Ethereum Climbs to $3,400 as Bearish Momentum Starts to Fade

Jakarta, Pintu News – On November 5, Ethereum (ETH) almost broke the $3,000 mark, briefly dropping to $3,053 before rising again. This drop shook the market, triggering liquidation and panic selling. However, after several weeks of steady decline, the first signs of recovery have finally begun to appear.

Despite falling 27% in the past month, both technical and on-chain data now suggest that Ethereum may have hit a temporary bottom. So, how will Ethereum price move today?

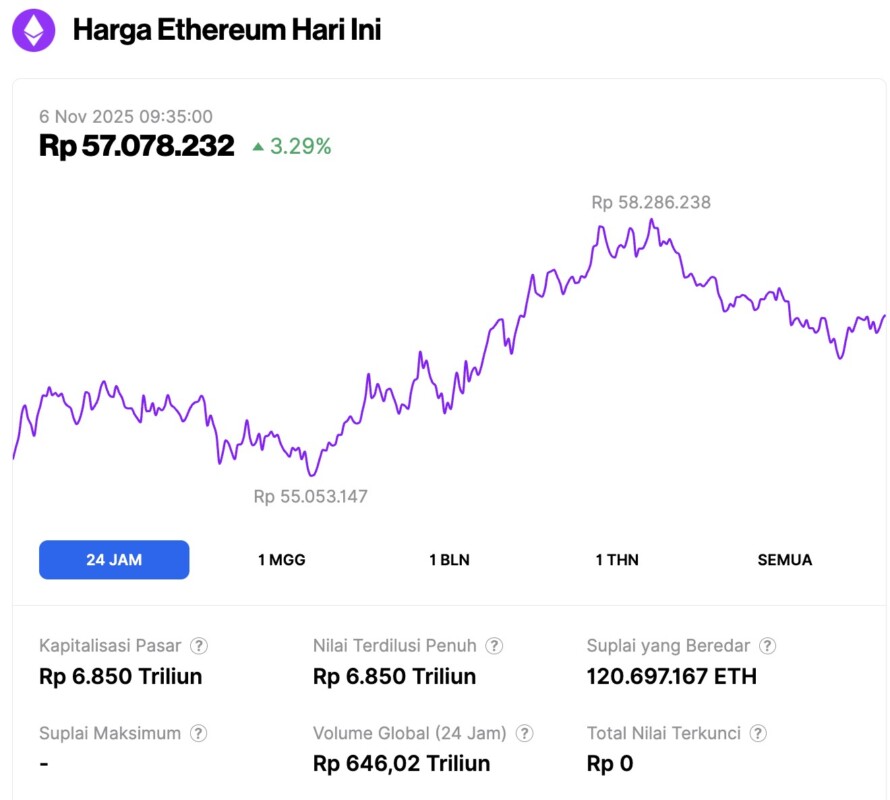

Ethereum Price Up 3.29% in 24 Hours

On November 6, 2025, Ethereum was trading at approximately $3,407, or around IDR 57,078,232 — marking a 3.29% increase over the past 24 hours. During that time, ETH reached a low of IDR 55,053,147 and a high of IDR 58,286,238.

As of writing, Ethereum’s market capitalization stands at roughly IDR 6,850 trillion, while its daily trading volume has dropped by 51% over the past 24 hours to IDR 646.02 trillion.

Read also: Bitcoin Price Recovers to $102,000 Today: Important BTC Indicators Show “Opportunity Zones”

Early Rebound Preparation Seen in the Chart

Ethereum’s price movements in recent weeks suggest that the bearish momentum is starting to slow down.

On the 12-hour chart (5/11/25), Ethereum’s Relative Strength Index (RSI), which measures price momentum to indicate whether an asset is overbought or oversold, started forming higher lows, although the price experienced lower lows between September 25 and November 4.

This pattern is known as a bullish divergence, which usually signals that the selling pressure is starting to fade and a trend reversal or rebound is likely.

Since hitting a low of $3,053, Ethereum’s price has risen 9% as of this writing. This could be a sign of the start of a rebound, although it’s still too early to tell.

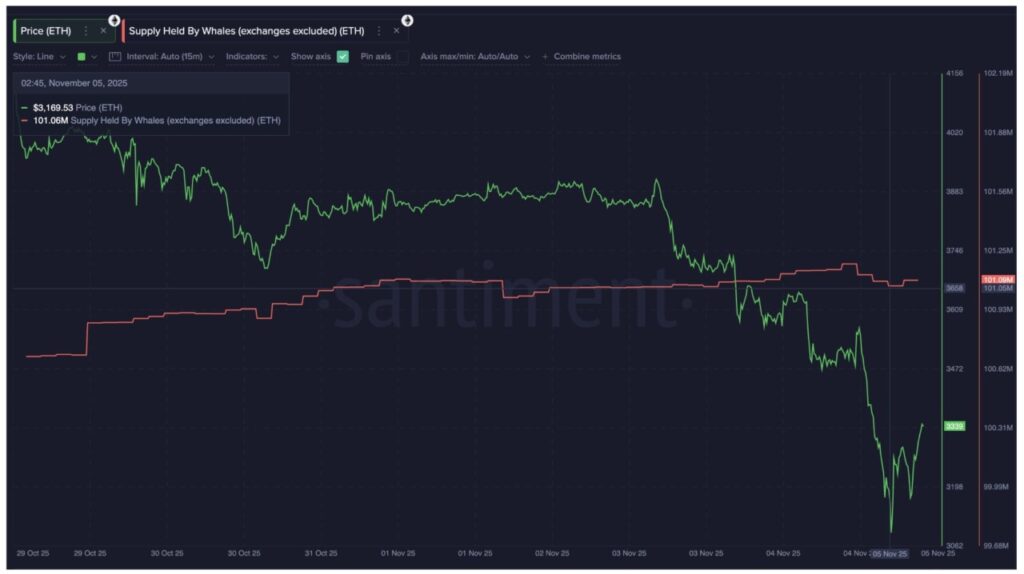

In support of this pattern, large wallet holders have begun to quietly return. Ethereum whales have increased their combined holdings from 101.05 million to 101.09 million ETH in just a few hours, adding about 0.04 million ETH, or $134 million worth at current prices.

While this is not an aggressive accumulation, it shows a recovery in confidence after the sharp sell-off.

Meanwhile, the Net Unrealized Profit/Loss (NUPL) ratio, which measures how much profit or loss investors are still holding onto, has dropped to 0.27, the lowest level since July 7. When NUPL falls this low, it often means that most weak investors have exited at a loss, leaving behind more persistent holders.

Read also: Cardano Potential to Break $3? Crypto Analyst Reveals Power of Three (PO3) Pattern

The last time this indicator dropped and formed a temporary low in mid-October, Ethereum skyrocketed by more than 10% in two sessions, which suggests that the market may be repeating the same pattern of behavior.

Derivatives Data Shows Pressure Rising to Short Squeeze Ethereum Price

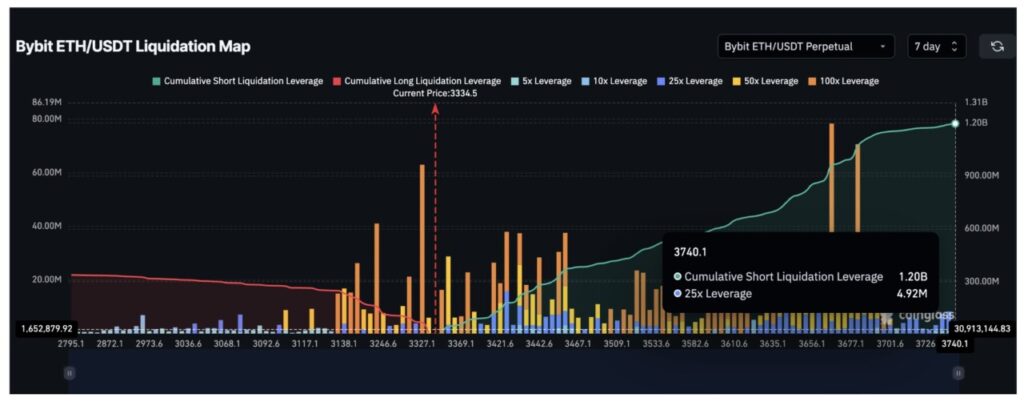

Ethereum’s derivatives market also supports the possibility of a rebound. Based on Bybit’s ETH/USDT liquidation map, nearly $1.2 billion of short positions are now at risk in the price range of $3,320 to $3,740.

This is huge when compared to just $330 million of leveraged long positions. This imbalance-which shows almost 3.5 times more short positions than longs-suggests that any upward movement could trigger a short squeeze, forcing short traders to buy back and accelerate the price increase.

However, some large long positions around $3,100 are still at risk of being lost if Ethereum drops again. This is one element of risk that traders need to monitor closely.

Technically, Ethereum continues to move within a downward channel, confirming that the broader trend is still bearish. However, the important support zone at $3,053 has so far remained intact.

If Ethereum manages to close above $3,338, it will confirm a rebound pattern. From there, the next major resistance is around $3,799.

Breaking that level with a 14% gain could trigger a stronger move towards $4,000 and even $4,260. However, if the 12-hour candles close below $3,053, Ethereum price will invalidate this rebound hypothesis.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Rebound Price Bottom at $4000 Setup. Accessed on November 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.