Ethereum Layer-2 Security Polemic: Buterin vs Yakovenko

Jakarta, Pintu News – Ethereum (ETH) founder Vitalik Buterin and Solana (SOL) founder Anatoly Yakovenko have expressed opposing views on the security of Ethereum’s layer-2 (L2) network.

This divergence of views sparked a debate in the crypto industry as to whether L2 solutions truly inherit the strong security level of Ethereum’s base layer.

Buterin Defends Ethereum’s Layer-2 Security Model

Vitalik Buterin asserted that the layer-2 (L2) solution on Ethereum retains a strong level of security against 51% attacks. He stated that the L2 solution still inherits the finality guarantee from Ethereum’s base layer. In a recent post on the X platform, Buterin said:

Read also: Ethereum whales accumulate again, signaling a strong revival of the ETH market

“One of the important properties of blockchain is that even a 51% attack cannot make an invalid block valid. This means that even if 51% of validators conspire (or get hit by a software bug), they still can’t steal your assets.”

However, Buterin also recognizes that there are limitations when a set of validators are trusted to perform functions outside the control of the blockchain itself.

“This trait does not apply if you start entrusting your validators to do other things that the chain cannot control,” he adds. “Under those conditions, 51% of validators can conspire and give the wrong answer, and you don’t have any legal recourse.”

Large L2 networks such as Arbitrum (ARB), Base, Optimism (OP), and Worldchain currently collectively secure over $35 billion in total value locked (TVL). These networks rely on Ethereum’s security architecture.

Today, the number of Ethereum validators has surpassed one million active participants – far more than Solana’s 2,000 validators. Ethereum proponents argue that this strengthens resilience against coordinated attacks.

Yakovenko Questions Ethereum’s Layer-2 Security Assumptions

Solana (SOL) founder Anatoly Yakovenko directly challenged Vitalik Buterin’s statements regarding the security of Ethereum’s layer-2 (L2) solution.

“The statement that L2 inherited Ethereum’s security is false. It’s been five years since the L2 roadmap began, but ETH wormholes on Solana have the same worst-case risks as ETH on Base, and generate the same revenue for stakers on Ethereum layer-1,” Yakovenko wrote on the X platform (Twitter).

He questioned whether technical limitations made it difficult for the L2 solution to achieve the expected level of security.

“Yes, there is something fundamental about L2 that makes it difficult to actually achieve the desired safety. That’s why it hasn’t materialized for five years. Or are you suggesting that all L2 teams are lazy or stupid?” he continued.

Yakovenko identified three main problems in the current L2 implementation:

- Wide attack surface – L2 networks have complex code and are difficult to audit thoroughly, making them more vulnerable to exploitation.

- Multi-signature asset management – This system allows funds to be moved without the user’s consent if signatories collude or security is compromised.

- Off-chain processing – Many L2s rely on off-chain mechanisms, which potentially creates centralization and goes against the core decentralization principle of blockchain technology.

As a solution, Yakovenko proposed the development of a specialized bridge that would position Ethereum as layer-2 on top of Solana. The goal is to enable seamless transfer of assets between ecosystems while still addressing existing security issues.

Read also: Can Solana (SOL) Price Break $200 Again? Check out the Analysis!

Layer-2 Growth Raises Concerns in the Ethereum Ecosystem

Ethereum’s layer-2 (L2) landscape has been growing rapidly. According to data from L2Beat, there are currently 129 verified networks, plus another 29 unverified networks. This surge in numbers has sparked a debate: whether this development is driving innovation or creating inefficiencies in the ecosystem.

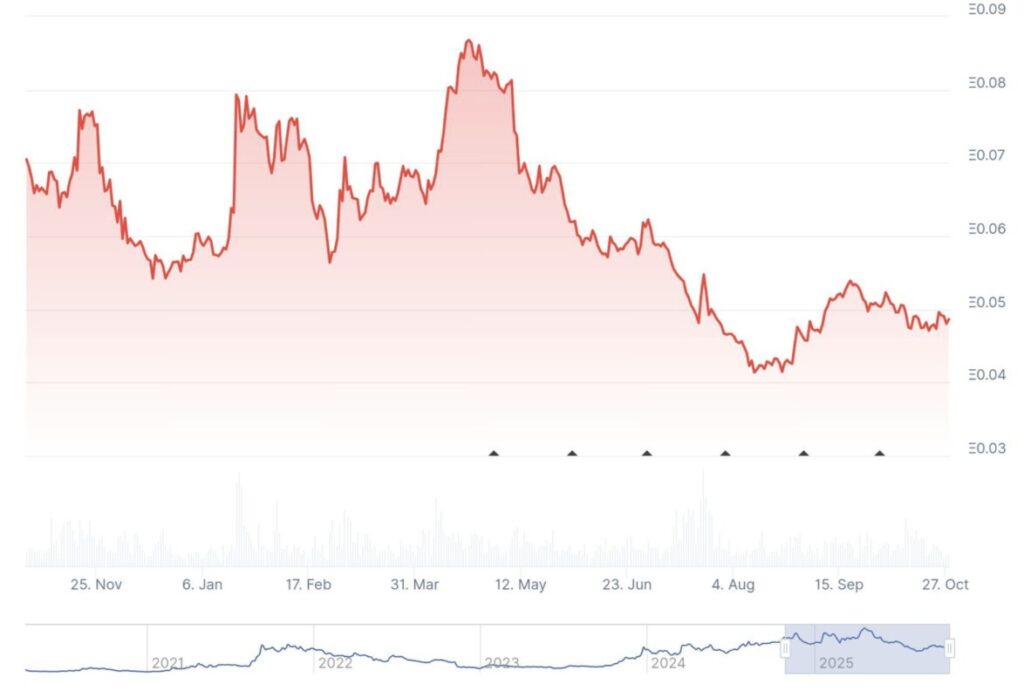

Data from CoinGecko shows that during the first half of 2025, the price of Ethereum fell by 25.0%, while Solana experienced a 19.1% decline.

However, in January, Solana briefly outperformed Ethereum with a higher performance of 26.2%, before both were pressured by general market conditions.

This difference in performance reflects a shift in market sentiment. Industry observers note that as L2 networks evolve, initiatives such as data availability sampling and shared sequencing are being introduced to mitigate the risks of centralization. This debate highlights the ongoing challenge of finding a balance between security and scalability.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. ‘Invalid can’t become valid’ – Vitalik Buterin on Ethereum’s unbreakable core. Accessed on October 27, 2025

- BeInCrypto. Buterin and Yakovenko Clash Over Ethereum Layer 2 Security. Accessed on October 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.