Ethereum Pulls Back to $3,995 Today, Yet Market Structure Stays Intact

Jakarta, Pintu News – Ethereum (ETH) price has risen about 3.5% in the past week, indicating a slight recovery. However, the token is still down more than 2% on the daily chart, suggesting that the selling pressure has not completely subsided.

This combination of short-term recovery and daily weakness explains why Ethereum’s attempt to break a certain level failed on October 27 – despite that, a group of investors is still quietly preparing for a possible subsequent rise.

Then, how will Ethereum price move today?

Ethereum Price Drops 2.00% in 24 Hours

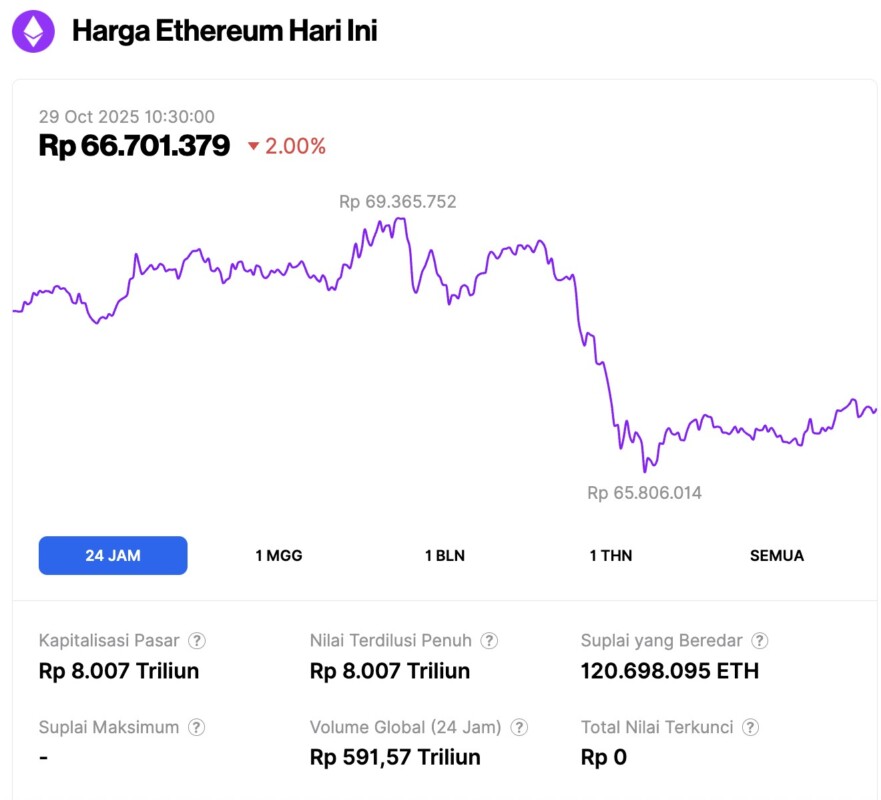

As of October 29, 2025, Ethereum was trading at around $3,995, or approximately IDR 66,701,379, marking a 2.00% drop over the past 24 hours. During that time, ETH reached a low of IDR 65,806,014 and a high of IDR 69,365,752.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 8,007 trillion, while its 24-hour trading volume has slipped by 0.49% to IDR 591.57 trillion.

Read also: Bitcoin Price Drops to $112,000 Today: FOMC Triggers BTC Volatility!

Cooling Demand Explains the Breakout Failure

Ethereum’s latest rejection is rooted in slowing accumulation from active holders.

The holder accumulation ratio, which measures how many wallets increased versus decreased their ETH holdings, fell from 31,278 to 30,964 – a decrease of about 1% from its peak in the last three months.

This decrease shows that fewer wallet addresses are buying or adding ETH, even though the price is rising – indicating that traders are starting to be cautious or waiting for a better entry moment.

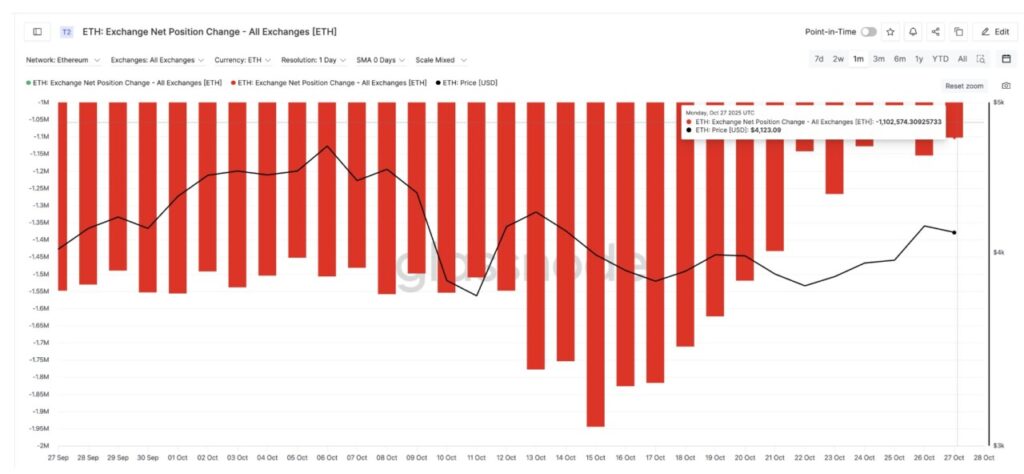

At the same time, the flow of funds to and from the exchange also confirmed this change in sentiment. The change in net position on the exchange, which shows how much ETH is leaving the exchange, became less negative. On October 15, the outflow stood at around 1.94 million ETH, but by October 27 it had shrunk to 1.10 million ETH – a decrease of 43%.

When outflows shrink, it usually means more holders are leaving their ETH on exchanges – which is a sign of increased interest in selling in the short term. It is these two factors that explain why Ethereum’s attempt at a breakout was unable to maintain its momentum.

Supply Cluster Holds Back Ethereum’s Rally Rate

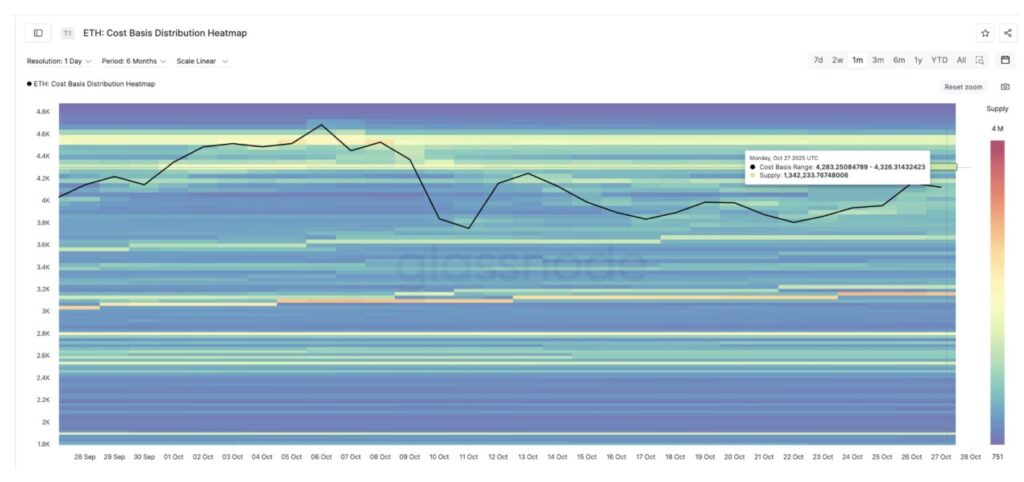

The cost-basis heatmap, which displays where a lot of ETH was last purchased in bulk, shows the strongest supply cluster to be in the range of $4,283 to $4,326 – totaling around 1.34 million ETH.

Read also: 5 Cryptocurrencies Gaining Major Attention in November 2025

This zone is also the same area where Ethereum’s rally has stalled – the $4,254 to $4,395 range seen on the chart (to be highlighted later). Whenever ETH price approaches this area, previous buyers tend to start selling to secure profits, adding to the selling pressure.

As long as this “wall” hasn’t been breached, Ethereum’s upward movement will likely continue to be restrained. However, not all indicators point to weakness.

Ethereum Price Setup Still Looks Balanced

Ethereum is still moving within the symmetrical triangle pattern formed since October 7. The latest rejection at the upper trendline on October 27 indicates strong resistance, but does not invalidate the overall structure of the pattern.

For Ethereum to rally again, the price needs to close convincingly above the upper boundary of the triangle and be able to hold that position. If successful, this will pave the way to the next important resistance zone. The first level to break is $4,254, followed by $4,395 (a gain of almost 7%).

A breakout of these levels – if confirmed by a 12-hour candle close – would also mean conquering the cost-basis cluster mentioned earlier.

There is reason enough to believe that the resistance zone could eventually be broken. The Smart Money Index – which tracks the activity of wallets that have historically outperformed the market – has continued to show higher lows since October 22.

This means that even though the price has risen, these wallets are still accumulating, indicating a belief in a rebound in the near future.

However, if the price drops below $3,918, this pattern starts to weaken, and $3,711 will be the next support level. If that happens, then the optimistic outlook and signals from the smart money will lose their validity.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Sellers Halt Breakout – But One Group Is Still Hopeful Of A Price Bounce. Accessed on October 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.