Crypto Whales Buy Solana Amid Medium-Term Bearish Sentiment, What’s Happening?

Jakarta, Pintu News – Solana (SOL) whales have recorded massive accumulation over the past week, even though the general market sentiment is still bearish in the medium term. So, why are investors buying Solana amid bearish sentiment?

Solana’s Investment Inflow Reaches $3.2 Billion

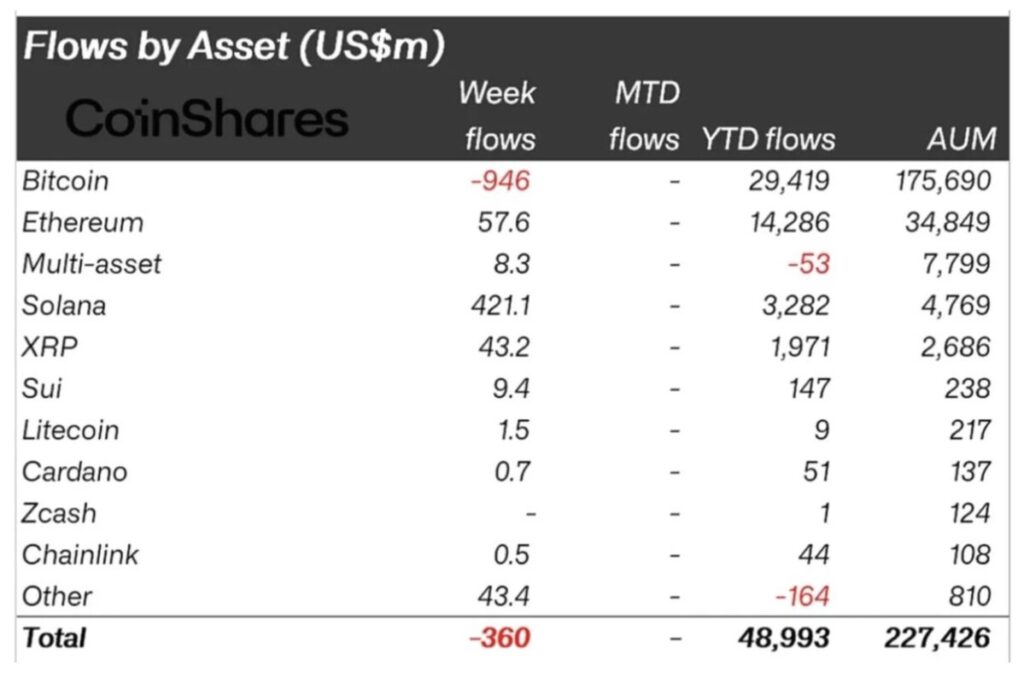

Based on the weekly report from CoinShares, Solana leads the way compared to other crypto asset investment products with net cash inflows of approximately $421 million.

As such, the total cash inflows for Solana’s investment products so far this year amounted to around $3.2 billion, with the total value of assets under management reaching around $4.76 billion. Interestingly, Solana was able to outperform Ethereum (ETH) and XRP which only recorded net cash inflows of $57.6 million and $43.2 million respectively.

Read also: Whale Throws $26 Million at Long Solana as Market Crashes – SOL Ready to Rise?

It’s also worth noting that Bitcoin investment products actually experienced a net cash outflow of around $946 million last week, which helped suppress bullish sentiment towards the asset.

Spot SOL ETF Hype Boosts Market Demand Ahead of Altseason 2025

Demand for Solana is naturally driven by market enthusiasm for spot SOL ETFs in the United States. The recent launch of the Bitwise Solana Staking ETF raises the possibility of a similar product amid the ongoing partial US government shutdown.

Capital rotation from Bitcoin to Solana is expected to happen more easily through the ETF market, especially ahead of the much-anticipated 2025 altseason. In addition, the altseason is predicted to be triggered by the start of the Federal Reserve’s Quantitative Easing policy in December.

Ecosystem Growth and Resilience of Solana Tissue

The Solana ecosystem is growing as the adoption of digital assets by the general public increases. Based on market data analysis from DeFiLlama, the total locked value (TVL) on the Solana network has crossed the $10 billion mark, while the market capitalization of stablecoins in the ecosystem is around $14.5 billion.

Read also: XRP Price Prediction: ETF launch could push XRP to $3?

This rapid growth has been driven by Solana’s proven network resilience. In the last 12 months, Solana’s network has not experienced any serviceoutages, despite the surge in usage from the mainstream market.

Next SOL Price Estimate

From a technical analysis standpoint, the SOL/USD pair is currently near the top of a long-term (multi-year) ascending triangle pattern.

If the price manages to close above the previous record high consistently, then it is likely that the SOL price will continue to rise in the coming months.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Solana Whales Aggressively Accumulate Amid Midterm Bearish Sentiment. Accessed on November 5, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.