Bitwise Solana Staking ETF’s Impressive Debut, Yet SOL Price Falls, What Happened?

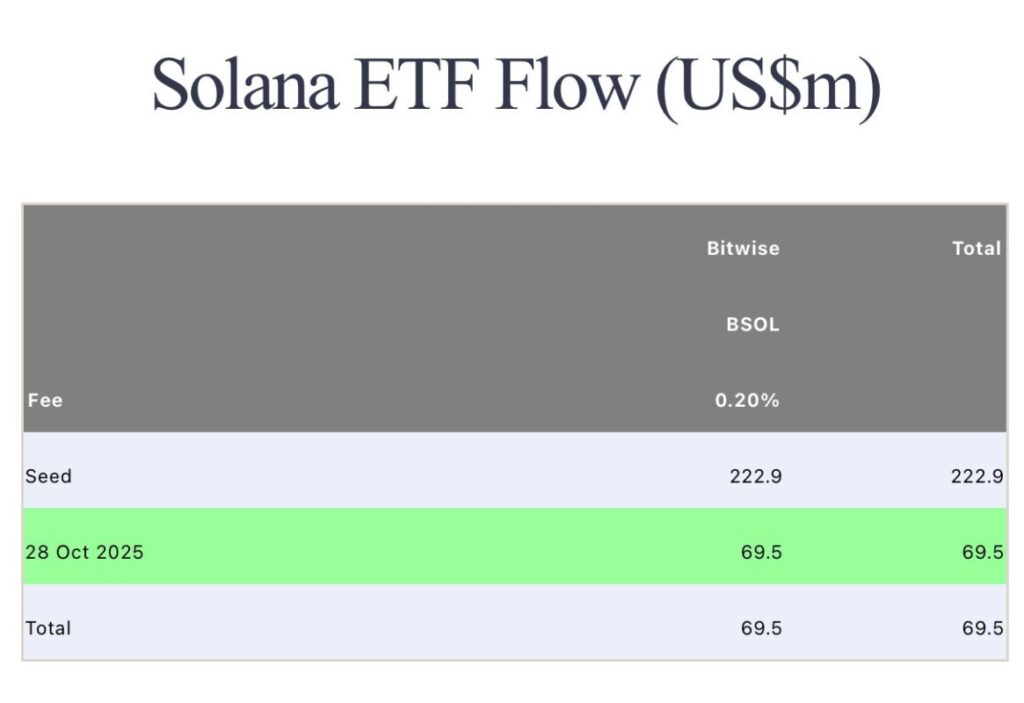

Jakarta, Pintu News – On its market debut, the Bitwise Solana Staking ETF (BSOL) posted impressive numbers with a fund inflow of $69.5 million. Despite this, the price of Solana (SOL) declined, contrary to the high expectations of large investors.

Bitwise Solana Staking ETF Records Phenomenal Debut

The Bitwise Solana Staking ETF (BSOL) officially traded on NYSE Arca with an initial capital of $222.9 million, recording a first-day trading volume of $56 million. Compared to other ETFs such as Canary’s HBAR ETF and Litecoin ETF, which only recorded volumes of $8 million and $1 million, BSOL performed far superior.

Bloomberg’s senior ETF analyst Eric Balchunas commented on the amount of assets gathered as “impressive” and added that true demand is now easier to measure as there is no additional first-day leverage. The ETF not only recorded a large inflow but also showed significant net asset value (NAV) growth.

According to data from SoSoValue, BSOL’s NAV has reached nearly $289 million, which is 0.01% of Solana’s (SOL) market capitalization. This marks BSOL as the first Solana staking ETF approved for trading in the United States, offering exposure to Solana (SOL) with an annualized yield of over 7% through 100% SOL staking.

Also Read: Top 3 Crypto’s that are Trending and Stealing Investors’ Attention by the End of 2025!

SOL Price Declines Despite Whale Accumulation

Despite heavy accumulation by whales in response to the BSOL launch, Solana (SOL) prices have fallen by more than 3% in the last 24 hours. The current price stands at $194, with a 24-hour low and high of $191.39 and $203.83. Trading volume has also seen a significant increase, up 25% in the last 24 hours, indicating high interest from traders.

In the derivatives market, there has been noticeable buying in recent hours. Data from CoinGlass shows that 4-hour Solana (SOL) futures open interest (OI) rose by almost 0.22%. Overall, the total open interest of Solana (SOL) futures increased 3% to $10.22 billion in 24 hours, with a 0.03% drop on CME and a 2.50% surge on Binance.

Outlook and Market Potential for BSOL

With a strong debut, BSOL sets a new standard for cryptocurrency-based financial products. The presence of products like BSOL in the United States market indicates a wider acceptance of cryptocurrencies as a legitimate asset class. It also opens up opportunities for investors looking to diversify their portfolios without having to directly engage in the physical purchase and storage of coins.

The market will continue to observe the interaction between ETF inflows and Solana (SOL) price movements going forward. With a structure that allows staking, BSOL is not only attractive to those seeking exposure to Solana (SOL) but also to those seeking passive returns through staking.

Conclusion

Although BSOL’s debut was marked by impressive numbers, Solana’s (SOL) price drop demonstrates the complexity of the cryptocurrency market which does not always move in line with expectations. However, the presence of products like BSOL in traditional financial markets signals a step forward for the integration of cryptocurrencies in mainstream investment portfolios.

Also Read: Bitcoin (BTC) Breaks $115,000, Fear & Greed Index is Neutral!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitwise Solana Staking ETF (BSOL) Makes Record Debut Inflows, NAV. Accessed on October 30, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.