawal of $5 million on October 23. These persistent outflows suggest that investors prefer to hold or stake ETH rather than sell it, thus reducing the available supply in the market.

With reduced liquidity on centralized platforms, buying pressure becomes more significant and drives price strength. This combination of increased institutional demand and reduced supply puts Ethereum price in a strategic position for a potential breakout to higher valuation levels.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Poised for Breakout as Wyckoff Re-Accumulation Meets BlackRock’s $110M Purchase. Accessed on October 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.