Dogecoin Sinks to $0.18 — Is a Recovery on the Horizon?

Jakarta, Pintu News – The price movement of Dogecoin (DOGE) remains cautious as the market consolidates after a sharp drop from a high of $0.27. The asset has continued to move around the $0.19 zone over the past few sessions, suggesting mild bearish pressure.

This period of consolidation reflects uncertainty among traders after the recent volatility. However, the underlying data shows increased speculative participation, indicating that Dogecoin’s next move could be bigger than it currently appears.

So, how is the Dogecoin price moving today?

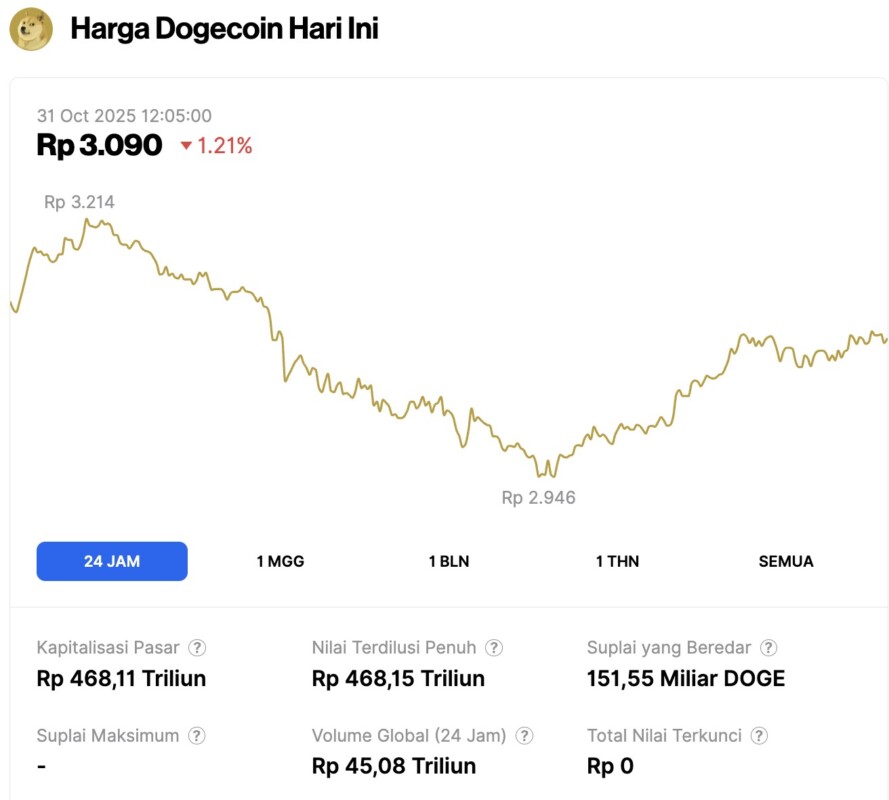

Dogecoin Price Drops 1.21% in 24 Hours

On October 31, 2025, Dogecoin saw a slight decline of 1.21% over a 24-hour period, with the price settling at $0.1855 — approximately IDR 3,090. Throughout the day, DOGE traded within a range of IDR 3,214 to IDR 2,946.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 468.11 trillion, with a 24-hour trading volume of roughly IDR 45.08 trillion.

Read also: Ethereum Price Drops to $3,800 Today: ETH Loses $4,000 Support!

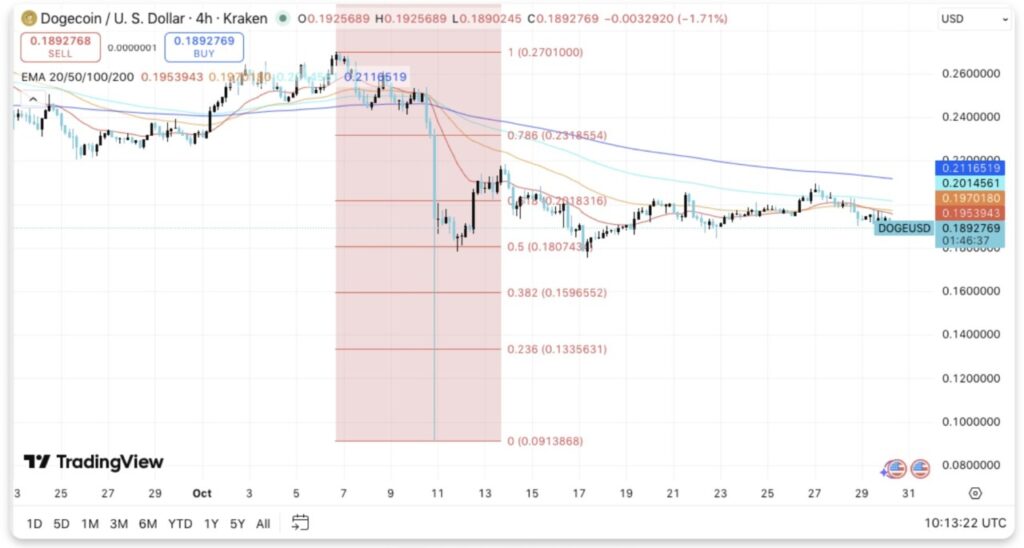

Consolidation within the Range of Key Fibonacci Levels

Dogecoin’s chart shows a broad Fibonacci retracement pattern from $0.27 to $0.091. The 0.5 retracement level around $0.1807 has so far remained as a support area, where buyers continue to hold their positions.

In the event of a decisive move below this point, it could trigger a drop towards $0.159 and potentially further down to $0.133 – which represent Fibonacci levels of 0.382 and 0.236 respectively.

On the upside, Dogecoin faces immediate resistance near the 20-day EMA at $0.195, while the 200-day EMA around $0.211 becomes the key barrier. Also, the 0.618 Fibonacci level at $0.218 remains a critical point that could mark a trend reversal.

In the event of a breakout above $0.23, bullish momentum could return and pave the way for a retest of the swing high level at $0.27.

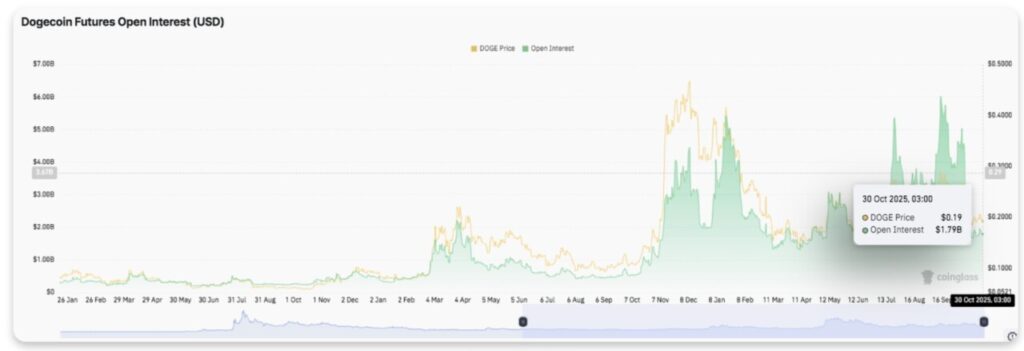

Increase in Open Interest Shows Market Speculation

Aside from the chart structure, derivatives market activity also showed increased participation. Open interest jumped to $1.79 billion, up from under $1 billion in early September.

This spike signals that traders are starting to take positions aggressively, most likely anticipating a specific directional breakout. The combination of rising prices and increased open interest indicates high leverage in the market.

However, such conditions often precede short-term volatility. If the funding rate remains positive, a continuation of the uptrend becomes more likely. Conversely, a drop in open interest could signal profit-taking and cause a temporary pullback.

Therefore, traders are advised to watch out for sudden changes in derivatives activity as a potential signal of market direction.

Sustained Outflows Signal Profit Taking

Dogecoin spot market data shows persistent outflows, totaling $6.76 million as of October 30, 2025. This trend indicates that investors are engaging in profit-taking, suggesting limited accumulation.

Read also: Bitcoin Price Stuck at $109,000 Today: Is this the End of its Rise?

Moreover, consistent outflows also reduce liquidity support and are often a sign that the price recovery will be weaker.

Consequently, for bullish sentiment to return, sustained inflows need to replace the current selling pattern. Until that happens, Dogecoin is expected to remain in a consolidation phase, with short-term movements influenced by derivatives market dynamics and the strength of the support zone at $0.18.

Dogecoin Price Technical Outlook

Dogecoin’s price structure remains evident as the asset is in a consolidation phase around the $0.19 level, having previously experienced strong rejection from the swing high at $0.27. The Fibonacci levels between $0.133 to $0.23 are still important zones that traders are watching.

Resistance level (above):

- $0.195 (20-day EMA) and $0.211 (200-day EMA) were the initial obstacles.

- $0.218 (Fibonacci 0.618) and $0.23 (Fibonacci 0.786) are key breakout zones.

If Dogecoin is able to break these levels convincingly, a move towards $0.27 could potentially occur, which would mean a full recovery from the previous correction.

Support level (bottom):

- The main support remains at $0.1807 (Fibonacci 0.5),

- This is followed by $0.159 (Fibonacci 0.382) and $0.133 (Fibonacci 0.236).

If the price falls below $0.18, there is a possibility of a deeper retracement with a potential retest to the $0.16 to $0.13 zone.

Overall, the technical structure suggests that DOGE is under pressure between medium-term support at $0.18 and resistance at $0.21 – forming a symmetrical consolidation pattern that often precedes major price movements in a particular direction.

Will Dogecoin Recover?

The direction of Dogecoin’s next move largely depends on buyers’ ability to hold support at $0.18 amid ongoing outflows. Strength in the derivatives market, with open interest having breached $1.79 billion, suggests increased speculative interest.

However, continued selling pressure in the spot market still limits the upside momentum. If inflows increase along with a stable funding rate, DOGE could potentially rally to retest the $0.21 level and even reclaim $0.23.

Conversely, failure to hold above $0.18 could trigger a further drop towards $0.16 – and slow down the overall price recovery process.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Dogecoin Price Prediction: DOGE Consolidates as Open Interest Climbs. Accessed on October 31, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.