UK prepares to regulate stablecoins, aiming for synergies with US in 2026?

Jakarta, Pintu News – The UK government has announced plans to hold a consultation on stablecoin regulation on November 10, with a target of implementation by the end of 2026. The move comes as crypto users in the UK reach 7 million, up 204% from 2.3 million four years ago. The policy aims to align regulations with developments in the United States.

Stablecoin Consultation and Regulatory Framework in the UK

The UK government is showing it is serious about regulating the stablecoin market by planning a public consultation that will begin this November. The purpose of this consultation is to gather input from various parties regarding the regulatory structure that will be implemented.

This is in response to a similar development that occurred in the United States following the passage of the GENIUS Act. The Bank of England has been tasked with overseeing that all stablecoin issuers must hold reserves in the form of government bonds or short-term securities.

This policy is expected to increase investor and user confidence in stablecoins in the UK, by ensuring that the value of stablecoins in circulation is backed by safe and liquid assets.

Read also: Google Finance Now Integrates Predictive Market Data, What’s the Impact?

Role and Impact on Financial Institutions

With this new regulation, financial institutions that act as stablecoin reserve managers will gain new business opportunities. They will be responsible for ensuring that stablecoin reserves are held in the form of secure assets such as government bonds or short-term securities. This not only increases the security of stablecoin assets, but also opens up opportunities for cooperation with other financial institutions.

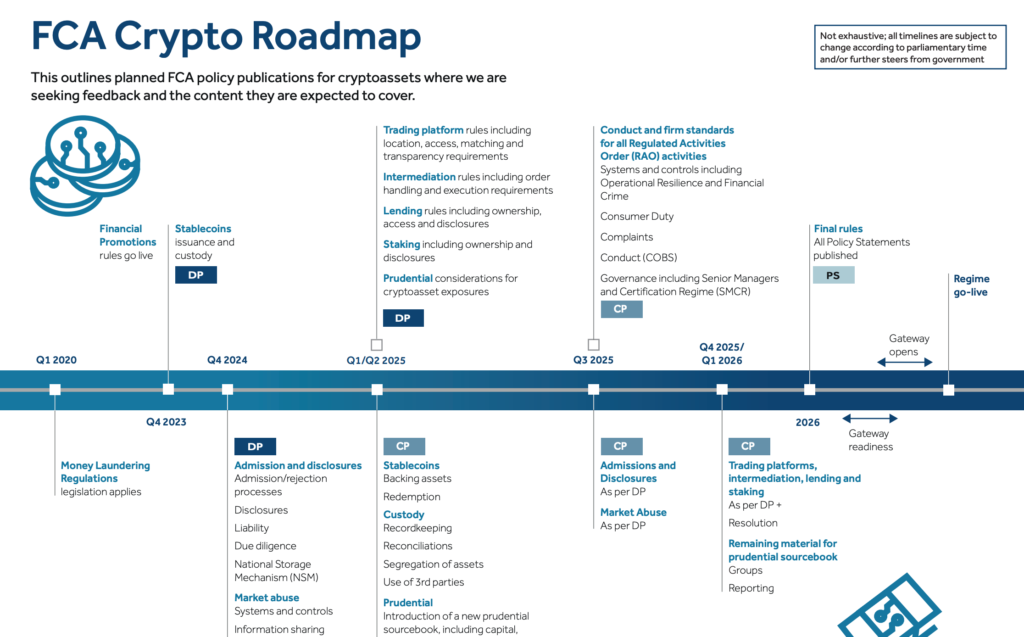

The UK’s Financial Conduct Authority (FCA) has also released a cryptoasset roadmap outlining a phased implementation approach until 2026. The roadmap includes details on how regulation will be implemented and supervised, as well as the roles that various stakeholders in the financial industry will play.

Also read: Japan Starts a State-Supported Bitcoin Mining Race, Here are the Details!

Market Expansion and Global Competition

Circle, one of the major players in the stablecoin market, has secured licenses in France for EURC and Tether (USDT) under the European Union’s MiCA regulation, signaling their expansion in Europe. Meanwhile, Tether (USDT) still holds a dominant global market share, despite facing increased scrutiny regarding reserve transparency and auditing practices.

An increasingly regulated UK market is expected to attract more institutional players to enter. Clear and structured regulation is expected to reduce risk and increase investor confidence, thereby strengthening the UK’s position as a globally competitive crypto finance center.

Conclusion

With this progressive move, the UK is not only increasing safety and trust in the use of stablecoins, but also positioning itself as a leader in global crypto regulation. The synergy with US regulation will hopefully bring stability and continued growth to the global crypto industry.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. UK Stablecoin Regulation Targets 2026 Implementation. Accessed on November 7, 2025

- Featured image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.