BTC and ETH Are Crashing — Why Is the Crypto Market Down Today? (October 29, 2025)

Jakarta, Pintu News – The cryptocurrency market turned red again on Tuesday, October 28, 2025, after the total market capitalization fell more than 1% to around $3.9 trillion (Rp64.6 quadrillion).

Bitcoin (BTC) price led the weakness by falling to a daily low of around $112,412 (Rp1.86 billion), while Ethereum (ETH) corrected more than 3% to around $3,946 (Rp65.5 million). Although market sentiment remains weak, some analysts think the pressure is temporary ahead of the Fed’s latest interest rate decision scheduled for this week.

Fed uncertainty pressures crypto market

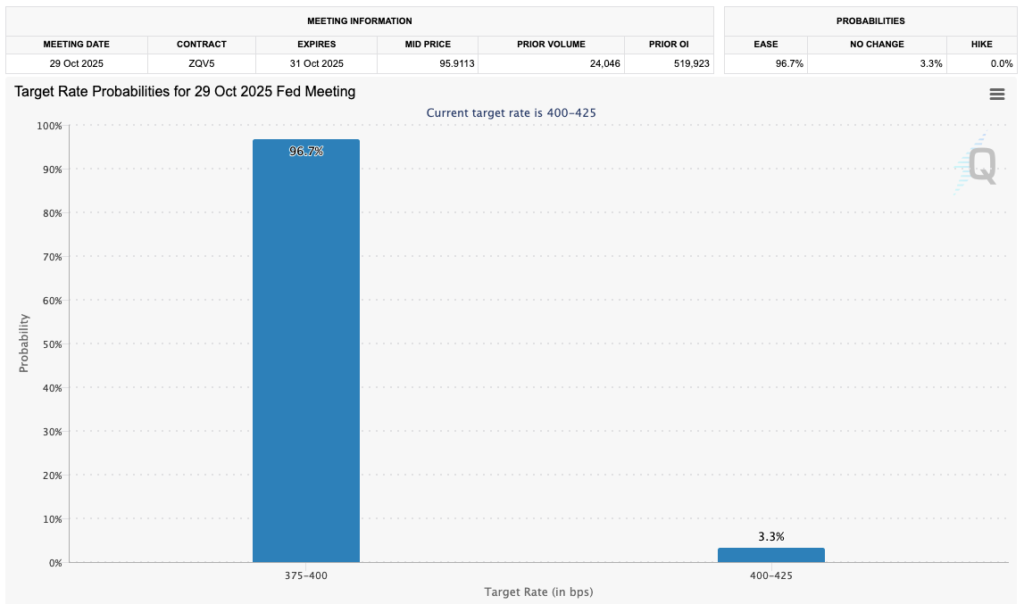

Much of the crypto market’s decline this time is attributed to the uncertainty of the Federal Reserve’s (Fed) interest rate policy ahead of the FOMC meeting results announcement on Wednesday US time. Investors are opting for caution amid speculation that the Fed will make a 0.25% interest rate cut, which could be a big catalyst for market movements. However, before the official decision is announced, market volatility is likely to increase sharply.

These concerns also triggered profit-taking from traders who had previously enjoyed a brief rally earlier in the month. Some analysts predict that if the rate cut does happen, then the crypto market will rally again, especially with the prospect of new Quantitative Easing (QE) that could add global liquidity. Until the decision is made, market participants are likely to opt for defensive positions.

Impact of “Sell the News” After Altcoin ETF Release

One of the other factors that suppressed crypto prices today was the “sell the news” effect following the news that an altcoin spot ETF was officially launched amid the US government shutdown. The enthusiasm for altcoin ETFs that previously drove the brief rally has now started to subside, as most market participants think the news is already “priced in”.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (10/29/25)

This condition makes some investors take the safe step of selling some of their assets to secure profits. Although the short term looks negative, analysts predict that in the medium term altcoin ETFs could strengthen cryptocurrency adoption among institutional investors. Currently, traders’ main focus has shifted to the potential for new economic stimulus from the Fed that could support the next rally.

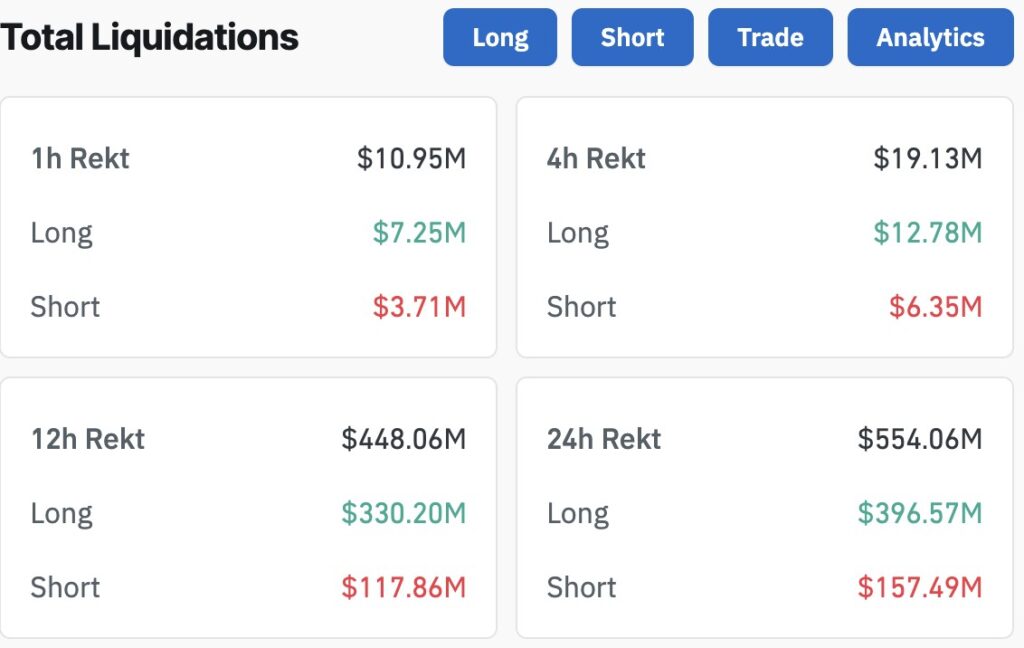

Big Long Squeeze: Trader Loses IDR6.9 Trillion

In addition to macroeconomic factors, the crypto market has also been hit by a massive wave of liquidation against long positions. Based on data from CoinGlass, more than $567 million (IDR 9.4 trillion) worth of crypto assets were liquidated in the last 24 hours, with $409 million (IDR 6.8 trillion) of that coming from traders who were long. This surge in liquidation suggests that the market is experiencing a long squeeze, which is when long positions are forced to close as prices fall sharply.

This phenomenon accelerated the price decline of major assets such as Bitcoin and Ethereum. After the big spike at the beginning of the month, many traders utilized high leverage which ended up exacerbating the selling pressure. As a result, volatility increased and crypto prices fell faster than expected. Nonetheless, some analysts think that this decline could be a new accumulation opportunity, especially if the market stabilizes after the Fed’s decision is announced.

Conclusion

With the combination of global macroeconomic factors, the psychological effect of the altcoin ETF release, and a large wave of liquidation, the crypto market is again under short-term pressure. However, the long-term outlook is still positive, especially if the Fed actually cuts interest rates and restarts the Quantitative Easing program.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Why is the Crypto Market Down Today? Accessed October 29, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.