Bitcoin Stalls at $109,000 on October 31, 2025 — Is the Rally Losing Steam?

Jakarta, Pintu News – Bitcoin (BTC) continued its decline this week, falling below the crucial $110,000 level as investor confidence weakened amid changing market conditions.

The crypto king’s failure to sustain previous recovery attempts reflects weakening bullish momentum and growing uncertainty towards short-term support levels. With selling pressure continuing to mount, Bitcoin’s recovery path is likely to hit a roadblock.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 1.37% in 24 Hours

As of October 31, 2025, Bitcoin is trading at $109,783, or approximately IDR 1,833,759,956 — marking a 1.37% increase over the past 24 hours. During this time, BTC reached a low of IDR 1,780,885,689 and peaked at IDR 1,862,672,353.

At the time of writing, Bitcoin’s market capitalization is around IDR 36,208 trillion, with 24-hour trading volume rising by 16% to IDR 1,254 trillion.

Read also: Here are 3 Altcoins That Could Rally This Halloween 2025, Based on Historical Trends

Bitcoin Holders Are the Problem

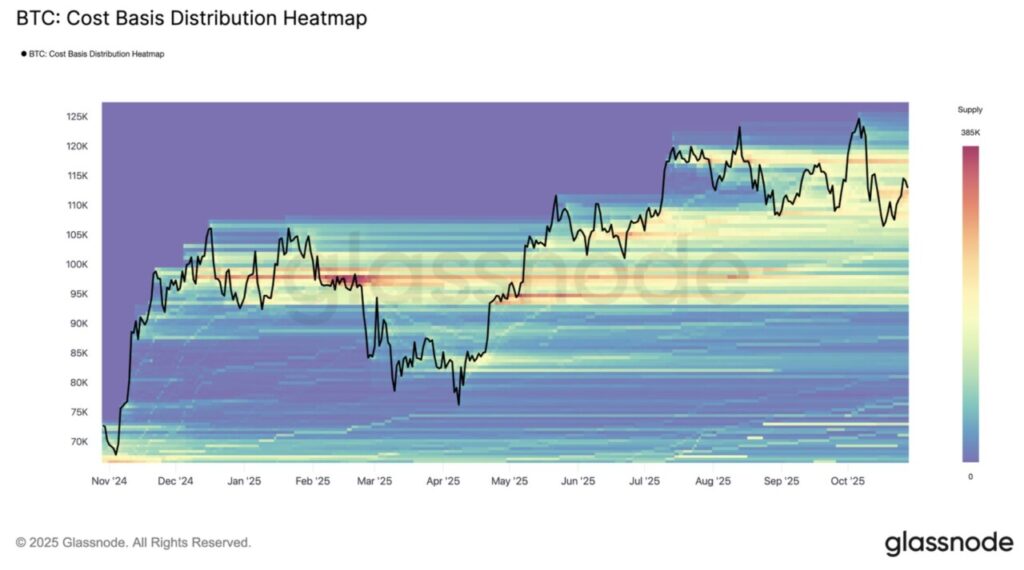

The Cost Basis Distribution Heatmap shows that the Bitcoin price bounced off the centerline around $116,000, before dropping back down to around $113,000. This pattern is similar to the price bounce after reaching an All-Time High that occurred in the 2-3rd quarter of 2024 and the 1st quarter of 2025.

At that time, the brief rally was immediately met by massive selling pressure, limiting further price gains.

Another round of selling by long-term holders (LTH) is now reinforcing the resistance zone. Many investors who bought during the previous high seem to be starting to realize profits, creating additional obstacles to BTC’s upward movement. As a result, any recovery attempt towards $115,000 is always held back by selling pressure from above, signaling that market sentiment is still fragile.

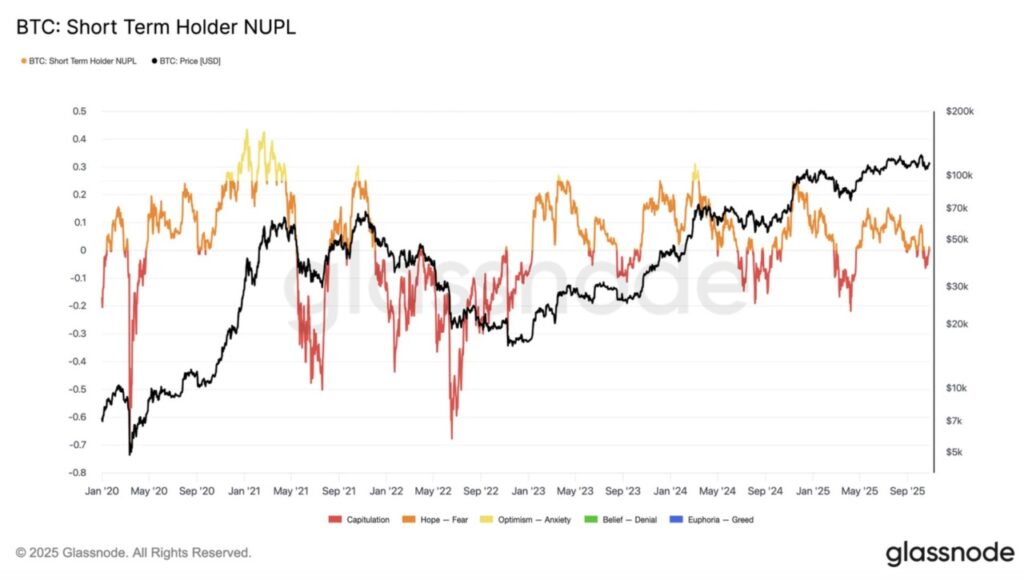

The STH-NUPL (Short-Term Holder Net Unrealized Profit/Loss) indicator shows that the market is in a fragile position. Although it has not yet entered the total capitulation phase, the bullish momentum is starting to fade as investor confidence weakens.

Historically, transitions like this often precede prolonged periods of consolidation, especially when market confidence is weakened. If time continues to be unfavorable to the buyers’ side, BTC could experience a deeper correction.

The lack of sustained accumulation and the lack of fresh capital inflows may encourage further selling pressure, especially when traders opt to secure profits before volatility increases.

Read also: 4 Altcoins Likely to Surge with Strong Catalysts in November 2025

BTC price tries to recover from weakness

As of October 30, 2025, Bitcoin is trading at $108,590, slightly above the crucial support level of $108,000. This drop comes after a second attempt – in less than a month – to break $115,000 failed again.

The continued selling by long-term holders is likely to be the main factor holding back Bitcoin’s growth. For now, BTC’s short-term target is to maintain a position above the $105,000 support.

Maintaining this level could prevent further declines and attract new buyers looking for discounted prices.

To invalidate the bearish scenario, Bitcoin needs to reclaim the $110,000 level as support and break $115,000 convincingly. If that happens, positive momentum could return and push the price towards $117,261, opening up opportunities for optimistic sentiment ahead of November.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Slips Below $110,000 As Conviction Continues To Erode. Accessed on October 31, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.