Bitcoin (BTC) Surges, but Indicators Still Show Bearish Trend? (10/28/25)

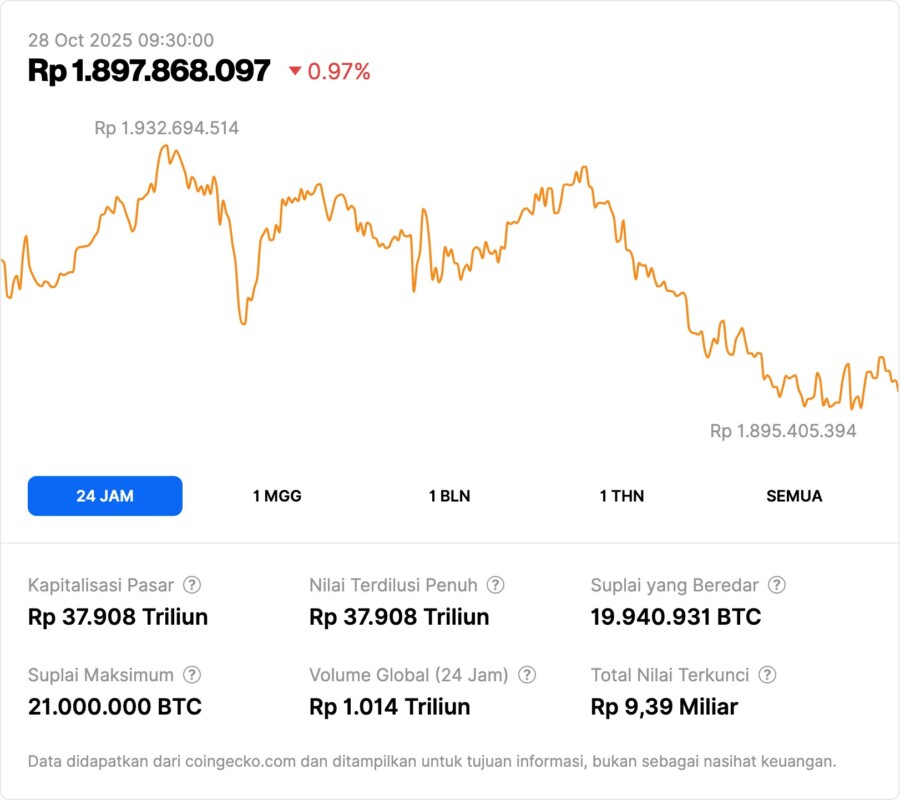

Jakarta, Pintu News – Bitcoin (BTC) has recently managed to break the 50-day simple moving average (SMA), which is often considered an indicator of a short-term bullish trend. Despite positive signals from some technical indicators, there is still caution in the market.

This rise in the price of Bitcoin (BTC) appears to have been triggered by expectations of an interest rate cut by the Federal Reserve scheduled to occur this Wednesday, as well as positive developments in trade tensions between the US and China.

Bitcoin (BTC) Technical Analysis

The breakout above the 50-day SMA was supported by a bullish crossover on the daily MACD histogram and a bullish crossover between the 5-day SMA and 10-day SMA. This indicates an increasingly strong upside momentum. However, despite these bullish indications, Bitcoin (BTC) is still below the Ichimoku cloud on the daily chart, which is a key resistance level.

A decisive move above the Ichimoku cloud would confirm a bullish revival and potentially set the stage for a rally towards $120,000 and higher. However, as long as Bitcoin (BTC) is unable to break this level, opportunities for further gains are limited.

Also Read: Potential DOGE Explosion November 2025: Technical Analysis Shows Sharp Rise?

CoinDesk Trend Indicator for Bitcoin (BTC)

Despite some positive signals from technical indicators, the CoinDesk Bitcoin (BTC) Trend Indicator still shows a bearish trend. This indicator measures the presence, direction, and strength of momentum, and currently does not support substantial higher price movements.

Investors and traders should pay attention to this indicator as it can give a broader picture of market sentiment. Although there is hope for a recovery, caution is still required as the market may still experience volatility.

Influence of Federal Reserve Policy and US-China Trade

The recent rise in Bitcoin (BTC) price has also been influenced by market expectations of the Federal Reserve’s monetary policy. An anticipated interest rate cut could weaken the US dollar, making assets like Bitcoin (BTC) more attractive.

In addition, positive developments in trade negotiations between the United States and China also provided a boost. A reduction in tensions could boost global market sentiment and encourage more investment into riskier assets such as cryptocurrencies.

Conclusion

Although Bitcoin (BTC) has shown some positive signals, there are still some obstacles to overcome before the bullish trend can be fully confirmed. Investors and traders should monitor key indicators and global developments to make informed investment decisions.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Bitcoin Surpasses 50-Day Average but CoinDesk BTC Trend Indicator Remains Bearish. Accessed on October 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.