Crypto whales buy Bitcoin (BTC), will the price recover soon?

Jakarta, Pintu News – As the crypto market experiences a sharp correction, large holders of Bitcoin (BTC) are accumulating again. This signals renewed confidence despite the market having just lost more than 20% of its recent high. Currently, Bitcoin (BTC) is trading above $101,000, after hitting $99,600 two days ago.

Bitcoin whales show new signs of hope

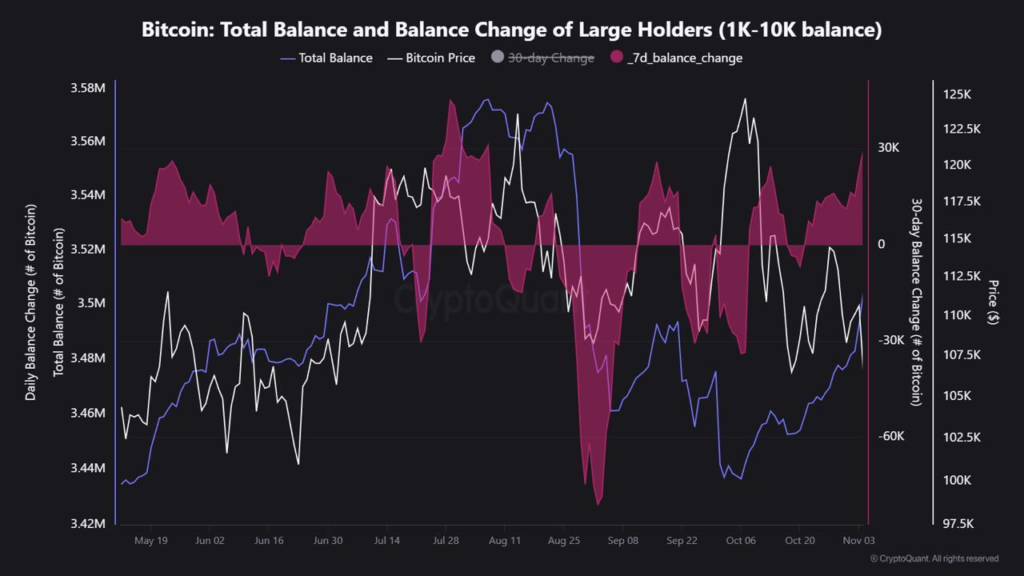

Data from CryptoQuant shows that wallets holding between 1,000 and 10,000 Bitcoin (BTC) have added around 29,600 Bitcoin (BTC) in the last seven days. Analyst JA Maartun noted that the combined balance of these whale wallets increased from 3.436 million to 3.504 million Bitcoin (BTC). This is the first major accumulation phase since late September.

This behavior shows that large entities, which usually include institutions and early whales, are buying in times of market weakness, not abandoning it. Their actions are in stark contrast to retail sentiment, which has become fearful after much liquidation and outflow of funds from ETFs. More than $1 billion in leveraged positions were erased last week, and the spot Bitcoin (BTC) ETF in the US recorded more than $2 billion in withdrawals.

Also read: Gold Jewelry Price Today, Friday, November 7, 2025

Bitcoin Outlook at the End of November

Technical indicators show that Bitcoin (BTC) is consolidating between $100,000 and $107,000, while the Fear & Greed Index is in the “Extreme Fear” zone. Historically, when large holders increase their exposure during periods of high fear, a price recovery often follows within a few weeks. However, short-term volatility is still possible.

Prolonged institutional outflows and derivative settlements could keep the market volatile before a sustained rebound. If whale accumulation continues, this could be the basis for a medium-term recovery towards $115,000-$120,000.

Read also: UK prepares to regulate stablecoins, aiming to synergize with the US by 2026?

Whale’s Long-term Strategy

By absorbing about four times the weekly supply from mining, whales are tightening the liquid supply on exchanges and strengthening the $100,000 support zone. This accumulation is also taking place amid challenging macro conditions. The Federal Reserve’s cautious stance towards cutting interest rates has weakened demand for risky assets, which contributed to the recent decline in Bitcoin (BTC) prices.

However, this condition also creates a liquidity vacuum-an opportunity that whales seem to be taking advantage of. While short-term traders are panicking, long-term holders are positioning themselves for the next move. This steady accumulation shows confidence that the market’s structural trend remains intact, although sentiment has yet to catch up.

Conclusion

In this week of Whale Watch, one thing is clear: amidst the panic of short-term traders, long-term holders are showing a different course of action. They not only maintained their positions, but also added to their investments in Bitcoin (BTC), showing confidence in the future price recovery.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Whales Buying the Dip: Weekly Whale Watch. Accessed on November 7, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.