Bitcoin (BTC) is soaring, is it time to invest? (10/28/25)

Jakarta, Pintu News – Bitcoin (BTC) recently recorded a significant rise, breaking the $112,000 barrier with high trading volume and stabilizing around $114,500. This rise coincided with a massive liquidation of $319 million worth of short positions in the last 24 hours, signaling a potential trend change in the cryptocurrency market.

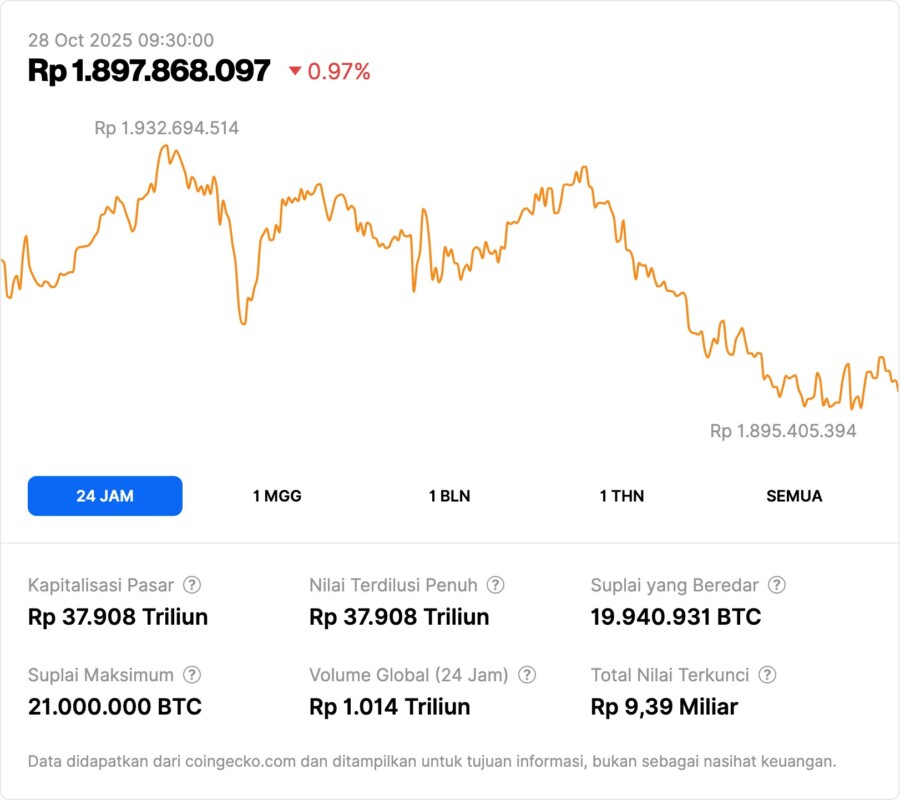

Bitcoin (BTC) Price Increase

Bitcoin (BTC) broke through the psychological barrier of $112,000 and continued to rise until it reached $114,501 at 23:35 UTC on October 26. This rise was driven by massive liquidation of short positions, which reached $319.18 million in 24 hours. This phenomenon suggests that many traders who bet against Bitcoin (BTC) were forced to close their positions, which in turn pushed the price higher.

The trading volume jumping about 318% above the session average shows strong interest from buyers. This rise not only broke the $112,000 barrier but also created strong momentum that could take the price to higher levels if this trend continues.

Also Read: Potential DOGE Explosion November 2025: Technical Analysis Shows Sharp Rise?

Market Dynamics and Liquidation

In the last 24 hours, CoinGlass recorded a total liquidation of $393.74 million across multiple platforms, with a predominance of liquidation of short positions. The largest liquidation in a single order amounted to $19.04 million for the Bitcoin (BTC)-USD pair on the Hyperliquid platform. This shows that market volatility is still very high, and traders who took short positions were forced to exit with heavy losses.

This massive liquidation also suggests that many market participants may have misread signals or been overly pessimistic about Bitcoin’s (BTC) prospects. This often creates opportunities for traders who are able to read and respond appropriately to market dynamics.

US-China Meetings and Consultations

The meeting between top US and Chinese officials in Kuala Lumpur discussed various issues of trade and economic cooperation. From this meeting, the two countries reached some basic agreements and plan to continue dialogue to finalize further details. Issues discussed included tariffs, law enforcement cooperation on fentanyl, agricultural trade, and export controls.

This meeting is considered a positive step that could reduce trade tensions and promote global economic stability. This stability is important for financial markets, including cryptocurrency markets, as it can reduce uncertainty and boost investor confidence.

Conclusion

With the important meeting between the US President and the Chinese President coming up, as well as the FOMC meeting, the market may see more significant price movements. Traders and investors are advised to monitor these developments closely, as they could provide further indications on the future direction of the Bitcoin (BTC) and other cryptocurrency markets.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Bitcoin Rebounds as $319M in Shorts are Liquidated While Traders Eye U.S.-China Talks. Accessed on October 28, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.