Dogecoin’s Drastic Drop in Early November 2025: What Should Investors Know?

Jakarta, Pintu News – Dogecoin (DOGE) experienced a sharp decline on Tuesday, breaking through a long-standing key support zone. The decline was triggered by massive distributions by whales, signaling institutional-led selling pressure.

The significantly increased trading volumes during this period are also indicative of panic in the market. This decline comes amid broader uncertainty in the cryptocurrency market, where investors are starting to lose faith in more speculative digital assets. Dogecoin, which originally started as a joke, is now facing serious challenges in maintaining value amid growing competition from other tokens.

Price Action Summary

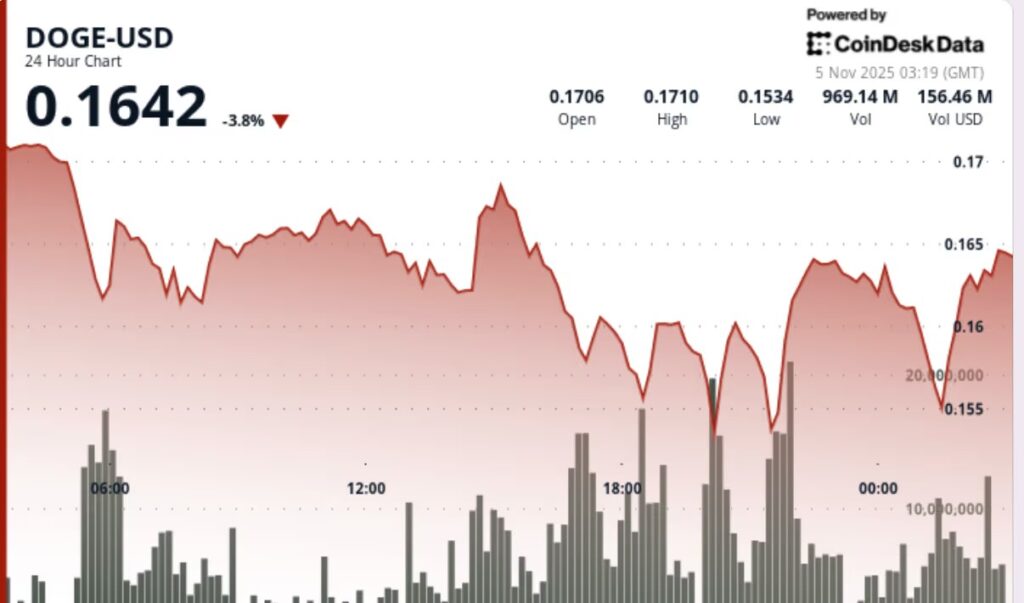

In early trading, Dogecoin (DOGE) attempted to hold its value around $0.16, but heavy selling pressure saw it continue to decline. A break below this level marks a change in market sentiment that may be difficult to reverse in the near future. Investors hoping for a quick recovery may need to adjust their expectations.

In addition, technical analysis suggests that Dogecoin (DOGE) may face more selling pressure. The price pattern showing consecutive declines with no significant signs of recovery is a strong indicator that bears still dominate the market. This is a crucial time for investors to monitor closely.

Also Read: Will Bitcoin (BTC) Experience a Sharp Drop Before Surging Again? Here’s the Analysis!

Current Technical Analysis

From a technical perspective, the Dogecoin (DOGE) chart shows a consistent formation of lower-lows, which is a bearish indicator in technical analysis. It shows that every time the price tries to go up, there are always more sellers ready to unwind their positions, pushing the price lower again.

It is important to note that the support level that has been broken could become resistance in the future. If Dogecoin (DOGE) tries to recover, this level will be an important barrier to overcome. Investors and traders should take note of this level to make informed trading decisions.

What Investors Should Know

Investors should be aware that the cryptocurrency market is highly volatile and market conditions can change rapidly. Decisions to buy, sell or hold an asset should be based on careful analysis and thoughtful consideration of risk. In the case of Dogecoin (DOGE), keeping up with market developments and related news can provide important insights.

In addition, it is important for investors not to be overly influenced by short-term price movements. Focusing on long-term investment strategies and portfolio diversification can help reduce risk and increase potential future returns.

Conclusion

This significant drop in Dogecoin (DOGE) price is a reminder that investing in the cryptocurrency market requires caution. Investors should keep themselves informed and be ready to adjust their strategies according to changing market dynamics. Understanding the basics of technical and fundamental analysis and monitoring regularly will go a long way in making informed investment decisions.

Also Read: Dash price soars, hitting $100 after almost 4 years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Dogecoin Falls 5% as Lower Lows Pattern Aids Bearish Outlook. Accessed on November 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.