Gold Weekly Prediction: Fed Policy Impact and US-China Trade Truce

Jakarta, Pintu News – Gold prices are expected to move volatile this week as the market assesses the direction of the Federal Reserve’s (Fed) latest policy and the development of a trade truce between the United States and China. According to BeInCrypto analysis, these two factors have the potential to influence global risk sentiment and the direction of gold price movements as the main hedge asset!

Gold continues to weaken amid trade optimism

Gold (XAU/USD) experienced strong selling pressure and reached its lowest level since early October, below $4,000, due to cautious comments from Federal Reserve (Fed) Chairman Jerome Powell on monetary policy and easing trade tensions between the United States (US) and China.

Both of these factors have reduced gold’s appeal as a safe haven asset. Earlier in the week, gold lost more than 3% in value, triggered by growing hopes over a trade deal between the US and China.

Read also: Markets are Bleeding, Why is Crypto Down Today (5/11/25)?

Market Reaction to Fed Policy and US Economic Data

The Fed decided to cut interest rates by 25 basis points to a range of 3.75%-4% at its October policy meeting, in line with market expectations.

However, Fed Chairman Jerome Powell’s comments stating that a further rate cut in December is “far from certain” has strengthened the US Dollar (USD) and pushed the 10-year US government bond yield above 4%.

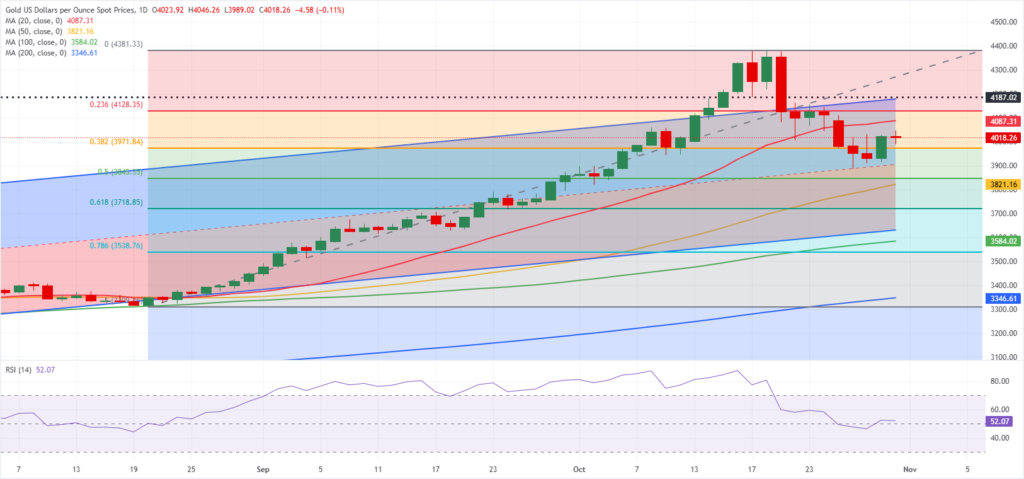

This puts additional pressure on XAU/USD which continues to move below the 20-day simple moving average.

Also read: Will Ripple (XRP) ETF be the savior of the ailing crypto market?

Technical Forecast and Key Levels for Gold

On the technical front, the Relative Strength Index (RSI) on the daily chart is near the 50 mark, indicating that momentum is still neutral. Gold is below its 20-day simple moving average and is still within the upper half of the upward regression channel that started since the beginning of the year. If gold manages to rise above $4,090 and stabilize, then $4,130 could be the next resistance level before reaching $4,200.

Conclusion

With various dynamics affecting the gold market, investors need to pay attention to both upcoming US economic data and comments from Fed officials. These two factors will largely determine the direction of gold prices in the short term. Further stability in US-China trade relations could also play an important role in market sentiment towards gold.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Gold Weekly Forecast: Correction Deepens. Accessed on November 5, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.