Ethereum Falls to $3,800 as It Loses Key $4,000 Support Level

Jakarta, Pintu News – The announcement of the FOMC meeting results and interest rate cut by the Fed on October 29 became a “sell-the-news” moment in the crypto market, where investors chose to sell after the anticipated news was officially released.

Ethereum (ETH) price lost an important support level at €4,000,000, dropping 3% in 24 hours on October 30. Analysts see this as a classic bear trap, which could fool market participants.

On the other hand, the inflow of funds into the spot Ethereum ETF is negative again, indicating that institutional investors’ interest is also weakening. Then, how is Ethereum’s current price movement?

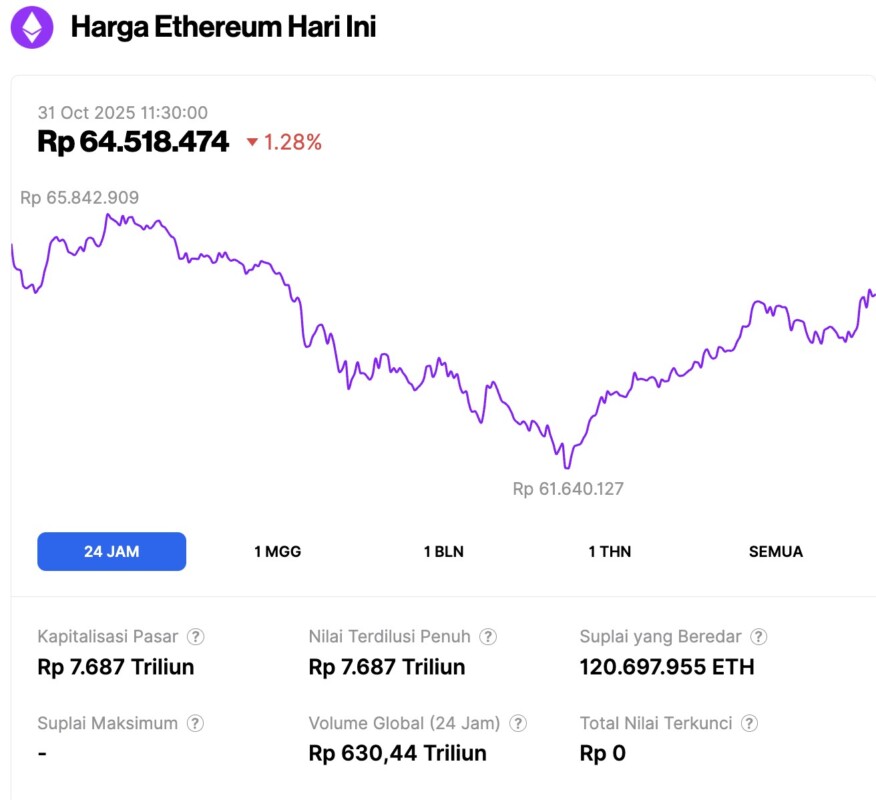

Ethereum Price Drops 1.28% in 24 Hours

On October 31, 2025, Ethereum was trading at approximately $3,862, or around IDR 64,518,474 — marking a 1.28% decline over the past 24 hours. During this time, ETH dipped to a low of IDR 61,640,127 and reached a high of IDR 65,842,909.

As of this writing, Ethereum’s market capitalization is estimated at IDR 7,687 trillion, while its daily trading volume has increased by 5% over the last 24 hours, reaching IDR 630.44 trillion.

Read also: Bitcoin Stalls at $109,000 on October 31, 2025 — Is the Rally Losing Steam?

ETH Price Loses $4,000 Support in Bearish Decline

After repeatedly trying to keep the price above $4,000, the bulls have finally been beaten back by selling pressure. Today, Ethereum (ETH) is down 3%, marking significant weakness for the largest altcoin.

Data from Coinglass (30/10) showed that open interest on ETH futures fell 2.7% to $46 billion, indicating reduced speculative interest.

Crypto analyst Ted Pillows noted that the ETH price fell below the important support level of IDR4 million again, despite some major macroeconomic developments that were previously expected to boost market sentiment.

In the last 24 hours (30/10), a number of important factors emerged, such as the Fed’s 25 basis points (bps) rate cut, the Fed’s termination of its quantitative tightening (QT) policy, the Fed’s balance sheet shrinkage plan starting December 1, and the reopening of US-China trade talks.

According to Pillows, there are two possible scenarios at the moment:

“Either this is a classic bear trap, or the crypto market is really going down deeper.”

Although Ethereum has recently experienced high volatility, another analyst named IncomeSharks asserts that ETH must stay above $4,000 to keep the bullish momentum alive.

However, based on the chart he shared, if ETH fails to maintain that level, the price could potentially fall deeper to near $2,200, which is the lower limit of support.

Read also: Shiba Inu Price Prediction: Will Support $0.0000095 be able to withstand a Deeper Correction?

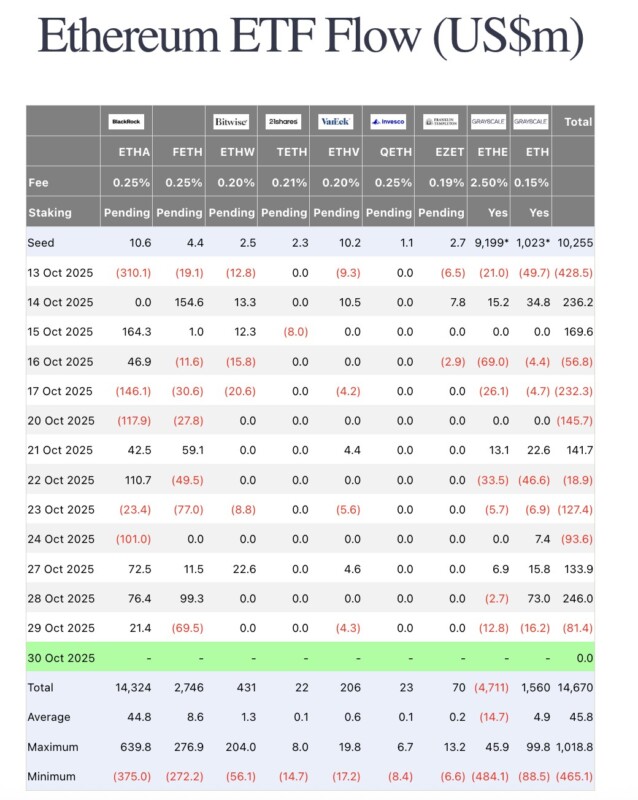

Fund Flows to Ethereum ETF Turn Negative

The spot Ethereum ETF in the United States experienced a reversal, with flows turning negative after the first two days of strong inflows.

On October 29, total fund flows were negative by $84 million. Fidelity’s ETF (FETH) was the biggest contributor to outflows with $69.5 million, followed by Grayscale’s ETH with $16.2 million.

In contrast, BlackRock’s ETHA recorded positive inflows of $21.4 million, according to data from Farside Investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. ETH Price in a “Classic Bear Trap” Under $4,000 Says Expert, While Ethereum ETF Flows Turn Negative. Accessed on October 31, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.