Bitcoin Dips to $112K Today Amid FOMC-Driven Volatility

Jakarta, Pintu News – As of October 28, Bitcoin (BTC) broke through the $116,000 level after the opening of Wall Street markets on Tuesday, in line with the crypto market’s strong October resurgence – a trend that the community often refers to as “Uptober”.

Then, how is the current Bitcoin price movement?

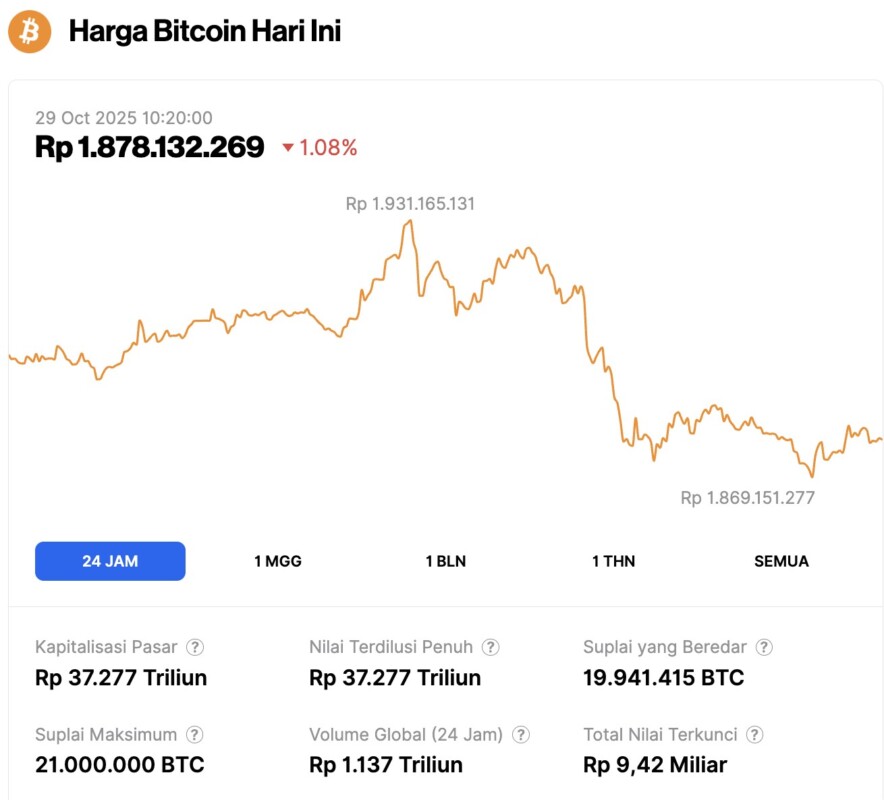

Bitcoin Price Drops 1.08% in 24 Hours

As of October 29, 2025, Bitcoin was priced at $112,557, or approximately IDR 1,878,132,269, reflecting a 1.08% decline over the past 24 hours. During this period, BTC hit a low of IDR 1,869,151,277 and a high of IDR 1,931,165,131.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 37,277 trillion, while 24-hour trading volume has increased by 11%, reaching approximately IDR 1,137 trillion.

Read also: 3 Altcoins to Watch Ahead of the FOMC Meeting at the End of October 2025!

FOMC Meeting Triggers BTC Price Volatility

According to Cointelegraph, in a move that further surprised traders, Bitcoin didn’t even follow its usual pattern of declining ahead of major economic events in the US – in this case, the interest rate decision by the Federal Reserve.

The Federal Open Market Committee (FOMC) is widely expected to cut interest rates by 0.25% on Wednesday. Markets are also watching Fed Chair Jerome Powell’s statement for clues on future policy direction during his press conference afterwards.

“So far, Bitcoin is doing well. The price is holding pretty strong and is making a small retest,” said crypto trader, analyst, and entrepreneur Michaël van de Poppe on platform X.

In a separate post, Van de Poppe stated that the inverse correlation between Bitcoin and gold helped drive the price up. Gold prices fell to $3,886 per ounce on the day-the lowest since October 6.

“The fall in gold prices and its consolidation move is a strong bullish signal for risky assets, including altcoins,” he wrote.

Meanwhile, another trader named Killa forecasts the $117,000 level as a local peak ahead of the FOMC announcement, before Bitcoin price is likely to drop back to close the weekend gap on CME Group’s Bitcoin futures market at around $111,000.

Read also: 5 Cryptocurrencies Gaining Major Attention in November 2025

“As we can see, the CME gap is not very far, and I think breaking this blue line will be a challenge,” he said.

“However, the chances of returning to the $111,200 level are quite high.”

CME Gap at $111,000 is a Big Threat

Many market views still expect BTC prices to decline before the Fed’s announcement.

BitBull traders pointed out two price levels of concern, $106,000 and $110,000, before the BTC/USD pair moved towards new record highs.

“I still believe that the BTC price peak has not been reached yet, and there is one more big spike left,” he told his followers on the X platform.

As Cointelegraph reports, concerns about the lack of trading volume and technical indicators showing bearish divergence continue to cast doubt on whether this bull market can last – or even set new record highs.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin price taps $116K as analysis weighs odds of CME gap fill. Accessed on October 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.