Altcoin Collapse, BTCD Hits 60%! Is This the End of the Altcoin Era?

Jakarta, Pintu News – After experiencing a weak period for more than two months, Bitcoin (BTC) has regained its dominance in the crypto market. The Bitcoin Dominance Index has now surpassed the 60% mark, a level that has not been seen since mid-2021.

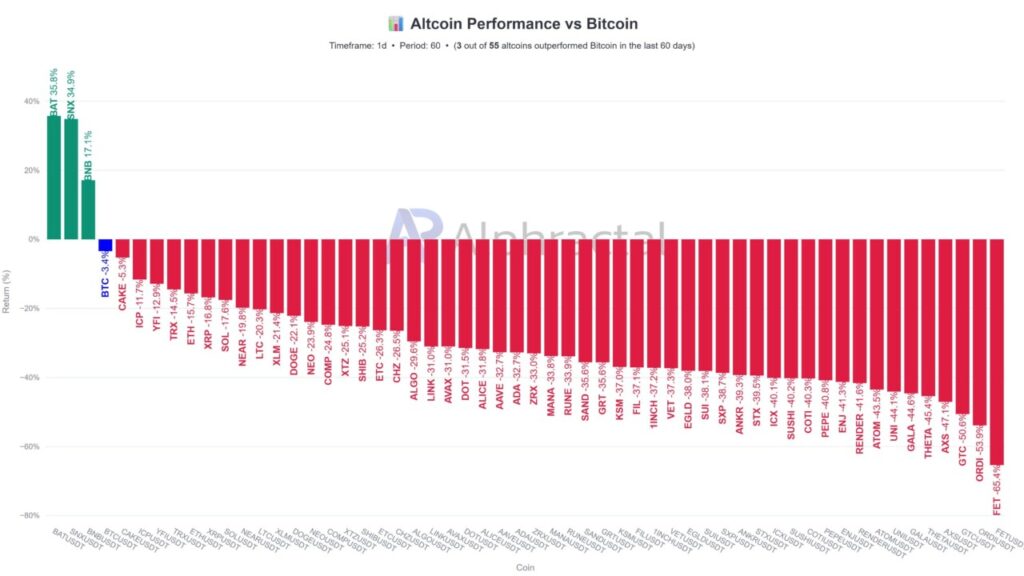

On the other hand, most altcoins experienced sharp declines, with less than 5% of the top 55 tokens able to outperform Bitcoin (BTC). This signals that the current market sentiment tends to be risk-averse, with continuous institutional capital flowing into Bitcoin (BTC).

Bitcoin Consolidates Strength

Data from Alphractal shows that only three of the 55 major altcoins have managed to outperform Bitcoin (BTC) in the last 60 days. Meanwhile, the rest of the altcoins lost between 20% to 80% of their value.

The Altcoin Seasonality Index, which is currently in the range of 25-29, indicates that the market is in Bitcoin Season. With the Bitcoin Dominance Index (BTC.D) reaching 60.74%, it signals that capital is starting to move from riskier assets to Bitcoin (BTC).

Read also: Pi Network (PI) Creates Bullish ‘Cup and Handle’ Pattern, Preparing for 47% Surge?

Altcoins Lose Momentum

Selling pressure in the altcoin market is increasing after some analysts noted that the structure formed after the October crash is starting to collapse. If this selling momentum continues, altcoins could enter a deeper downward phase.

However, some traders are still optimistic about the broader market structure in the next three to six months. Bitcoin (BTC) continues to hold above its 50-week EMA, with increased liquidity and expectations of a rate cut by the Fed in December.

Also read: Bitcoin (BTC) price crashes 5.47%, will it continue to fall below $100,000?

Selective Recovery on the Horizon

Although the short-term outlook for altcoins’ performance against Bitcoin (BTC) appears bleak, some analysts highlight the possibility of a technical bounce soon. The “Others vs BTC” chart just closed its monthly candlestick with a long wick down, a pattern that historically precedes short-term rebounds.

If Bitcoin (BTC) experiences a pause or drawdown, it could provide an opportunity for altcoins to selectively recover, allowing speculative capital to flow back into small-cap tokens.

Conclusion

While a short-term recovery is possible, only certain market segments are likely to benefit, especially projects with strong fundamentals and real applications such as RWA, DeFi, or AI-related tokens.

The market is becoming increasingly selective, leaving little room for narrative-driven altcoins with weak fundamentals. Therefore, the end of 2025 may not bring a broad “altseason”, but rather a selective mini-altseason defined by quality rather than hype.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoin Massacre: Bitcoin Crushes the Market. Accessed on November 5, 2025

- Featured image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.