5 Steps Ripple Takes to Dominate Global Financial Markets Through XRP & RLUSD Stablecoins

Jakarta, Pintu News – Ripple has once again captured the attention of the crypto world after announcing the acquisition of Hidden Road, now rebranded as Ripple Prime. This strategic move makes Ripple the first cryptocurrency company to own and operate a multi-asset prime brokerage globally, according to a report from Kevin Helms on Bitcoin.com News.

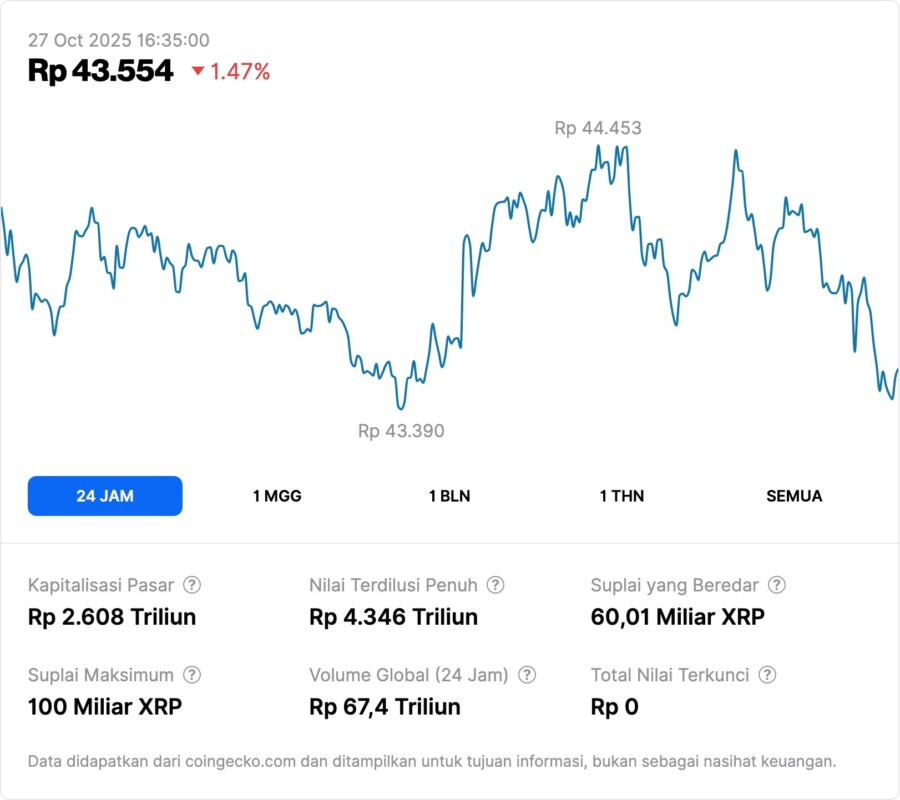

Based on Ripple data as of October 24, 2025, this acquisition strengthens the role of XRP (XRP) and RLUSD stablecoins in the global financial ecosystem. Ripple stated that the Ripple Prime business has grown by three times since the initial announcement of the acquisition.

1. Ripple Prime becomes a major weapon in the global market

With Ripple Prime, Ripple now provides services that include crypto, forex, derivatives, swaps, and bonds. Ripple CEO, Brad Garlinghouse, mentioned that the acquisition of Hidden Road is the fifth acquisition in the last two years, adding to the strategic portfolio after GTreasury, Rail, Standard Custody, and Metaco.

According to Garlinghouse on the X platform (formerly Twitter), all these moves are part of Ripple’s grand vision to build an “Internet of Value”, where XRP is at the center of all the company’s activities.

Also Read: 7 Altcoins that Cross-Chain with XRP Most Often

2. RLUSD: Ripple’s Stablecoin that Institutions Hunt for

The RLUSD stablecoin has been under the spotlight since it was used as collateral in various Ripple Prime products. Ripple mentioned that some derivatives customers have now chosen to hold their balances in RLUSD, which is projected to grow significantly in the next few months.

According to data from Bluechip in July 2025, RLUSD earned an “A” rating thanks to its transparency, governance, and strong asset backing. The Bank of New York Mellon (NYSE: BK) was appointed as the primary custodian for the stablecoin’s reserves.

3. Ripple Integrates Blockchain Infrastructure into Prime Brokerage

Ripple Prime brings integration between traditional financial services and blockchain technology, allowing institutions to gain direct access to cross-asset liquidity and a blockchain-based trading ecosystem.

This gives Ripple a competitive advantage as a pioneer of crypto prime brokerage, a service model previously only available to institutions through non-crypto intermediaries.

4. Global Impact and Wider Access to Digital Assets

With Ripple Prime, institutions across the globe now have access to previously limited digital financial products, such as crypto-based derivatives and decentralized swaps. This strengthens Ripple’s position in the global financial landscape, especially in providing a bridge between traditional assets and cryptocurrencies.

Many analysts predict that this move will boost institutional interest in cryptocurrencies and accelerate the adoption of stablecoins like RLUSD in the fast-growing financial ecosystem.

5. Ripple & Hidden Road: The Combination Market Participants Are Watching

The acquisition of Hidden Road marks a major shift in Ripple’s strategy. With the synergy with Hidden Road’s CEO, Marc Asch, Ripple is expected to expand its services even more globally.

This step is considered by many as a serious effort by Ripple to strengthen the position of XRP and RLUSD as the two main pillars in a blockchain-based financial system that is compliant with regulations and ready to compete at the institutional level.

Conclusion

According to an official report from Ripple, the strategy of strengthening XRP and RLUSD through Ripple Prime is part of a long-term plan to build a global digital financial infrastructure. This move not only steals the show, but also signals that cryptocurrencies like XRP are not only for retail investors, but are now also being hunted by large institutions around the world.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Kevin Helms / Bitcoin.com News. Ripple Arms XRP and RLUSD for Global Finance as Prime Brokerage Bridges Global Markets. Accessed on October 27, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.