5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Jakarta, Pintu News – Over the past year, the investment world recorded significant growth in several types of assets. Amidst market volatility, prudent investors managed to record gains from a variety of sectors, ranging from commodities to digital assets such as cryptocurrencies. This article looks at five investment types that have performed best over the past 12 months based on the latest data and market trends.

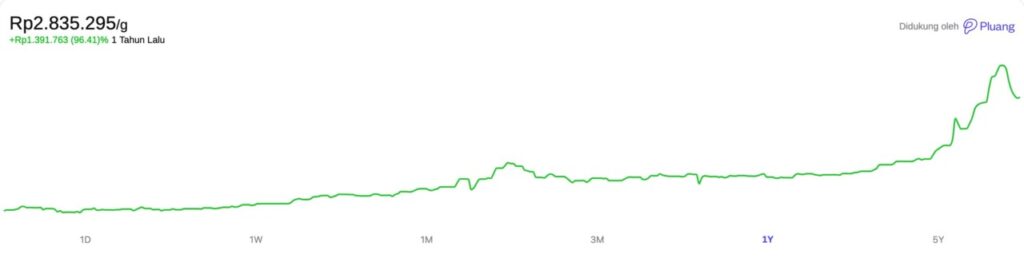

1. Gold: A Conservative Asset that Keeps Shining

As one of the oldest investment instruments, gold has again shown positive performance in the past year. Based on market data, global gold prices have risen about 96% in 12 months, driven by global inflation concerns and geopolitical turmoil that has yet to subside.

Investors still see gold as a hedge against currency depreciation and economic uncertainty. Not only in physical form, gold-based ETFs and shares of gold mining companies are also experiencing increased interest. With global economic conditions still unstable, gold is predicted to remain preferred and considered by conservative investors.

Also Read: 5 Shocking Facts: Prediction Market Volume Explodes 5-Fold, Reaching IDR 49.9 Trillion!

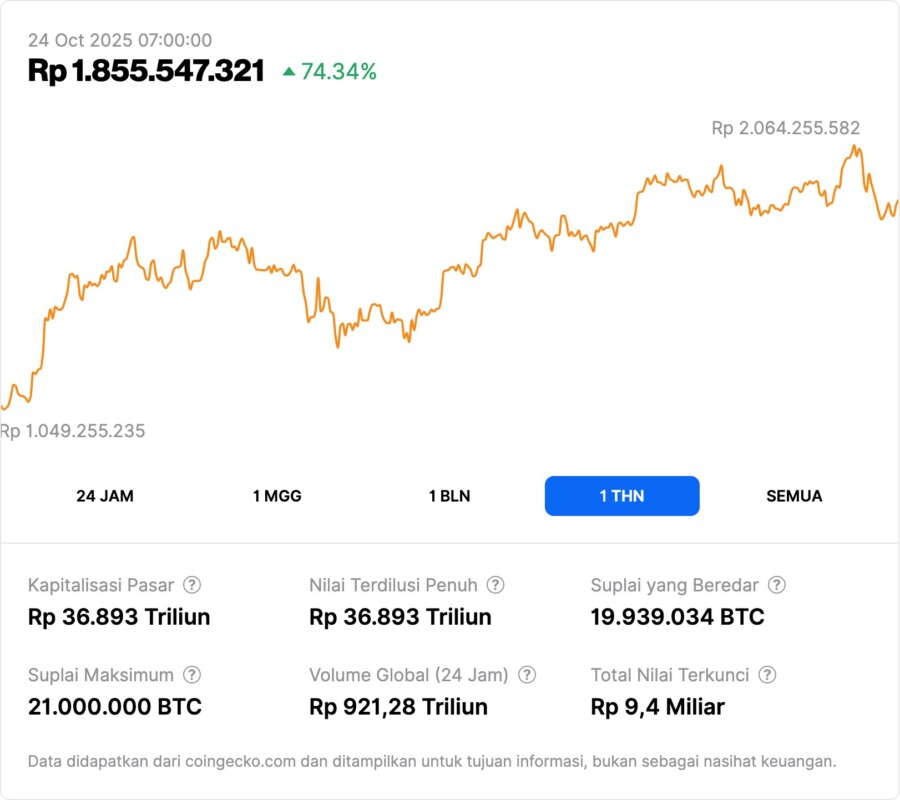

2. Bitcoin (BTC): The Top Crypto that Institutions Are Hunting

Bitcoin (BTC), as the cryptocurrency with the largest market capitalization, is back in the center of investors’ attention. Over the past year, the price of BTC surged by more than 93%, according to data from CoinMarketCap.

This rise has been driven by institutional adoption, recognition as “digital gold”, and wider access to Bitcoin through products such as crypto ETFs and retail investment platforms. With adoption from large corporations and financial institutions, BTC is now closely monitored by whales and considered a digital hedging asset in modern portfolios.

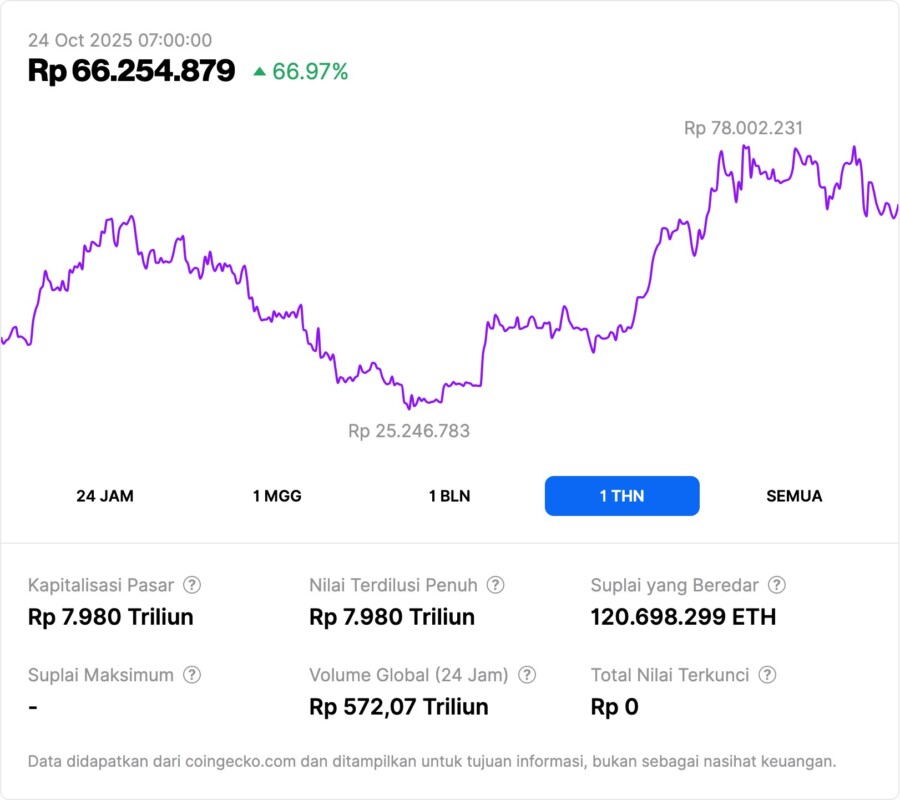

3. Ethereum (ETH): The Versatile Blockchain That Exploded

Ethereum (ETH) serves not only as a cryptocurrency, but also as a platform for smart contracts and decentralized applications (DApps). In the past 12 months, ETH has recorded a gain of more than 95%, thanks largely to a surge in activity in the DeFi and NFT sectors.

Ethereum’s transition to Ethereum 2.0 is also a much-discussed moment as it promises energy efficiency and higher transaction speeds. With an ever-evolving ecosystem, ETH is considered a potential resilient altcoin in the medium to long term.

4. Tech Stocks: Gaining Attention Again

After a brief correction in 2022-2023, big tech stocks such as Apple, Microsoft, and Nvidia are attracting investors’ attention again. The sector’s stocks have averaged 15-30% growth in the past year, supported by innovations in artificial intelligence (AI), cloud computing, and digital expansion.

Data from Nasdaq and Bloomberg suggests that technology-based ETFs are also being bought up by institutional and retail investors due to expectations of solid long-term growth. Despite their volatility, tech stocks remain an important pillar in a diversified portfolio.

5. Diversified Assets: Emerging Market ETFs & Mutual Funds

Smart investors now don’t rely on just one asset, but instead use diversification strategies through products such as thematic ETFs and emerging market funds. According to Investopedia, a portfolio that includes a combination of gold, stocks, and crypto is likely to provide optimal returns while lowering overall risk.

Mutual funds focusing on Asian and Latin American markets, as well as sector-based ETFs such as renewable energy and technology, showed positive performance of over 12% in a year. In a dynamic global market environment, a diversification strategy remains the key to successful long-term investing.

Diversification is the Wiseest Strategy

Looking at the performance of the five most attention-grabbing and talked-about asset classes throughout the year, it’s clear that no single investment is suitable for everyone. Whether it’s gold as a hedge, cryptos like Bitcoin (BTC) and Ethereum (ETH) for growth, or stocks and ETFs for industry exposure, the right combination will largely determine investment outcomes.

Also Read: Top 2 Trending Crypto Before November 2025: Widely Watched by Whale!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. Which Investments Have the Highest Historical Returns? Accessed on October 24, 2025

- Investopedia. Advantages and Disadvantages of Buying Stocks Instead of Bonds. Accessed on October 24, 2025

- Equitymaster. Top 5 Cryptos that Gave 100x Return in the Past 10 Years. Accessed on October 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.