These 3 Altcoins Are Becoming Rare — With Exchange Supply at Record Lows, Is a Price Surge Coming?

Jakarta, Pintu News – As reported by BeInCrypto, several altcoins seem to have survived the market scare over the past month. Despite the price decline, investors are not in a hurry to sell their assets on exchanges. Instead, they are accumulating more aggressively.

This accumulation has caused the supply of altcoins on exchanges to reach its lowest level in years. Scarcity like this is an important factor that can drive prices up. Which altcoins are showing this pattern?

1. Ethereum (ETH)

It’s no surprise that Ethereum (ETH) remains one of the most in-demand altcoins, both by institutional and retail investors.

Read also: 4 Standout Altcoins with Strong Momentum in November 2025

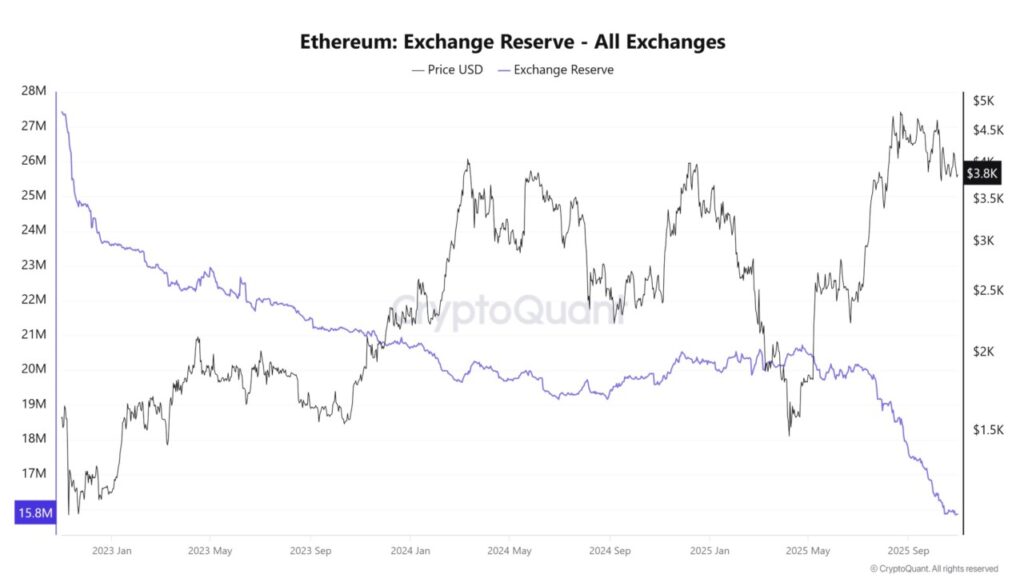

However, what may surprise many is the level of ETH scarcity on exchanges today. Data from CryptoQuant shows that the supply of Ethereum on exchanges fell to 15.8 million in October – the lowest level in three years.

In addition, ETH available for purchase on the open market is getting scarcer as more and more tokens are staked. According to data from Dune, the total amount of ETH staked has steadily increased over the past five years and now stands at nearly 36 million ETH, or about 29% of the total supply.

Although bearish market sentiment in October pushed ETH prices below $4,000, the growing scarcity suggests that the potential for price recovery is still wide open.

2. Chainlink (LINK)

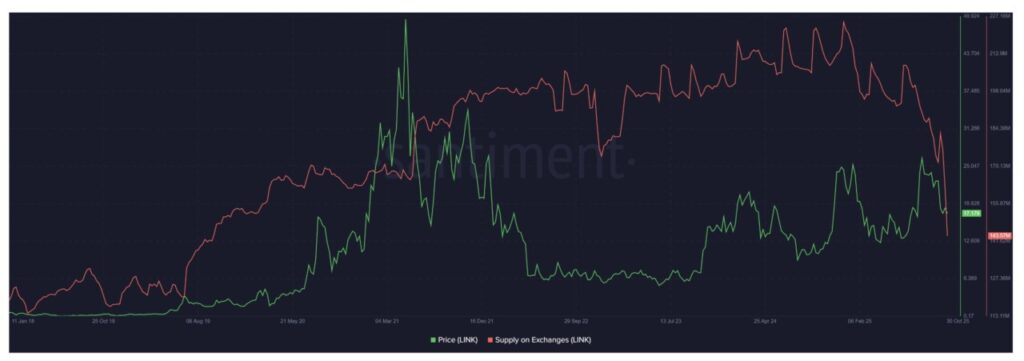

Chainlink (LINK) also surprised many. The supply of LINK on exchanges fell to 143.5 million – the lowest level since October 2019.

Since the beginning of the year, LINK balances on exchanges have declined from over 220 million to around 143.5 million. This means that about 80 million LINKs, or about 11% of the total circulating supply, have been withdrawn from exchanges in just 2025.

Based on BeInCrypto’s report, LINK is currently entering one of the biggest accumulation phases by whales in recent years.

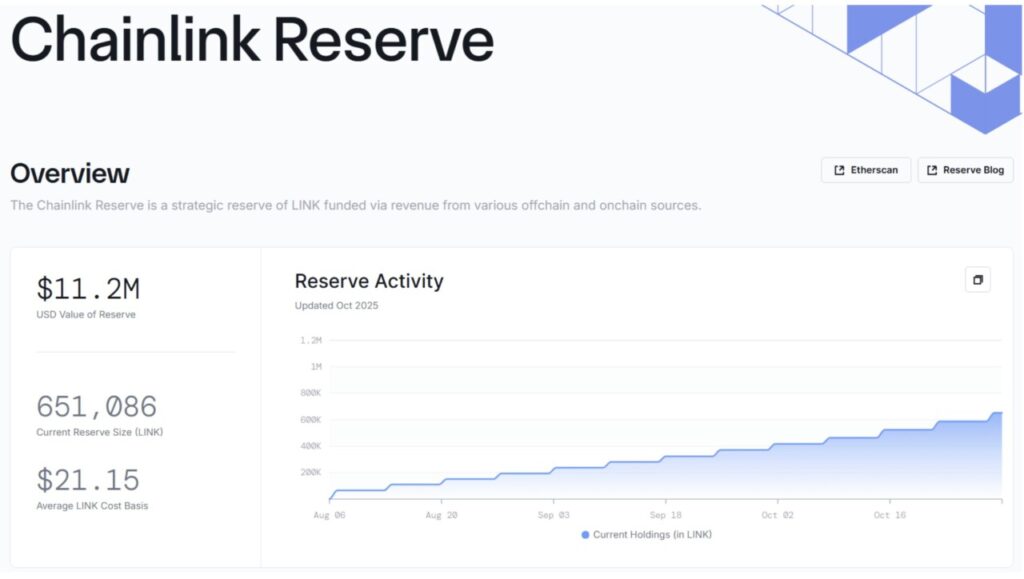

The latest update from Chainlink Reserve shows that more than $11 million in LINK has been accumulated since the program was launched in August.

Although the number of LINKS in the Chainlink Reserve is still relatively small compared to the total supply, it reflects the project’s commitment to its long-term strategy.

This behavior further reinforced the sentiment of scarcity among LINK holders. Community discussions about LINK have also remained positive, despite a 25% price drop in October.

Read also: 3 Meme Coins that Performed Well and Stole the Attention in Early November 2025

3. Pepe (PEPE)

Pepe (PEPE), an Ethereum-based meme coin, remains one of the highest liquidity meme tokens on the market.

Over the past month, investor interest began to shift from meme coins to privacy coins and perpetual DEX tokens. However, PEPE managed to maintain its own appeal.

Data from Santiment shows that the supply of PEPE on exchanges has dropped to its lowest level since 2023, with 86.39 trillion PEPE stored on exchanges – about 20% of the total supply in circulation.

This long-term decline in the exchange balance reflects the strong loyalty of PEPE holders to the token.

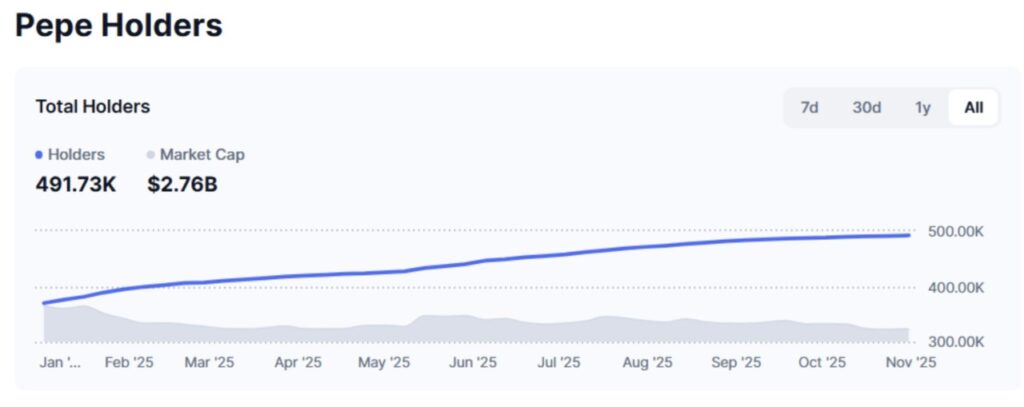

According to data from CoinMarketCap, the number of PEPE holders increased sharply throughout 2025, from 369,000 to over 491,000 people.

The decrease in supply on exchanges and the increase in the number of holders occurred despite the PEPE price dropping back to its early year levels in October. This suggests that most holders have yet to make a profit, but are choosing to hold on to their tokens.

“If you think PEPE is a bad investment, think again. You can’t shake diamond hands. I’m one of them. This price level is too good to miss,” said investor Defizard.

These altcoins show that even in the midst of a pessimistic market, investors remain loyal to tokens that they believe can preserve the value of their portfolios.

Whether big altcoins or meme tokens, they all share similar characteristics – being able to survive various market cycles, being backed by a loyal community, and having strong liquidity.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Reach Record Scarcity as Exchange Supply Falls to Multi-Year Lows. Accessed on November 7, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.