BTC Plummets, XRP Survives, & Franklin Templeton’s XRP ETF Approved Soon: Here’s the Outlook!

Jakarta, Pintu News – Bitcoin (BTC) suffered a sharp drop below $100,000 for the first time since June, while Ripple (XRP) showed investor resilience with a share sale rejection. On the other hand, Franklin Templeton is set to get approval for an XRP ETF, signaling new growth potential in the crypto industry.

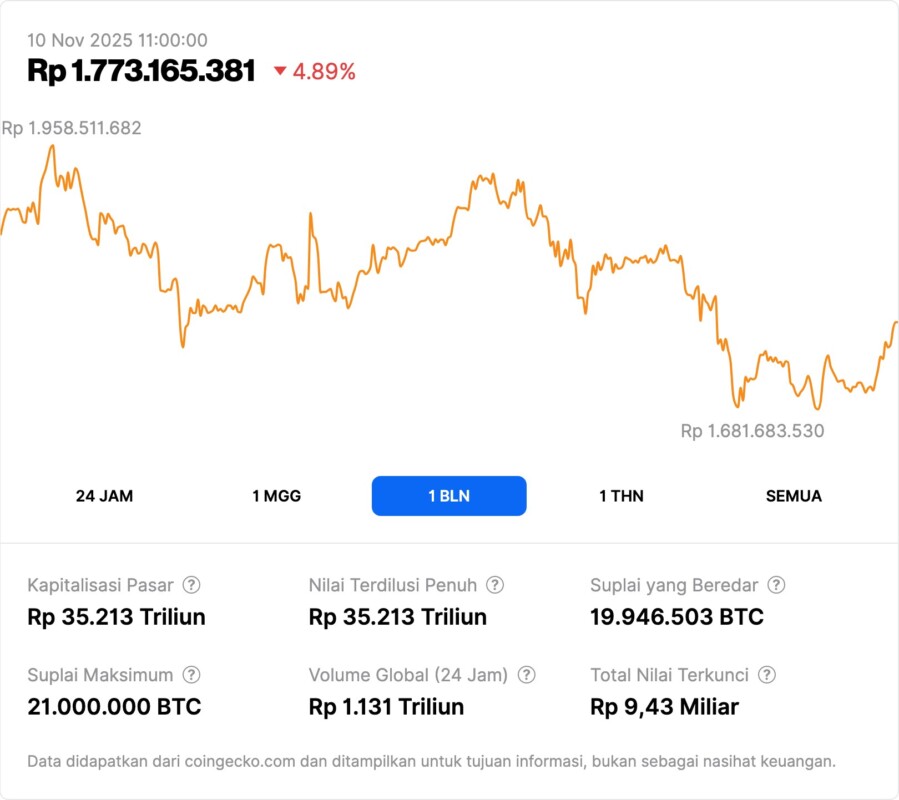

Drastic Drop in Bitcoin (BTC)

Bitcoin (BTC), a major cryptocurrency, has fallen below the $100,000 level, hitting its lowest point since June 22 with an intraday price of $99,941 on the OKX exchange. This drop marks Bitcoin’s (BTC) entry into a correction zone, with a decline of more than 22% from the record peak reached this month.

Betting site Polymarket now estimates the chances of Bitcoin (BTC) plummeting to $90,000 this year at 51%, a drastic increase from just 11% a month ago. This drop shows how quickly market sentiment towards Bitcoin (BTC) is changing. Investors and analysts are now considering the worst-case scenario, where further declines could occur if the selling pressure continues.

Also Read: Market Crash? Here are 5 Cryptos Predicted to Explode Due to Whale Activity in Futures Market

XRP ETF update by Franklin Templeton

Franklin Templeton, a US financial giant with $1.5 trillion in assets under management, has updated its S-1 filing for its Ripple (XRP) ETF. The filing is an important step ahead of the expected approval from the US Securities and Exchange Commission (SEC). The latest changes to the document include simplified language in Section 8(a), which allows regulators to delay the effectiveness of the registration.

This update comes after Canary Capital and Bitwise made similar moves, indicating an increasing trend of Ripple (XRP)-based products in the financial markets. The upcoming approval from the SEC could have a significant impact on the adoption and integration of Ripple (XRP) in the mainstream financial system.

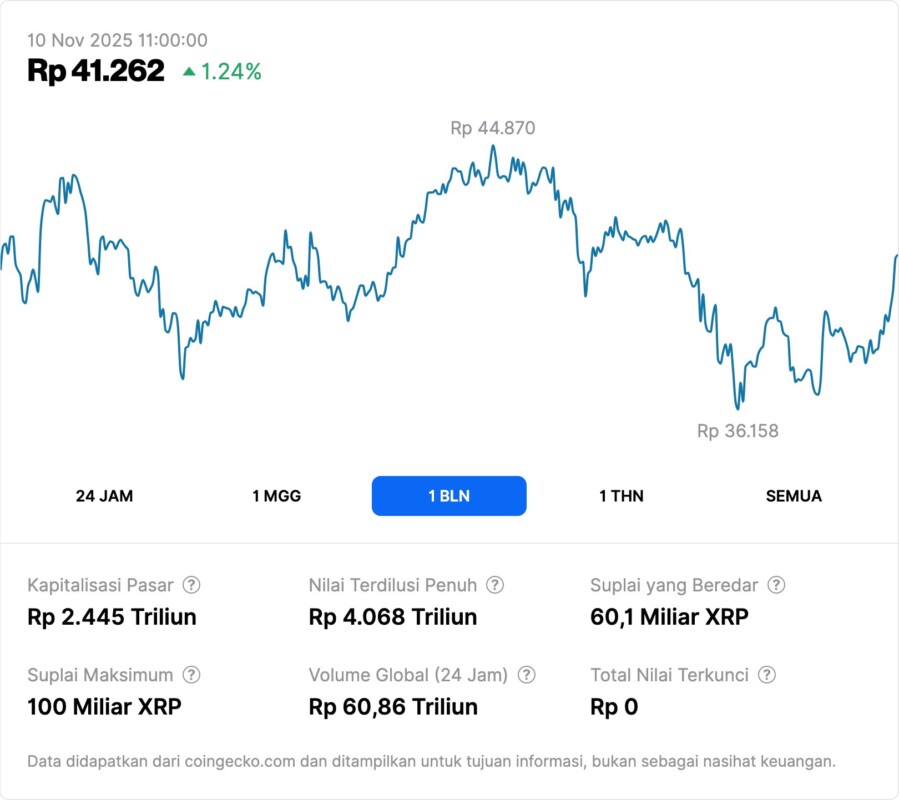

Ripple (XRP) Investor Resilience

Although Ripple Labs offered a $1 billion share buyback at a valuation of $40 billion, participation in this offer was record low. This suggests that many private shareholders chose not to sell their shares, showing confidence in the long-term potential of Ripple (XRP).

This confidence is reinforced by Ripple’s victory over the SEC and the series of major acquisitions it has made. Investors seem to be looking beyond short-term price fluctuations, considering the growth potential and wider adoption of Ripple’s (XRP) technology. The decision to hold onto the stock shows a positive expectation of the future of the company and the technology they are developing.

Conclusion

With the ever-changing dynamics in the crypto market, investors and market watchers should remain vigilant for further developments. The Bitcoin (BTC) price drop, the development of the Ripple (XRP) ETF by Franklin Templeton, and the resilience of Ripple investors show the complexity and volatility that continues to exist within the crypto market.

Also Read: 3 Memecoins that Whale is Starting to Look at in the Futures Market as of November 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Bitcoin (BTC) Loses $100,000, Ripple Holders Refuse to Sell. Accessed on November 10, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.