Solana ETF Could Draw $6 Billion in Its First Year as SOL Joins the Ranks of Crypto’s Elite

Jakarta, Pintu News – Investors are watching the launch of the first Solana staking exchange-traded fund (ETF), a move that is expected to pour billions of dollars into the Solana ecosystem and the altcoin market as a whole.

According to Bloomberg analyst Eric Balchunas, at least three altcoin ETFs are scheduled to launch on Tuesday. The three are Bitwise’s Solana (SOL) ETF, as well as Canary’s Litecoin (LTC) and Hedera (HBAR) ETFs.

Investors Await Launch of First Solana Staking ETF

The US Securities and Exchange Commission’s (SEC) approval of the first Solana staking ETF is considered a “transformational” milestone that, according to Bitget Chief Analyst Ryan Lee, has the potential to attract $3 to $6 billion in new funds into Solana within the first year.

Read slo: Elon Musk Introduces Grokipedia, an AI-Controlled “Truth” Encyclopedia

“Solana can now attract between $3 to $6 billion in its first year,” Lee said.

He also added that the staking feature of the new ETF-which provides holders with passive income of around 5%-has the potential to attract more institutional capital not only to the ETF, but also to the altcoin sector at large.

Staking is the process of locking tokens in a proof-of-stake (PoS) based blockchain network for a certain period of time to help secure the network, in exchange for passive income.

The launch of a new crypto-based ETF could push the price of the underlying altcoin to an all-time high. For example, for Bitcoin (BTC), ETFs accounted for about 75% of total new investments when the price of BTC broke $50,000 again on February 15, less than a month after the spot BTC ETF was officially launched on January 11.

Solana Enters “Big League” with ETF Launch, Driving Positive Sentiment for Altcoins

Solana has officially entered the “big leagues” with the top two cryptocurrencies with the launch of its ETF, an achievement that could boost institutional adoption of the altcoin market more broadly, according to Bitget analyst Ryan Lee.

“More than just Solana, this move reflects a broader acceptance of altcoins in regulatory-compliant and yield-generating structures. It encourages new capital flows into the DeFi sector, tokenization of real-world assets, and multi-asset ETF products,” Lee explained.

Read also: Whale Crypto Buys $500 Million Worth of XRP and Pushes XRP Price to $2.5!

The launch of a spot Bitcoin ETF in the US previously attracted $36.2 billion in investment in its first year, while a spot Ethereum (ETH) ETF raised $8.64 billion in the same period, according to data from SoSoValue, a blockchain data aggregator.

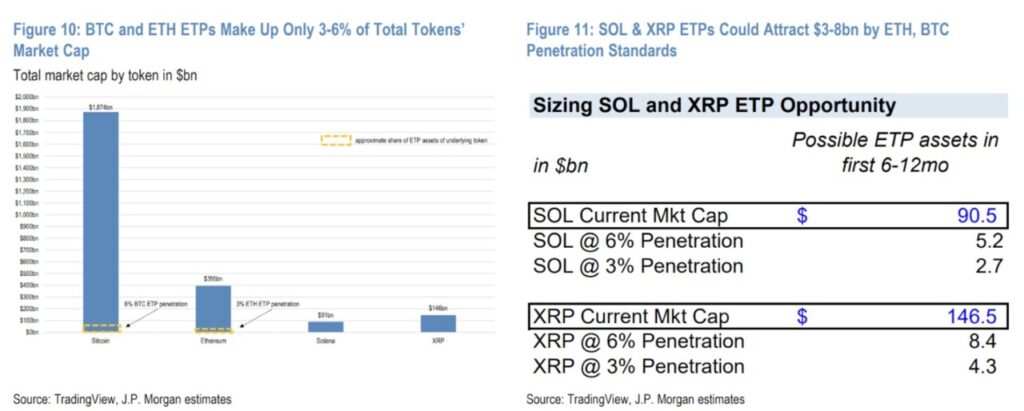

Based on the adoption rate of Bitcoin and Ethereum ETFs, global investment bank JPMorgan predicts that the Solana ETF could potentially attract $3 to $6 billion in new funds. Meanwhile, the XRP ETF (XRP) is expected to attract between $4 to $8 billion in new investor funds.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Solana ETFs may attract $6B in first year as SOL joins ‘big league’. Accessed on October 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.