3 Altcoins at Risk of a Major Liquidation Wave in Early November 2025

Jakarta, Pintu News – The crypto market started the first week of November with a sharp decline, which caused short-term sentiment among derivatives traders to turn negative.

Currently, most of the capital and leverage is directed towards short positions, so the risk of massive liquidation on the short side is expected to increase in the next few weeks. In such unbalanced market conditions, certain altcoins have the potential to trigger huge losses for short traders.

So, which altcoins are in the riskiest position?

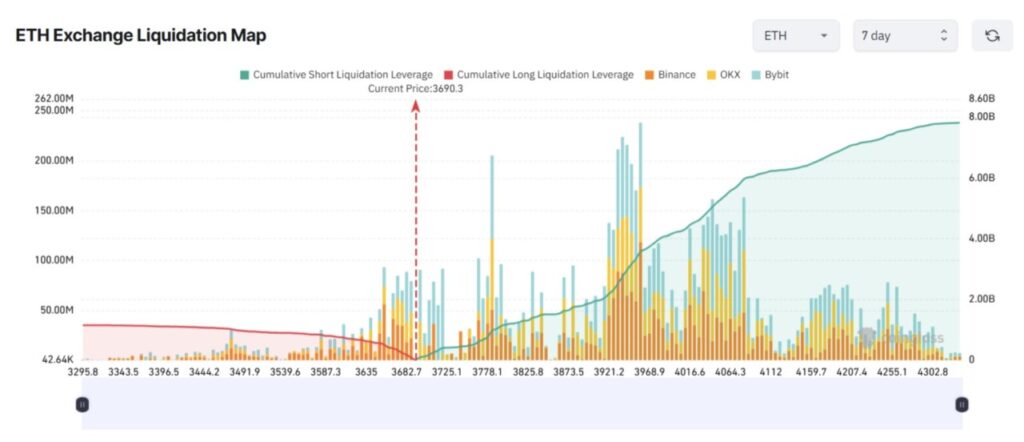

Ethereum (ETH)

The last seven-day liquidation map for Ethereum (ETH) shows a clear imbalance between the potential liquidation of long and short positions – with shorts dominating significantly.

Read also: Crypto Whales on the Move: Which Coin to Go For While the Market Crashes?

If ETH prices rise back to $4,000 this week, more than $4.2 billion worth of short positions could be liquidated. In fact, if the recovery continues to $4,300, the total liquidation of short positions could approach $8 billion.

Recent analysis from the BeInCrypto website shows a bullish divergence, indicating potential recovery momentum for ETH in the near future.

The analysts also highlighted that despite short-term volatility, the Ethereum network continues to set new records. This data reinforces solid fundamentals, encouraging investors to accumulate ETH when the price drops deeply.

For example:

- Ethereum app revenue hit an all-time high.

- The supply of stablecoins on the network continues to increase.

Under these conditions, short traders who do not apply good risk management could be exposed to a massive wave of liquidation if the price of ETH jumps sharply suddenly.

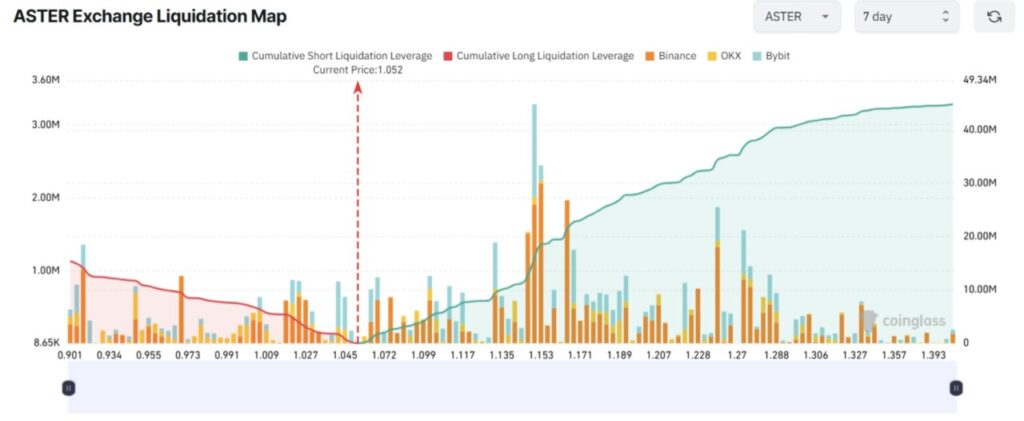

Aster (ASTER)

At the beginning of the first week of November, the liquidation map of Aster (ASTER) also shows a large imbalance, where the risk of liquidation of shorts is much higher than that of longs. If ASTER’s price rises to $1.4, around $44 million of short positions could be wiped out. Conversely, if the price drops to $0.9, the potential liquidation of long positions could reach $15 million.

What are the triggers that could lead to short liquidation on ASTER? The biggest risk is likely to come from social media influence, especially after recent posts from Changpeng Zhao (CZ), the founder of Binance, on the X platform.

After CZ revealed that he bought $2 million worth of ASTER tokens for long-term investment, ASTER’s price jumped 30%. This action triggered a number of other key opinion leaders (KOLs) to also announce their ownership of ASTER.

Although ASTER prices have corrected after the spike, uncertainty remains high. If CZ shares another ASTER-related update, it’s not impossible for another short-term price spike to occur – potentially triggering a wave of liquidation for traders who took short positions.

Therefore, short traders should be extra vigilant in situations with high volatility like this.

Read also: Altcoin Season 3.0 Has Arrived? Altcoin Market (TOTAL3) Breaks 4-Year Resistance at $1.13 Trillion

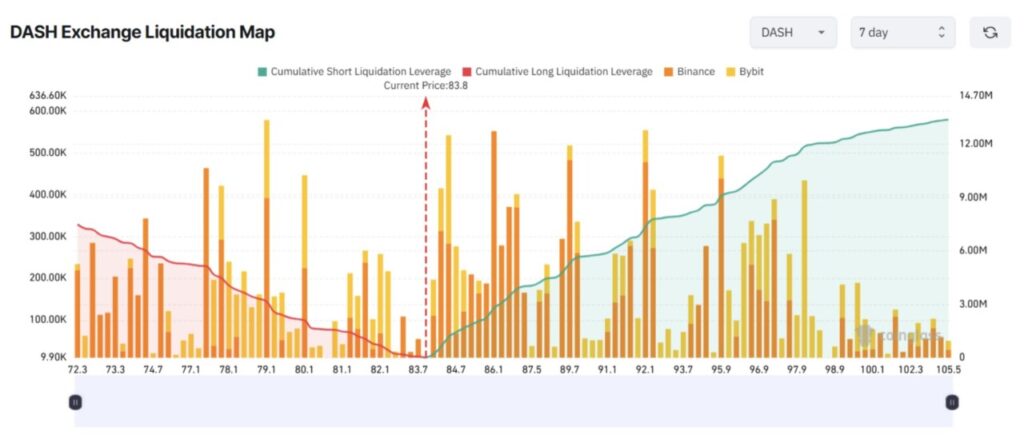

Dash (DASH)

The narrative around privacy coins continued in November, and this time it was Dash’s (DASH) turn in the spotlight. The coin managed to surpass Zcash (ZEC) and print its highest price in three years.

However, despite the price surge, derivatives traders have been aggressively opening short positions, indicating a bearish market trend. If the price of DASH rises to $105, more than $13 million worth of short positions could potentially be liquidated.

On the X platform (formerly Twitter), some analysts are projecting even higher price targets, indicating considerable community optimism.

In a FOMO (fear of missing out) driven rally like this, it is difficult to predict when the momentum will stop. As long as the discussion in the community remains dominated by bullish sentiment, going short on DASH could be a very high-risk strategy due to the huge potential for liquidation.

Altcoins like ETH, ASTER, and DASH that are being talked about by the community are bringing up old themes that have been recurring since the previous months – such as the Ethereum ecosystem, DEX, and privacy. This indicates that the market is running out of new catalysts.

Therefore, while the prices of these altcoins may still rise, such rallies are unlikely to last long. With volatility levels continuing to rise, both long and short traders face a high risk of large losses.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Major Liquidations in the First Week of November. Accessed on November 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.