Dogecoin Gains 2% as Short‑Term Buyers Begin to Enter the Market

Jakarta, Pintu News – Dogecoin (DOGE) is up more than 2% today, but its recovery appears volatile.

After experiencing a 20% drop in the past month, the Dogecoin price is now facing its toughest challenge yet in the near future – a zone that has halted any recent price gains.

Any price movement below this zone faces strong selling pressure, keeping DOGE prices locked in a narrow range for the past few weeks.

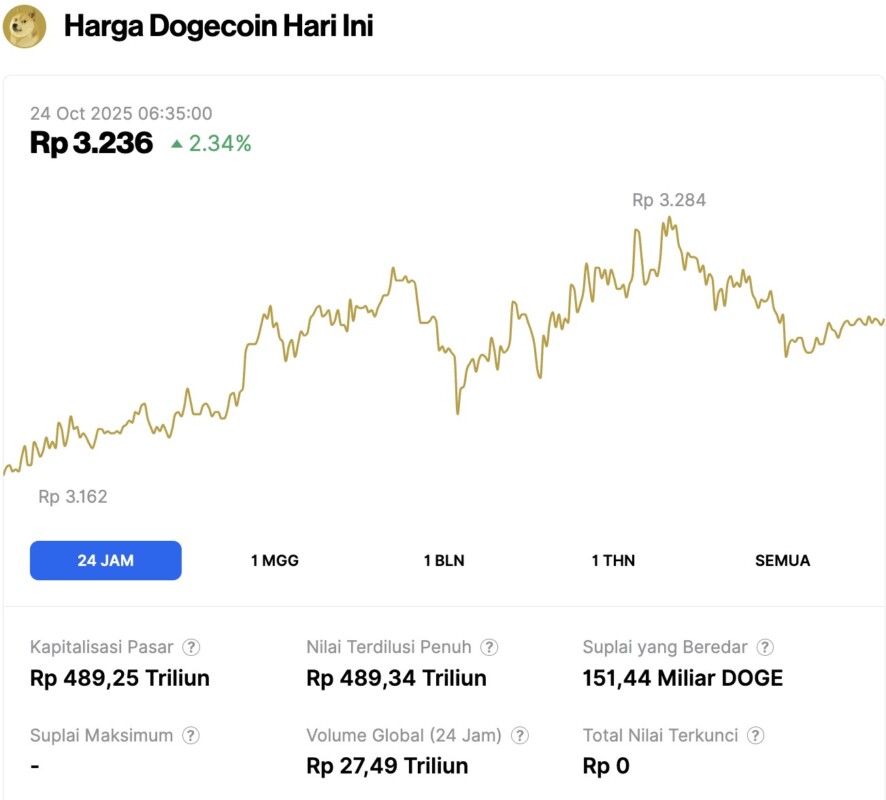

Dogecoin Price Rises 2.34% in 24 Hours

On October 24, 2025, Dogecoin saw a 2.34% gain over the past 24 hours, trading at $0.1946 — or about IDR 3,236. During that period, the price of DOGE moved within a range of IDR 3,162 to IDR 3,284.

At the time of writing, Dogecoin’s market capitalization is approximately IDR 489.25 trillion, with a 24-hour trading volume of around IDR 27.49 trillion.

Read also: Ethereum Holds Steady at $3,800 Today – Analysts Predict Major Rally Ahead

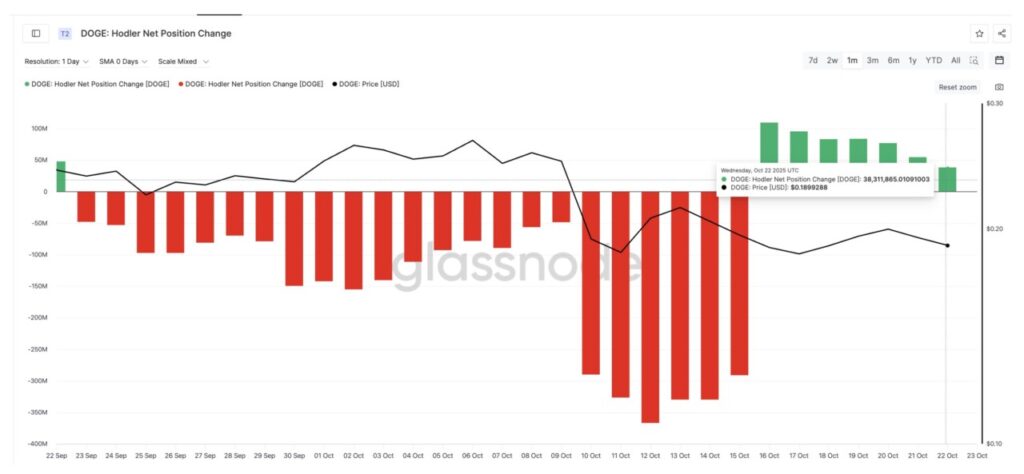

Long-Term Holders Retreat, Short-Term Buyers Step In

The Hodler Net Position Change indicator, which tracks whether long-term investors are adding or selling their assets, is now showing bearish signals. On October 16, long-term holders added about 109.8 million DOGE to their balance.

But on October 22, that number dropped dramatically to just 38.3 million DOGE – a 65% drop in accumulation.

This data suggests that long-time investors are starting to pull back and reduce their exposure after weeks of price pressure. Since then, Dogecoin’s price has flattened out, only dropping about 1.5% in the last seven days, signaling buying support preventing a deeper decline.

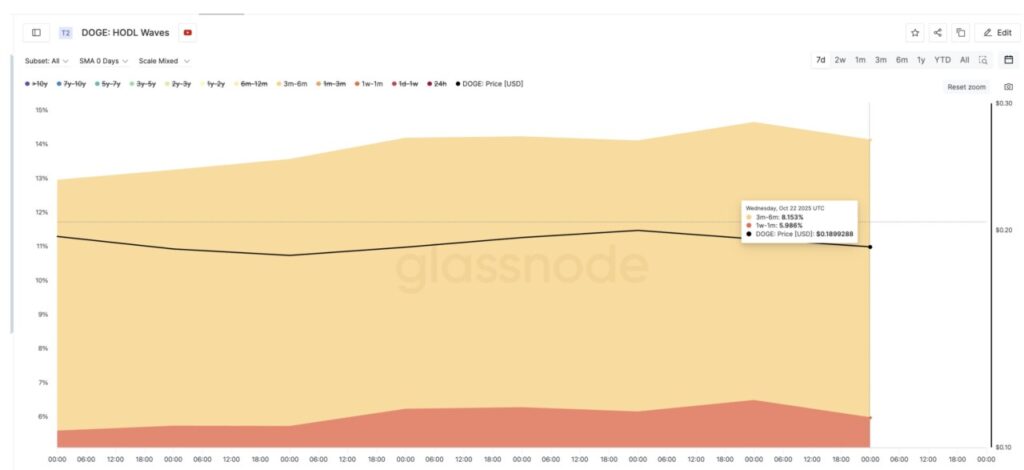

Meanwhile, short- and medium-term buyers are trying to maintain current price levels. Based on HODL Waves data, which shows the proportion of holdings based on the length of time the asset has been held, two groups of investors are seen continuing to add to their holdings.

The group holding DOGE between 1 week to 1 month increased their share from 5.59% to 5.98% since October 15. Meanwhile, the 3-month to 6-month group increased from 7.36% to 8.15%.

This tug-of-war created a price ceiling in the $0.20-$0.21 range, keeping DOGE prices moving in a narrow range. In many cases, additional buying impulses from other groups – especially the whales – can help break the ceiling. However, this time there may be deeper factors limiting the price’s upside potential.

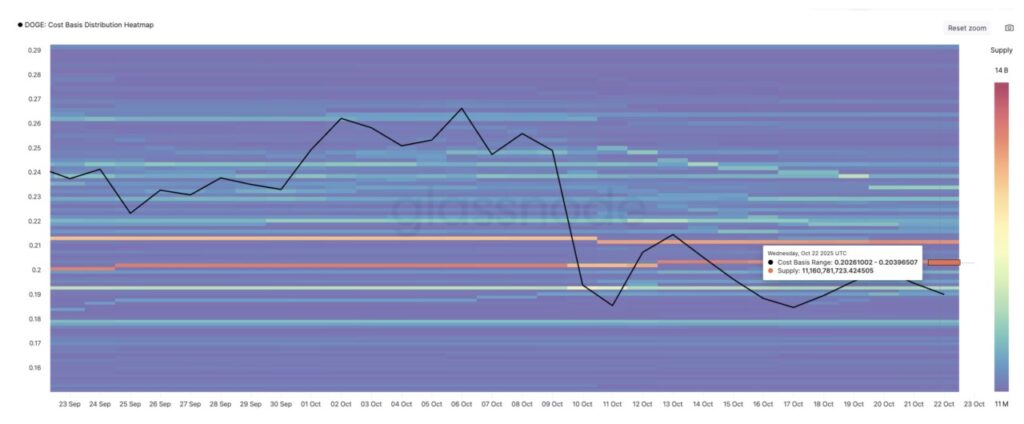

Cost Distribution Data Explains Why the Dogecoin Price is Struggling to Break the Upper Limit

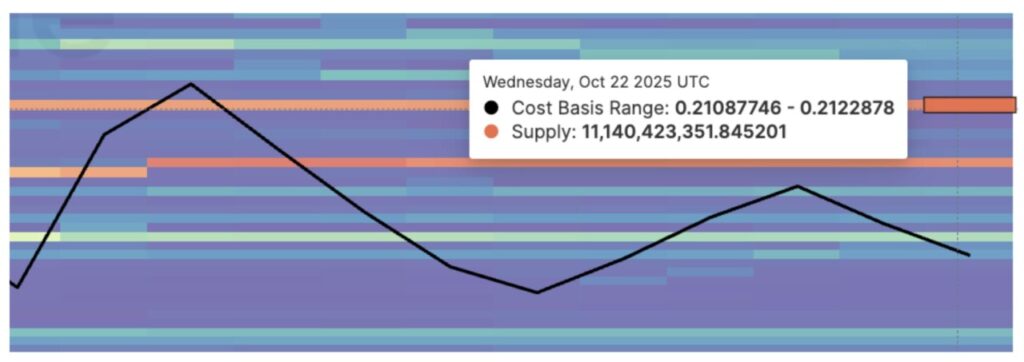

Cost Basis Distribution ‘s heatmap reveals the reason why the legendary meme coin has not been able to break the current price level.

Read also: Bitcoin Climbs to $110,000 Today – But Is a Pullback on the Horizon?

There are two large supply clusters – in the $0.202-$0.206 and $0.210-$0.212 range – that hold around 11.16 billion DOGE and 11.14 billion DOGE respectively. These are the largest clusters; there are smaller clusters with fewer DOGEs throughout the range.

This heatmap shows at what price most coins were last purchased by their holders.

Together, these clusters form one of the most powerful short-term barriers for Dogecoin. Whenever the price approaches the $0.20-$0.21 zone, selling pressure immediately arises as many holders try to sell at breakeven.

It is this supply pressure that has consistently halted price gains since October 11, making the area the most difficult resistance zone to break for DOGE at the moment.

If the DOGE whales start buying more aggressively, they could absorb some of this supply and help push the price through resistance. But as long as that doesn’t happen, the Dogecoin price will most likely remain stuck in its current range.

If the price manages to break above $0.21 (about 12% higher than where it is now), it could open a path towards $0.27. Conversely, if it slips below $0.17, the DOGE price risks dropping back to around $0.14.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin Price Faces Its Toughest Test – Every Bounce Below Key Level Could Fail. Accessed on October 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.