Dogecoin Slips 4% Today: Could It Slide Toward $0.07?

Jakarta, Pintu News – The price of Dogecoin (DOGE) has dropped more than 4% in the last 24 hours up to the time of this article, as bearish sentiment grows.

Since reaching the $0.30 level, the memecoin has been on a downward trend, while more than 75 other altcoins have performed better than Bitcoin (BTC). Currently, its outlook suggests a possible further decline towards the $0.07 zone.

Dogecoin Price Drops 4.45% in 24 Hours

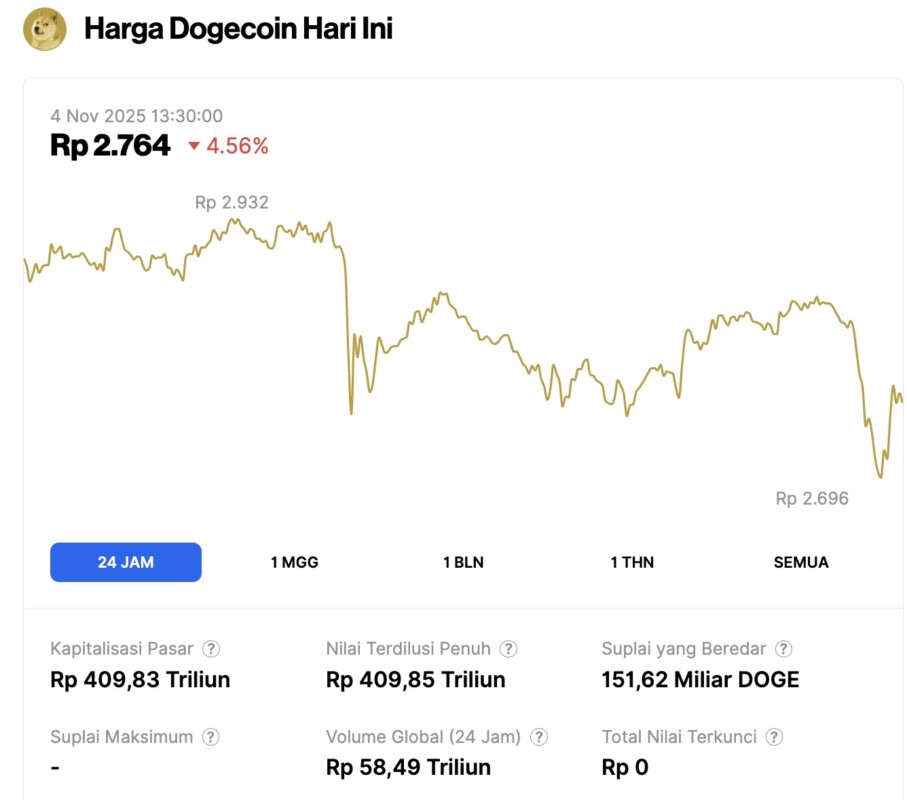

On November 4, 2025, Dogecoin experienced a 4.56% correction over a 24-hour period, with its price falling to $0.1655 — or approximately IDR 2,764. Throughout the day, DOGE traded within a range of IDR 2,932 to IDR 2,696.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 409.83 trillion, with a 24-hour trading volume of roughly IDR 58.49 trillion.

Read also: Dogecoin Predicted to Explode in November, Murad’s Meme Coin Portfolio Slashed by 59%

Possibility of DOGE Dropping to $0.07

Based on Dogecoin’s UTXO Realized Price Distribution data, the most crucial level for this memecoin is at $0.18. This level is the deciding point – if the price is unable to stay above it, then the potential for a drop to the $0.07 zone is even greater.

The $0.07 zone itself is the last price level where DOGE tokens were previously moved a lot.

Around 28.28 billion DOGE – or about 18% of the total supply – was accumulated in this area. This means that this zone is the next important buying area for investors.

The break below $0.18 has pushed DOGE into a downtrend. However, there is still a less significant zone before reaching $0.07 that could trigger a price bounce. Further price analysis shows the next important areas to watch.

Dogecoin Faces Resistance

On the charts, Dogecoin is seen to be under increasing selling pressure, with the price breaking below the Ichimoku Cloud on the 4-hour chart. The momentum of the candles formed indicates that sell-side liquidity is dominating the market.

Based on the price target analysis on the chart, the $0.1688 level is expected to be the next target in the short term.

For DOGE to return to a bullish trend, the price needs to break the Ichimoku Cloud resistance. Otherwise, the pressure from the bearish side will most likely continue to push the price down towards levels around $0.15 – the price at which Dogecoin once started its rise before almost reaching $0.50.

Read also: Will Ripple (XRP) Continue to Lose Money? This is the Critical Level to Reach!

However, the current technical structure does not favor a downside scenario to $0.07, as there are still strong support levels.

In addition, data from CryptoQuant shows that derivatives traders are starting to open long positions for this memecoin, supporting the view that a drop to $0.07 is considered too far away and unrealistic in the near future.

Bear Sentiment Still Dominates!

The bearish sentiment towards Dogecoin has not abated, as spot traders continue to sell their tokens. CVD’s Spot Taker indicator shows that since late September, trading volume has been dominated by sellers.

Meanwhile, the sentiment indicator shows that both retail traders(crowd) and Smart Money are still in a bearish position. The readings stand at -0.31 and -0.24 respectively, indicating that the more experienced market participants see a DOGE downside scenario as more likely.

Overall, Dogecoin’s price decline could continue – although a drop to $0.07 is considered unlikely, unless the bear market lasts longer.

However, if there is a shift in sentiment in the overall crypto market, DOGE could potentially break the Ichimoku Cloud resistance again and restore the strength of its bullish trend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Can Dogecoin hit $0.07 despite rising bearish sentiment? Accessed on November 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.