Bitcoin almost touches $100K, other crypto markets plummet, what’s going on?

Jakarta, Pintu News – Bitcoin has just experienced a sharp decline, almost touching the $100,000 mark before rebounding slightly to $101,000. This comes after a series of forced liquidations and returning macro concerns, wiping billions of dollars off speculative positions in the crypto market.

Main Causes of Drastic Decline

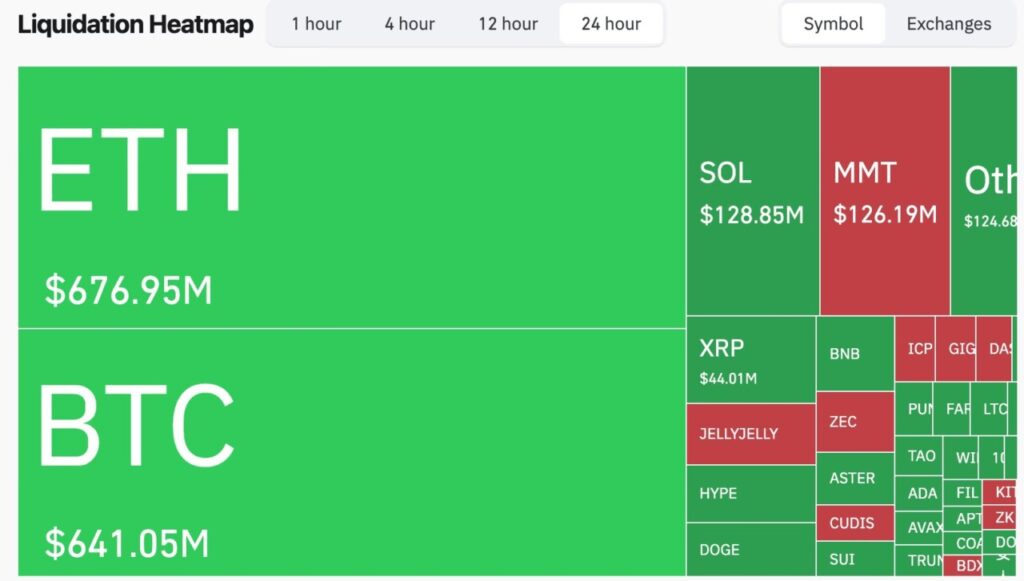

More than $2 billion in futures contracts have been liquidated in the last 24 hours, according to data from CoinGlass. Almost 80% of those losses, or about $1.6 billion, were from traders who went long. Liquidations occur when traders using borrowed funds are forced to close their positions as their margins fall below the required level.

On crypto futures exchanges, this process is automated, which means that when the price moves sharply against a leveraged trade, the platform will sell the position to the open market to cover the loss.

Large clusters of long liquidation may signal capitulation and a potential short-term bottom, while large short deletions may precede a local top as momentum reverses. Traders can also track where liquidation levels are concentrated, helping to identify zones of forced activity that may act as short-term support or resistance.

Also Read: Will Bitcoin (BTC) Experience a Sharp Drop Before Surging Again? Here’s the Analysis!

Impact on Other Crypto Markets

Bitcoin (BTC) fell 5.5% in a day and dropped more than 10% over the week. Ethereum (ETH) fell 10% to $3,275, while Solana (SOL) and Binance Coin (BNB) lost 8% and 7% respectively. Ripple (XRP), Dogecoin (DOGE), and Cardano (ADA) also fell between 5% and 6%. The total crypto market capitalization returned towards $3.5 trillion, the lowest level in over a month.

According to Gerry O’Shea, head of global market insights at Hashdex, risk-off sentiment has taken hold of financial markets, affecting various digital assets, stocks, and commodities. Recent speculation that the Federal Open Market Committee (FOMC) may skip another rate cut this year, as well as concerns over tariffs, credit market conditions, and equity valuations, have helped to drive markets lower.

Market Outlook and Future Predictions

Despite the high volatility, the analyst remains optimistic about the long-term outlook. According to O’Shea, while $100,000 may be a psychologically important support level, today’s price drop is not considered a sign of a weakening long-term investment case for Bitcoin (BTC).

With the Federal Reserve delaying further cuts and global risk appetite still fragile, the next session will test if Bitcoin’s (BTC) bounce can turn into a sustained recovery or if another wave of forced selling lies ahead.

Subtitle: Closing Paragraph

The current market conditions show how quickly the dynamics in the crypto market can change. Investors and traders are expected to remain vigilant and pay attention to macroeconomic indicators and internal market dynamics to make informed investment decisions.

Also Read: Dash price soars, hitting $100 after almost 4 years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Bitcoin Bounces Near $100K, ETH, SOL, XRP Drop 6-10% as Bulls See $1.6B Liquidations. Accessed on November 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.